Bitcoin could move fee-free in the Cosmos ecosystem if this proposal is approved

- The Cosmos DEX Osmosis community is voting on a proposal to adopt a “free” Bitcoin bridge through a decentralized protocol.

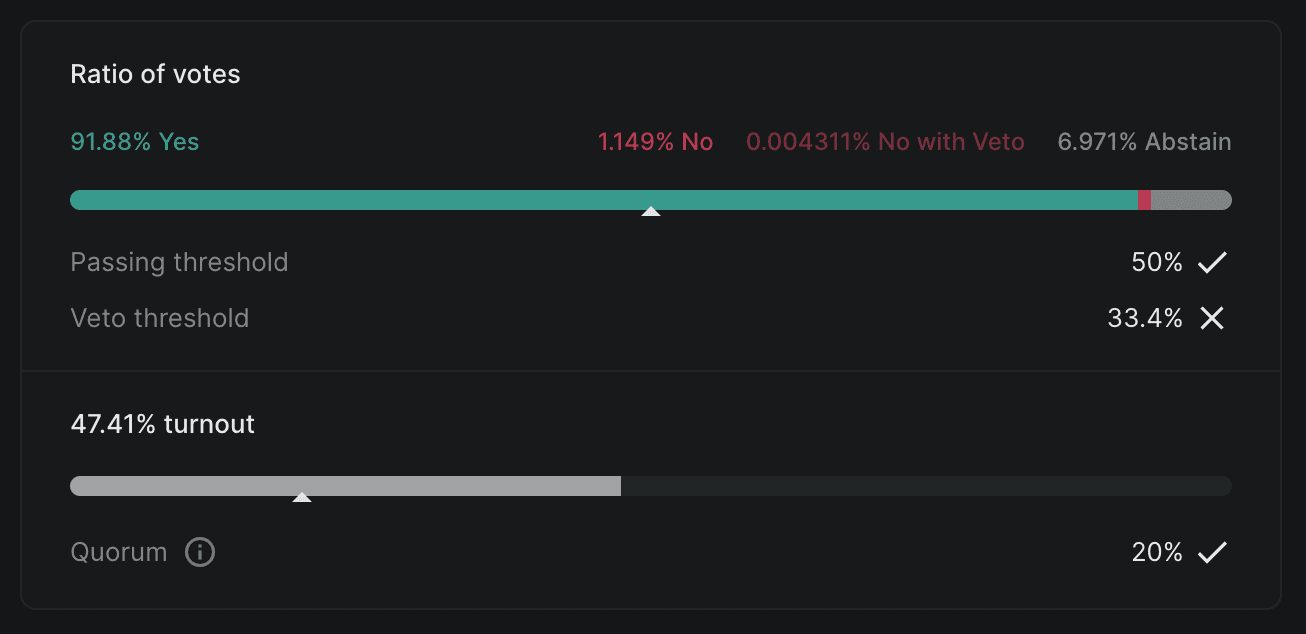

- Over 90% of the votes are in favor of bringing Bitcoin liquidity to the Cosmos ecosystem.

- Osmosis co-founder notes that if passed, the proposal will bring a new revenue-sharing business model for bridges.

- Both OSMO and ATOM have added less than 1% to their value on Friday.

Osmosis is an independent Layer 1 blockchain built using Cosmos’ software development kit. Osmosis DAO is set to vote in favor of adopting a “fee-free” bridge to bring Bitcoin to the Cosmos ecosystem.

At the time of writing, 91.88% of voters are in favor of the bridge.

Ratio of votes

Bitcoin “fee-free” bridge could go live with Osmosis, Nomic Protocols shared proposal

Osmosis DAO is set to vote in favor of the “fee-free” Bitcoin bridge, per the proposal discussion in the Osmosis zone. If approved, the upgrade would allow users to move BTC freely into the Cosmos ecosystem and likely attract new liquidity.

