- Bitcoin slips to $96,000 on Friday, down nearly 10% from its all-time high.

- Market-wide crash wipes out 6% of crypto market cap and altcoins.

- Whales are accumulating Bitcoin, Ethereum, Chainlink while taking profits on Shiba Inu and Pepe.

- Over $200 million in derivatives positions have been liquidated since Bitcoin’s decline under $100,000.

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins. The almost 10% by the largest cryptocurrency from its all-time high is driven by the US Federal Reserve’s (Fed) more hawkish outlook for 2025 and potential liquidity moves expected from the US Treasury in 2025.

The market-wide crash seen since Wednesday has erased millions in market capitalization, liquidating over $200 million in derivatives positions across exchanges.

As the market sentiment shifts, large wallet investors accumulated some tokens and took profit on others, signaling what retail investors should expect from crypto in the coming weeks.

Bitcoin bleeds nearly 10% from all-time high, down to $96,000

Bitcoin corrected from its all-time high of $108,353 on Tuesday to a low of $96,000 on Friday. The largest cryptocurrency’s decline has liquidated $216 million in derivatives positions in the last 24 hours across exchanges, according to data from Coinglass.

Bitcoin’s 12-hour price chart shows that the $93,885 to $94,640 is a key support zone for BTC as it aligns with a Fair Value Gap (FVG). Looking up, the main barrier stands at the $100,000 psychologically important level.

At the time of writing, Bitcoin consolidates close to $98,000.

BTC/USDT 12-hour price chart

Crypto prices crashed across categories, and over 6% of market capitalization was erased in response to the Fed Chair Jerome Powell’s words saying that the US central bank is not looking to hold Bitcoin and also prospects that there will be a more cautious approach to interest-rate cuts in 2025.

“We’re not allowed to own Bitcoin. The Federal Reserve Act says what we can own, and we’re not looking for a law change. That’s the kind of thing for Congress to consider, but we are not looking for a law change at the Fed,” Powell said on Wednesday.

The comments came in response to a question on the US strategic Bitcoin Reserve, a part of President-elect Donald Trump’s plan for bolstering crypto adoption.

Bitcoin price fell sharply on Wednesday and Thursday, as the sentiment among BTC holders shifted post the Fed Chair’s comments. As of Friday, BTC appears to have found a floor.

Crypto fear and greed index ends streak of “Extreme Greed”

