Bitcoin continues to chop around $48k as Ether’s exchange outflows spike

Bitcoin is in stasis as lingering macroeconomic risks keep gains in check. Ether, the native token of Ethereum’s blockchain, is seeing little action in the wake of supposedly bullish record daily outflows from exchanges.

Bitcoin, the largest cryptocurrency by market value, is trading around $48,000 for a second day. The upside momentum ran out of steam after the U.S. posted unexpectedly strong August retail sales figure on Thursday, reviving concerns of an early scaling back of Federal Reserve stimulus. Speculation about a so-called taper had subsided earlier this week following a weaker-than-estimated U.S. core inflation number.

Analysts at Standard Chartered expect the Fed to announce the taper next week after the Federal Open Market Committee meets. “The 22 September FOMC will likely signal a tapering decision at the next meeting, providing few details. The [interest rate] dots will likely signal one 2022 hike, and two added hikes in both 2023 and 2024. The risk skew is for more rather than less hikes; the added hawkish lean in not fully priced, in our view,” the bank’s analysts noted, according to efxnews.com.

Meanwhile, some observers are worried that Chinese property giant Evergrande’s debt problems may roil financial markets, including cryptocurrencies. Market activity in bitcoin futures and options suggests investors are cautiously bullish.

The bullish bias is evident from the mildly positive funding rates, or the cost of holding long positions, in the perpetual futures market, as Glassnode founders Jan Happel and Jann Allemann pointed out.

The cautious stance is apparent from the positive one-week and one-month put-call skews, which measure the cost of puts – or bearish bets – relative to calls, which are bullish bets. The positive values imply that traders are seeking short-term downside protection.

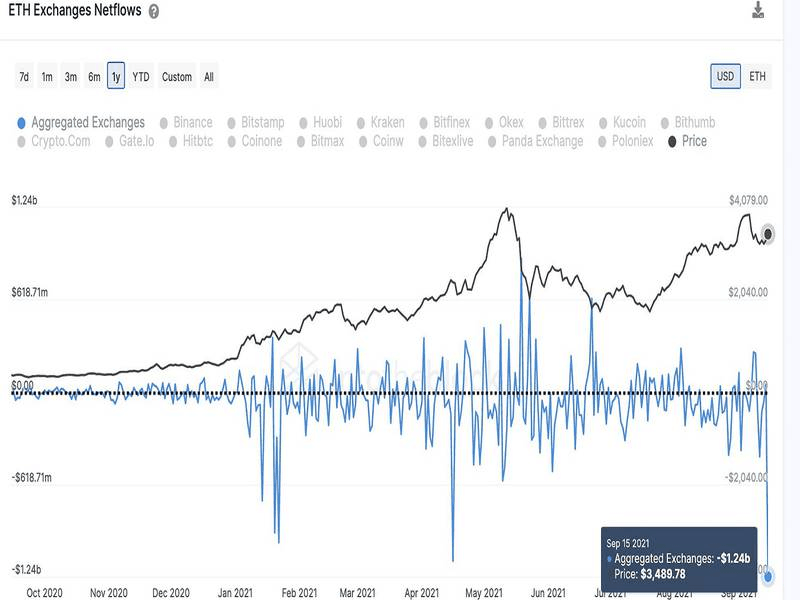

Record Ether exchange outflows

According to data analytics firm IntoTheBlock, centralized exchanges registered an outflow of more than 360,000 ETH worth $1.2 billion on Wednesday. That was the largest single-day net outflow in dollar terms on record.

Exchange outflows are typically considered bullish as they represent a decline in the coins available for sale in the market. Ether rallied by 60% within 30 days after centralized exchanges registered a single-day outflow of $1 billion on April 16.

As such, the crypto community is cheering the latest outflow. However, drawing definite conclusions based on blockchain metrics can be risky because not every outflow represents a withdrawal by investors. It could be an exchange’s internal transfer.

That said, ether’s exchange balance has been falling for over a year and reached a 2 1/2-year low of 15 million at the end of August. Meanwhile, the amount held in the ETH2 deposit contract continues to rise and currently sits at over 7 million, data source Glassnode shows.

Furthermore, in excess of 311,000 ETH – worth over $1 billion – has been burned or permanently taken out of supply since the activation of the Ethereum Improvement Proposal (EIP) 1559 on Aug. 9.

Combining these factors with Ethereum’s increased usage in decentralized finance suggests the path of least resistance for ether is to the higher side. Delphi Digital foresees a renewed rally in the ether-bitcoin exchange rate. At press time, ether is changing hands near $3,530, representing a 1% drop on the day.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.