Bitcoin could dodge a steep correction if BTC holds above this price level

- Bitcoin price consolidates near the crucial $57,750 resistance level.

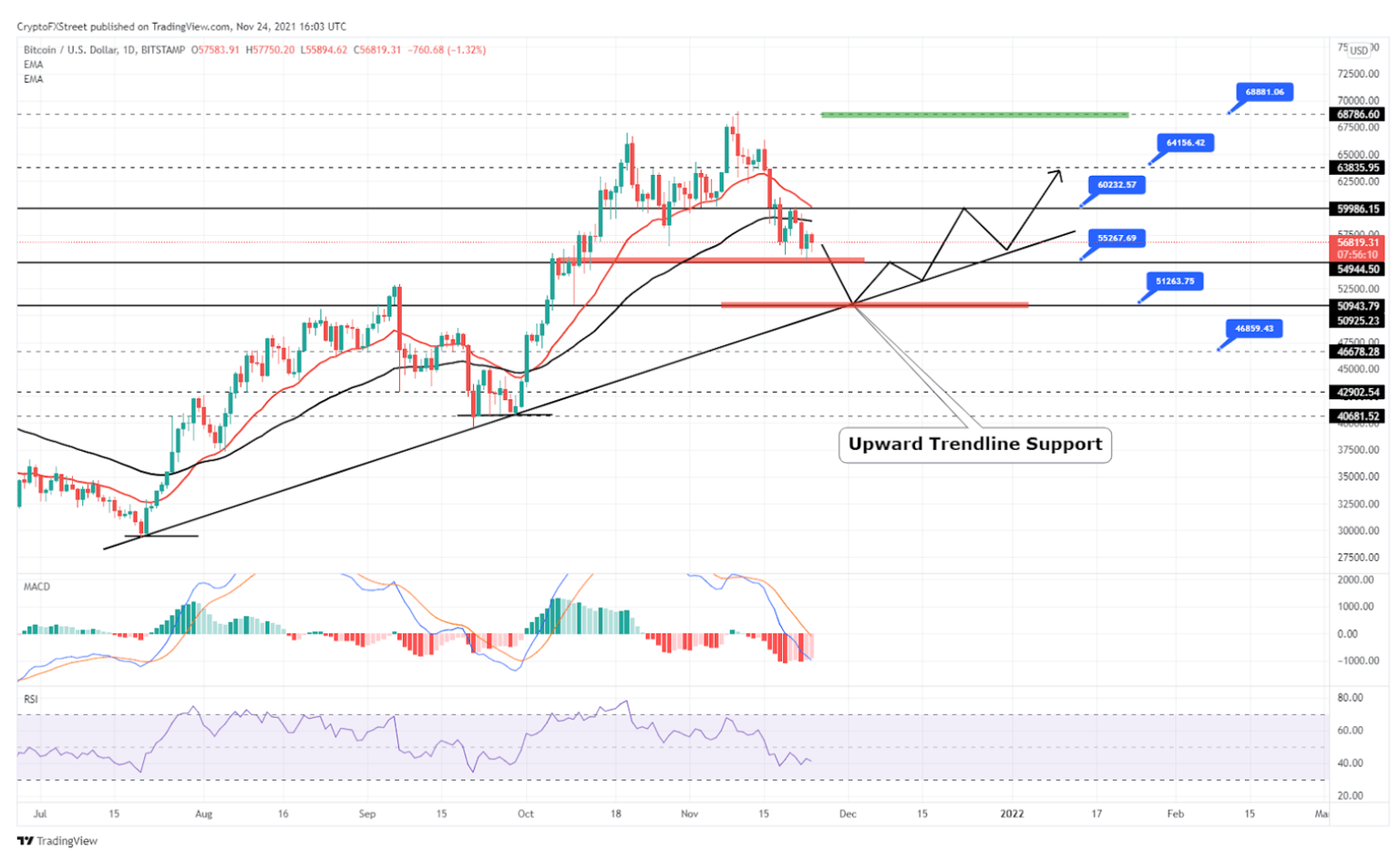

- BTC is now trading below the 20 and 50-day exponential moving average.

- A break below $55,265 could lead to further losses.

Bitcoin continues to struggle below $57,750 against the greenback. Technical indicators suggest BTC could spark more losses as a crucial support level weakens.

Bitcoin bears take control of the price action

Bitcoin price made another attempt to break above the $58,000 resistance level but failed to generate enough traction to break through it and reach $60,230. The rejection at $57,750 enabled bears to push BTC lower towards the $55,265 support.

At the moment, the largest cryptocurrency by market cap is consolidating below the $57,500 hurdle while its technical outlook remains bearish. Bitcoin currently holds below the 20 and 50-day exponential moving averages as the daily candlesticks over the last few sessions have closed below these EMAs.

There's also a crucial upward trend line forming on the 12-hourly chart. It’s hovering near $51,265, providing support for Bitcoin price. The MACD and RSI indicators are now gaining pace in the bearish zone. Therefore, losing support at $55,265 could spark more losses towards $52,990 or even $51,265 support levels.

Bitcoin 12-hourly chart - Upward trendline to support

On the other hand, BTC price needs to stay above $55,265 to be able to put the bearish outlook on hold. Any signs of strength at this price point could encourage bulls to get back on the market, pushing Bitcoin back to $58,800. A breach of this resistance level could then send prices to $60,000 or even $64,156.

Author

FXStreet Team

FXStreet