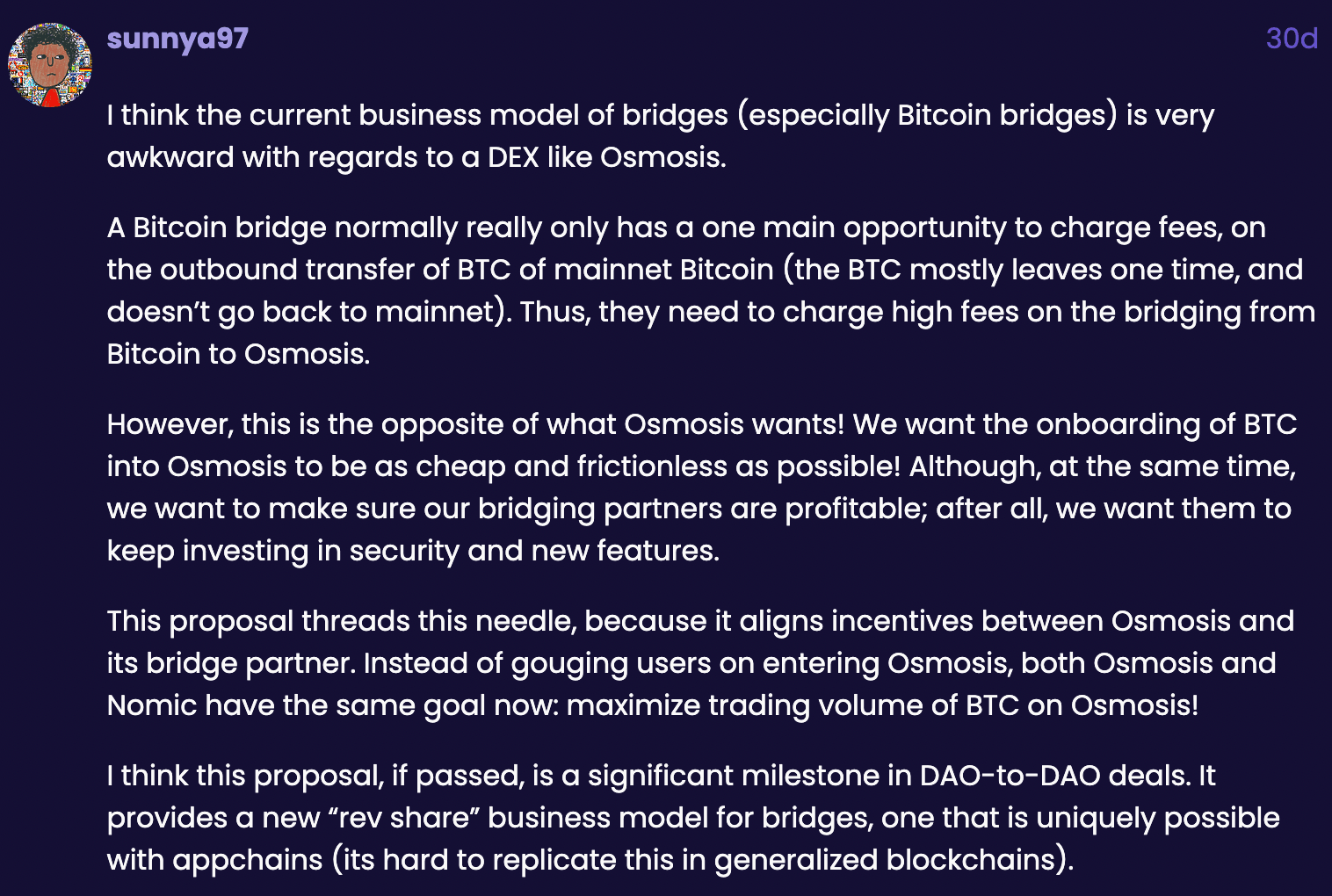

Osmosis co-founder notes that the proposal, if approved, to introduce a new revenue sharing business model for bridges. The co-founder behind the username @sunnya97 calls it “rev share” and explains that the protocol wants Bitcoin onboarding to be cheap and frictionless for users.

Sunny Aggarwal notes that the “fee-free” bridge aligns the incentives between Osmosis and its bridge partner. Both Osmosis and Nomic will maximize the trading volume of Bitcoin on the DEX.

Osmosis co-founder comments

Both OSMO and ATOM tokens have added less than 1% to their value on Friday. OSMO is trading at $0.5625 and ATOM at $6.874, at the time of writing.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.