Bitcoin bulls show signs of exhaustion after three-week rally

- Bitcoin tumbles below $64,000, erasing most of the prior week’s gains.

- Coinbase’s weekly report anticipates a constructive Q4 for Bitcoin due to US interest-rate cuts and China’s supporting economic policy.

- Historically, October has been strong for Bitcoin, often leading to gains in the fourth quarter.

Bitcoin (BTC) trades below $64,000 on Monday after a 3% rise last week. On-chain and historical data point to strong potential for October and a positive fourth quarter, as noted by Coinglass and Coinbase’s weekly report, which cites the recent US rate cut and supportive policies from China that could support risky assets like Bitcoin. Furthermore, increasing institutional demand for the US spot Bitcoin Exchange Traded Funds (ETFs) suggests a potential rally ahead.

Bitcoin performs best in fourth quarter and October month

Coinglass historical Bitcoin’s monthly returns and quarterly return data show optimism about Bitcoin’s price. Bitcoin generally has yielded positive returns for traders in October, with an average of 22.9%. More broadly, the fourth quarter data has generally shown a positive trend, with an average of 88.84%. Q4 will be important for the largest cryptocurrency because the upcoming US elections in November, with favorable conditions, could propel the price of Bitcoin.

Bitcoin Monthly returns (%) chart

Bitcoin Quarterly returns (%) chart

Coinbase, the largest cryptocurrency exchange in the US by trading volume, published its latest report on Friday. The report, written by David Duong, Head of Institutional Research, and David Han, Institutional Research Analyst, anticipates a constructive Q4 due to US rate cuts and significant fiscal and monetary stimulus from China. Both factors should enhance market liquidity and support BTC performance, the analysts say.

“The SEC’s approval of options on iShares Bitcoin Trust is a positive signal. These options could enhance institutional adoption and liquidity,” the report says, adding that Bitcoin and high-beta crypto assets have a strong overall outlook for the market in the upcoming months.

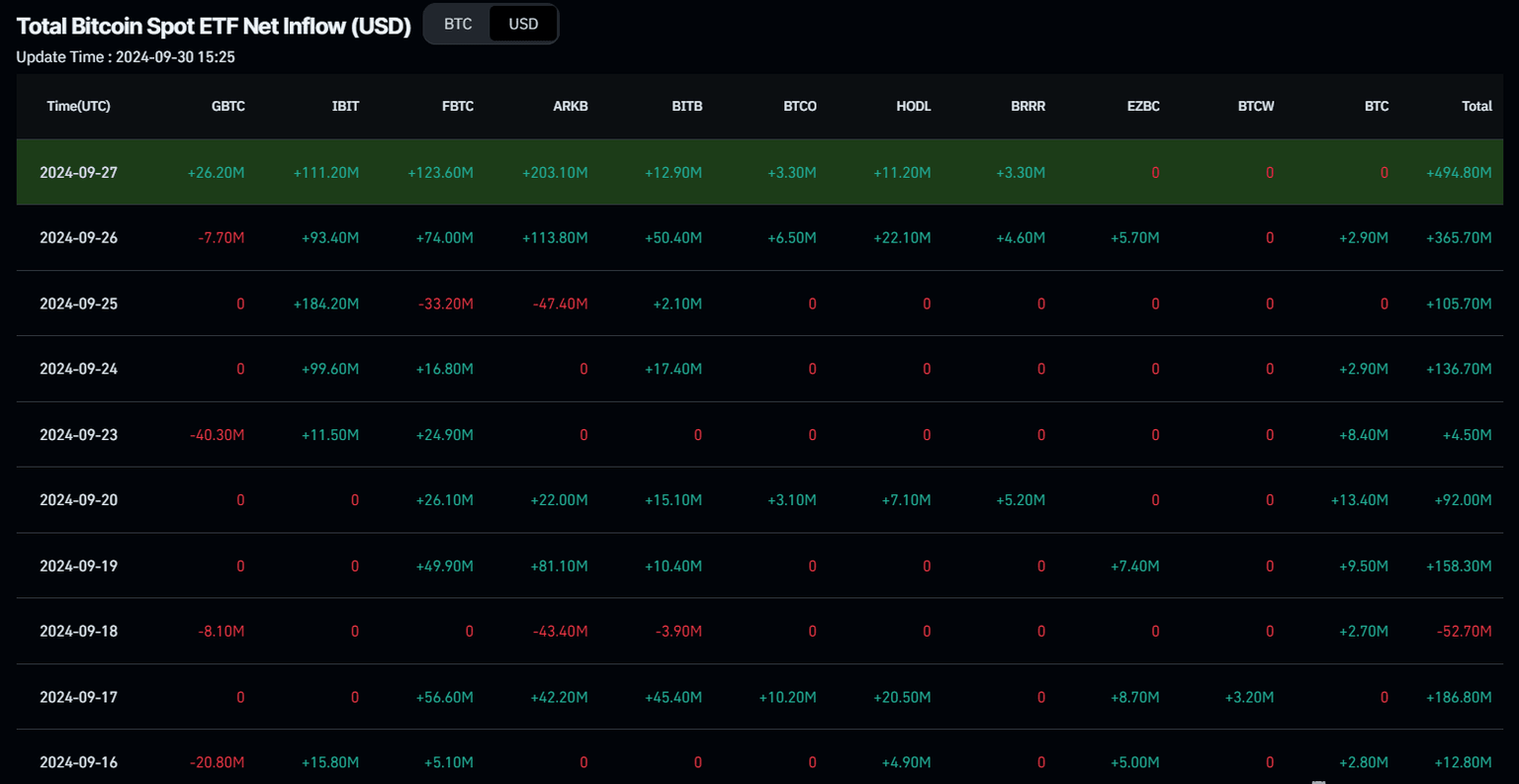

Institutional flows to BTC rose last week compared to the previous week. According to Coinglass data, the inflow into US spot Bitcoin ETFs increased from $397.20 million to $1.10 billion from the third to the fourth week of September. This sharp rise in inflows suggests that institutional investors are confident in Bitcoin.

Bitcoin Spot ETF Net Inflow chart

Ki Young Ju, founder and CEO of CryptoQuant, an on-chain Data and Analytics company, posted on Twitter that Bitcoin is “in the middle of the bull cycle.

“Its market cap is growing faster than its realized cap, a trend that typically lasts around two years,” he said.

This is generally a positive sign for Bitcoin, and if this pattern continues, the bull cycle might end by April 2025.

Hey bears, I'm sorry, but #Bitcoin is still in the middle of the bull cycle. https://t.co/QkaZx7wmAt pic.twitter.com/8lkIiRn1W7

— Ki Young Ju (@ki_young_ju) September 30, 2024

However, Coinglass’s Bitcoin long-to-short ratio highlights the possibility of a short-term correction for Bitcoin. The ratio stands at 0.91, the lowest level this month. This ratio reflects bearish sentiment in the market as a number below one suggests that more traders anticipate the asset’s price to fall.

Bitcoin long-to-short ratio chart

Technical analysis: Bitcoin faces short-term correction

Bitcoin price broke above the consolidation zone between $62,000 and $64,700 on Thursday and rose 1% in the next two days. However, it faced rejection around the $66,000 psychological level on Saturday and declined slightly the next day. As of this writing on Monday, it continues to trade down below $64,000.

If BTC breaks and closes above the $66,000 level, it could rally 6% to retest its July 29 high of $70,079.

The Relative Strength Index (RSI) on the daily chart declined slightly and is currently pointing downward, trading at 56, indicating a slowdown of bullish momentum. For Bitcoin to continue its rally, the RSI should rise back above 60 for the bullish momentum to be sustained.

BTC/USDT daily chart

However, if BTC breaks and closes below the consolidation zone around $62,000, it could extend the decline by 7% to retest its September 17 low of $57,610.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.