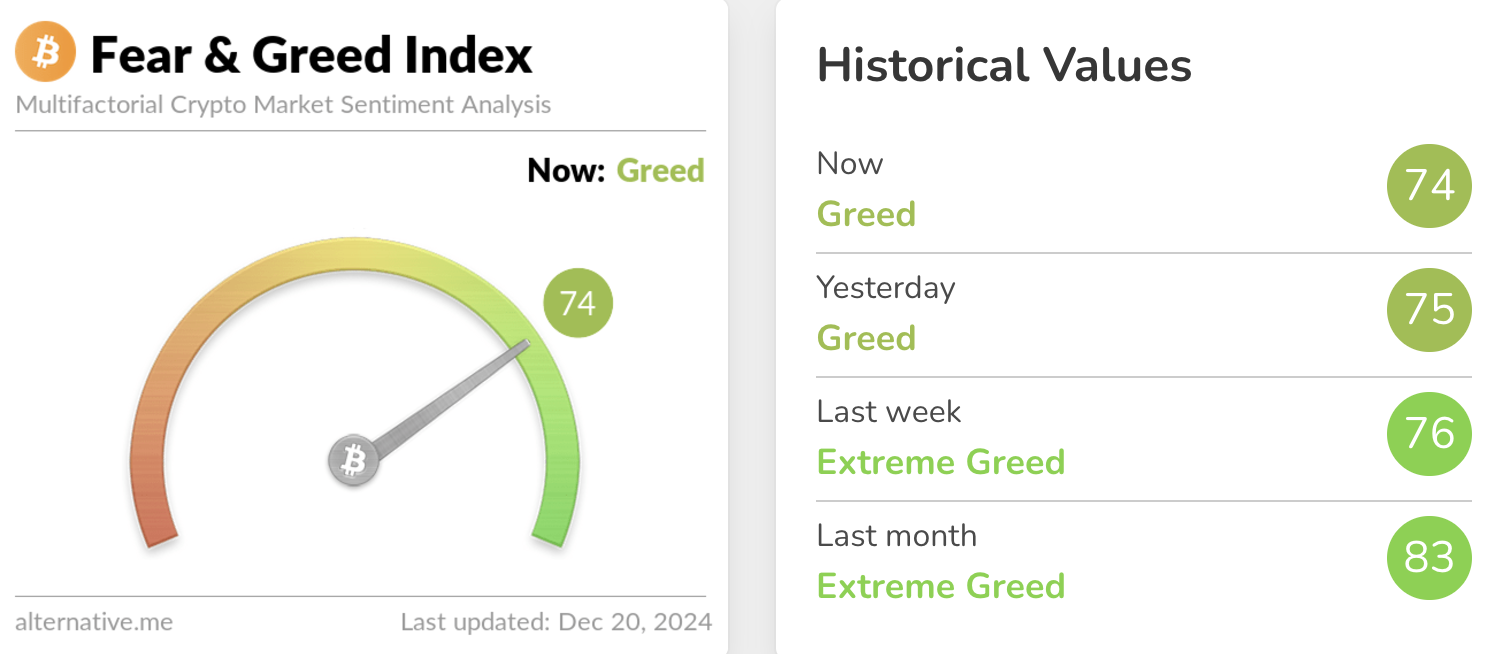

Alternative.me’s crypto fear and greed index helps gauge the sentiment of market participants on a scale of 0 to 100, from extreme fear to extreme greed. After reading “extreme greed” throughout last month, the gauge has recently shifted to “greed”.

Crypto fear & greed index

What are whales buying and selling?

During times of correction in crypto prices, retail investors look at large-wallet addresses for guidance on what to expect from token prices in the coming weeks. Recent whale activity tracked by Lookonchain shows the following:

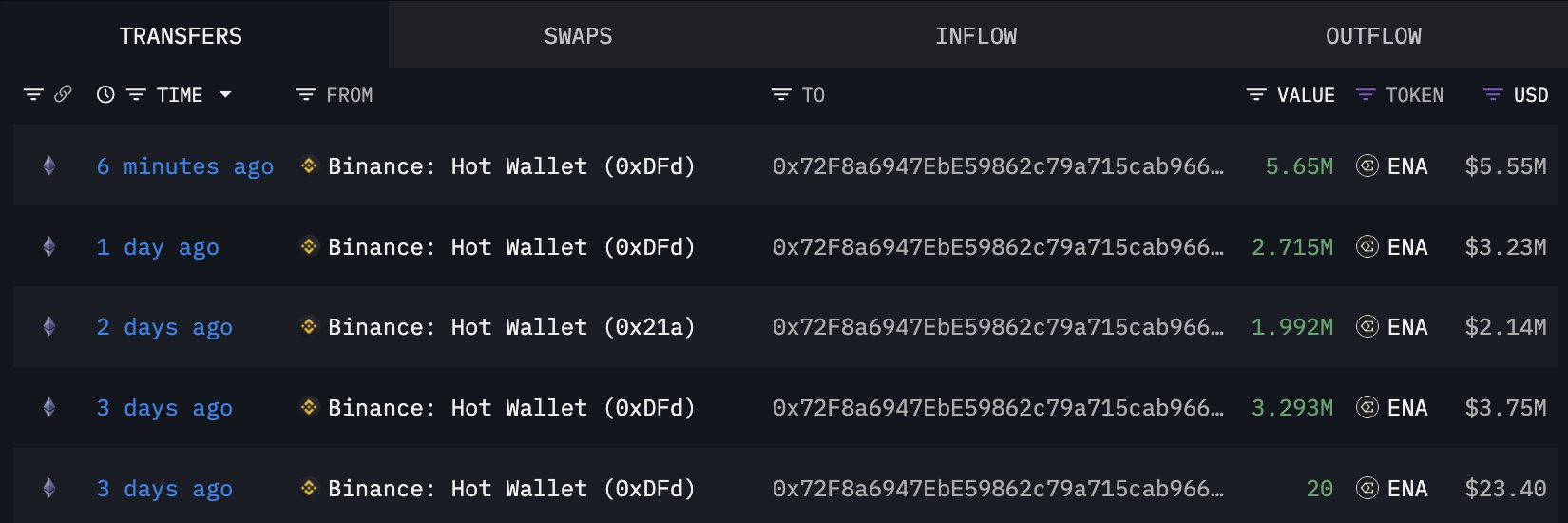

- Whales are accumulating Ethena (ENA). A whale wallet address tracked by Lookonchain withdrew 13.65 million ENA tokens (worth nearly $13.25 million) from Binance.

