Bitcoin, crypto may rebound in August: Insights from Santiment's July roundup

- Bitcoin's 365-day MVRV dropping below 0% could prove a good opportunity for heavy accumulation.

- Bitcoin Cash took traders shorting it by surprise with a parabolic 40% rise.

- Low social volume around Ethereum ETFs and declining prices present an opportunity to buy ETH at a relatively cheap price.

In its latest crypto market July roundup on Thursday, on-chain intelligence platform Santiment noted several metrics that could prove important as investors anticipate a market rebound in August.

What to expect in August after crypto's mixed sentiment in July

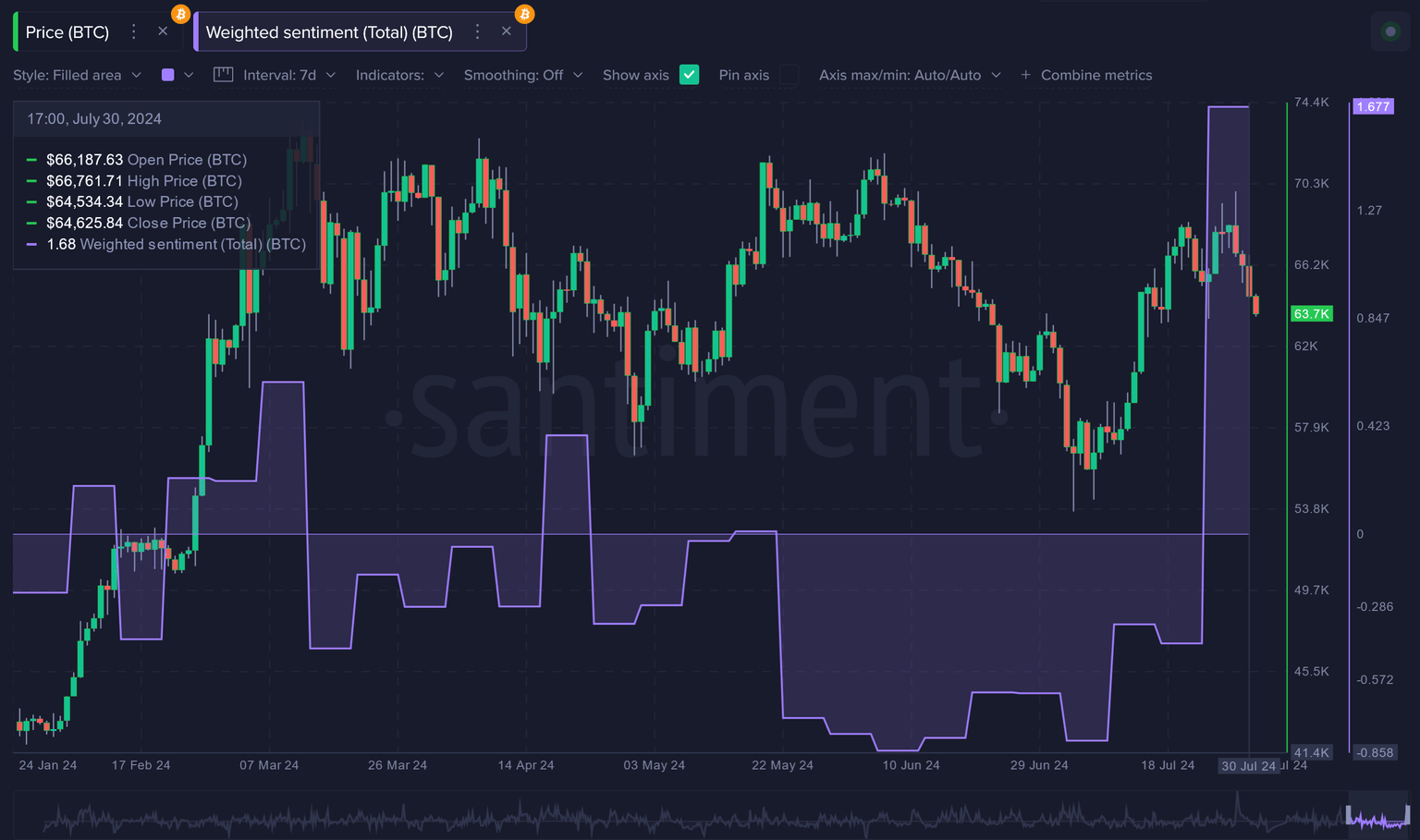

- The crypto market closed July with a sharp rise in Bitcoin's weighted sentiment, indicating increased bullish sentiment toward the top cryptocurrency, especially as it approached the 70K key psychological level.

However, such periods of increased euphoric sentiment are often accompanied by a correction. As a result, Bitcoin could experience choppy prices in the first few days of August. "As far as top indicators go, this was one of the most reliable ones we had seen in a long time, and was easily the best FOMO indication we have seen thus far in 2024," said Santiment.

BTC Weighted sentiment

- Bitcoin and the entire crypto market ended July with a correction in rising sentiment after the Federal Reserve announced it was maintaining rates at 5.25%-5.5%. The reset in social volume triggered a dip that saw the percentage of BTC supply in profit drop to a two-week low of 85.6%.

Since the beginning of the year, BTC often rebounds when this metric approaches the 75%-80% range. However, waiting for the 365-day Market Value to Realized Value (MVRV) ratio to drop below 0% could prove a good time to buy aggressively. "Keep in mind that when the 365-day MVRV very briefly fell below 0% around July 4, it signaled the optimal time to buy the dip and make a quick 15% on BTC," noted Santiment.

BTC 365-day & 30-day MVRV Ratio

- A few large Bitcoin holders (wallets with ten or more BTC) realized profits during the recent price dip, strengthening volatility in the market. A period of accumulation often follows such profit-taking as these sharks and whales begin buying again at lower prices. The $58K to $62K range could prove an aggressive accumulation zone to help prices bounce back up. However, these wallets may have no reason to accumulate if prices remain around $63K to $67K — around the same prices where they realized profits.

- Bitcoin Cash was the standout performer among altcoins, defying market expectations with a 40% rise between July 4 and the end of the month. The rise caught several traders off guard, who, banking on BCH's declining reputation, have been aggressively shorting it on Binance. "But bearish sentiments from novice traders, as we have learned, can sometimes be one of the best friends for a coin," wrote Santiment.

BCH may continue its parabolic run in August if funding rates from shorting activity continue rising.

Binance BCH Funding Rate

- Ethereum ETFs saw increased social volume around the third week of July as investors anticipated their launch. However, discussions surrounding the term have plummeted sharply since ETH ETFs went live. The drop has shown a correlation with ETH's price, probably due to FUD among investors. Santiment noted that traders could benefit by buying relatively low around ETH's current price.

ETH ETF Social volume

These metrics may prove crucial as investors prepare for their next line of action in August.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi