BTC price dropped as the Fed rolled out a 0.25% rate hike, but improving housing market data and Bitcoin options data suggests that bulls are ready for this week’s expiry.

Bitcoin’s 17.5% rally between March 16 and 22 surprised options traders betting on price levels below $26,000. The movement resulted from investors seeking protection against persistent inflation and the ongoing banking crisis.

Bitcoin bulls have been paying close attention to the negative effects of near-zero interest rates between April 2020 and April 2022, and some have used the information to profit from the $1.2 billion in BTC options that are set to expire on March 24.

Resilient inflation and improving housing markets

According to the official Consumer Price Index (CPI) released on March 22, Inflation in England unexpectedly increased to 10.4% in February due to higher food prices. This outcome is likely to prompt the Bank of England to raise interest rates on March 23, thereby increasing the likelihood of a recession. A higher cost of capital is detrimental to businesses and families, but it is the only way to stem the rise in consumer prices.

Meanwhile, existing home sales in the United States increased 14.5% in February, following the first annual price decline in over a decade. The numbers released on March 21 reflect the decrease in mortgage rates resulting from the increased demand for government bonds. In addition, the increase in sales suggests that the housing market has reached a price floor.

Investors frantically sought protection against monetary debasement as governments were forced to inject capital to prevent banking sector contagion. For example, the yield on five-year U.S. Treasurys decreased from 4.34% on March 8 to 3.6% on March 22, indicating increased demand for fixed-income instruments.

Is the new world one where the prices of all assets are rising?

Consumer prices continue to rise even as the S&P 500 reclaimed the 4,000 mark. Housing market demand is increasing, and gold gained 7.8% in 2023. Every asset with a chance to profit from inflation is increasing, a typical sign of fiat currency debasement.

The movement is not consistent with the macroeconomic scenario in which banks required emergency bailouts and major corporations were forced to lay off thousands of employees due to declining sales prospects. Therefore, a portion of Bitcoin’s recent gains toward $28,000 is due to the weakening U.S. dollar.

If the fear of a recession continues to have a negative impact on risk markets, Bitcoin may struggle to maintain the price levels necessary for bulls to earn $380 million or more by March 24 when weekly options expire.

Data also shows that bears were caught by surprise as Bitcoin surpassed $26,000

The weekly BTC options expiry has $1.2 billion in open interest, but the actual figure will be lower because bears have concentrated their bets on Bitcoin trading below $26,000.

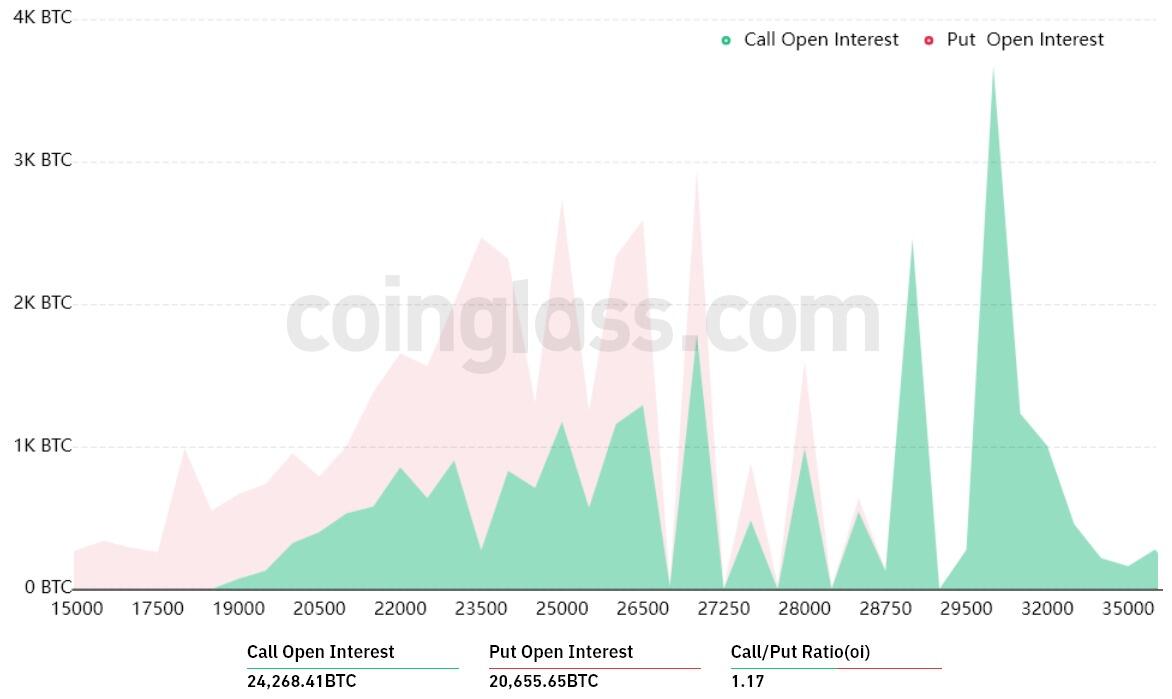

Bitcoin options aggregate open interest for March 24. Source: CoinGlass

The 1.17 call-to-put ratio reflects the difference in open interest between the $675 million call (buy) options and the $575 million put (sell) options. Bears were caught off guard on March 17 when Bitcoin’s price surged above $26,000, so the likely outcome will be much lower than anticipated.

For instance, if Bitcoin’s price remains near $27,700 on March 24 at 8:00 am UTC, there will be only $21 million in put (sell) options. This distinction arises due to the fact that the right to sell Bitcoin at $26,000 or $27,000 is null if BTC trades above that price on the expiry date.

The most likely outcomes favor bulls by a wide margin

Below are the four most likely scenarios based on the current price action. The number of options contracts available on March 24 for call (buy) and put (sell) instruments varies depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

Between $25,000 and $26,000: 7,400 calls vs. 5,500 puts. The net result favors the call (buy) instruments by $50 million.

Between $26,000 and $27,000: 9,100 calls vs. 3,700 puts. The net result favors the call instruments by $140 million.

Between $27,000 and $28,000: 12,700 calls vs. 800 puts. Bulls increase their advantage to $330 million.

Between $28,000 and $29,000: 14,300 calls vs. 20 puts. Bulls' advantage increases to $405 million.

This rough estimate considers only call options in bullish bets and put options in neutral-to-bearish trades. Nonetheless, this oversimplification excludes more complex investment strategies. A trader, for example, could have sold a put option, effectively gaining positive exposure to Bitcoin above a certain price, but this effect is difficult to estimate.

Bears can only reduce their losses, so they are likely to throw in the towel and concentrate on the $3.8 billion monthly expiry on March 31. However, based on the weekly options data, bulls are in a great position to profit at least $330 million.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.