Ethena withdrawal by whale wallet on Binance

- Donald Trump-backed World Liberty Financial is buying Ethereum (ETH) in the recent dip.

After the $ETH price drop, #Trump's World Liberty(@worldlibertyfi) spent 2.5M $USDT to buy 722 $ETH again 2 hours ago.https://t.co/AmeIF2plRb pic.twitter.com/UwI88MfoUK

— Lookonchain (@lookonchain) December 20, 2024

- A whale wallet, likely related to Long Ling Capital – an early-stage VC firm based in China – bought Ether during the price drop.

A smart whale (likely related to #LonglingCapital) bought 6,000 $ETH after the price drop.

— Lookonchain (@lookonchain) December 19, 2024

This whale is skilled at buying $ETH at low prices and selling at highs, with a total profit of $83M.

Since May 8, 2023, this whale bought 75,400 $ETH($180.4M) at an average price of… pic.twitter.com/OK0OS9U4ou

- On Thursday, large wallet addresses took profits in Shiba Inu (SHIB) and a whale wallet sold Pepe (PEPE) to realize a loss.

A whale sold 250B $SHIB($6.05M) for profit in the past hour!

— Lookonchain (@lookonchain) December 19, 2024

The whale spent $3.8K to buy 15.28T $SHIB($1.22B at the peak) as early as August 6, 2020.

This whale currently holds 2.15T $SHIB($52.18M), with a total profit of $109M on $SHIB.https://t.co/BWxcnWuwFR pic.twitter.com/aQZFPyhYSv

After the market drop, a whale deposited 150B $PEPE($2.72M) into #Binance to stop loss.

— Lookonchain (@lookonchain) December 19, 2024

This whale withdrew 150B $PEPE($2.94M) and 60B $SHIB($1.52M) from #Binance on Nov 28.

At current prices, the whale is facing a loss of $219K on $PEPE and $136K on $SHIB.… pic.twitter.com/kGDa9K7Z7z

Expert maintains optimism for 2025

“My outlook for crypto through 2025 remains optimistic, bolstered by a supportive regulatory environment that encourages broader capital investment in crypto,” said Nick Forster, founder of Derive.xyz, to FXStreet in an exclusive interview.

“More regulatory clarity is fostering deeper institutional engagement and enabling crypto's expansion beyond speculative trading into mainstream financial applications,” Forster added.

Meanwhile, Ruslan Lienkha, Chief of Markets at YouHodler, assuaged trader concerns on the growing correlation between Bitcoin and US macro moves.

"Fed policy has an indirect impact on the cryptocurrency market due to the growing correlation between crypto and traditional financial instruments, as cryptocurrencies become increasingly integrated into traditional finance. While the administration can directly influence the crypto market through policy decisions and regulatory actions, the Fed’s role is limited to managing monetary policy, which indirectly affects crypto via its impact on liquidity and investor sentiment in the financial ecosystem," he said.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP crash, wiping $1.17 billion from the market

Bitcoin price trades below $98,000 on Friday after declining more than 6% this week. Ethereum and Ripple followed BTC’s footsteps, closing below their key support and declining 12% and 4.5%, respectively, this week.

Bitcoin's trajectory shows similarities with previous cycles as long-term holders book profits of $2.1 billion

Glassnode's Week on Chain report revealed the similarities between the current Bitcoin uptrend and previous cycles amid changing market conditions. Meanwhile, long-term investors began distributing their tokens at the $100K level.

Crypto Today: Hawkish Fed triggers $400B sell-off as meme coins mirror ETH, SOL price dip

The cryptocurrency sector valuation fell below the $3.5 trillion mark on Thursday, with a 10.7% decline reflecting $390 billion worth of outflows. The crypto market dip has been linked to the US Federal Reserve hinting at a hawkish stance for 2025.

Ethereum Price Forecast: ETH may not sustain recent 10% decline despite panic selling from short-term holders

Ethereum declined below the $3,550 key support level on Thursday following bearish pressure from the Federal Reserve's rate cut decision. However, on-chain analysis shows that the price decline may not last long as long-term holders have stayed quiet despite the bearish sentiment.

Bitcoin: BTC reclaims $100K mark

Bitcoin briefly dipped below $94,000 earlier this week but recovered strongly, stabilizing around the $100,000 mark by Friday. Despite these mixed sentiments this week, institutional demand remained strong, adding $1.72 billion until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.