-

Bitcoin dips to lowest level since May 3 before paring losses.

-

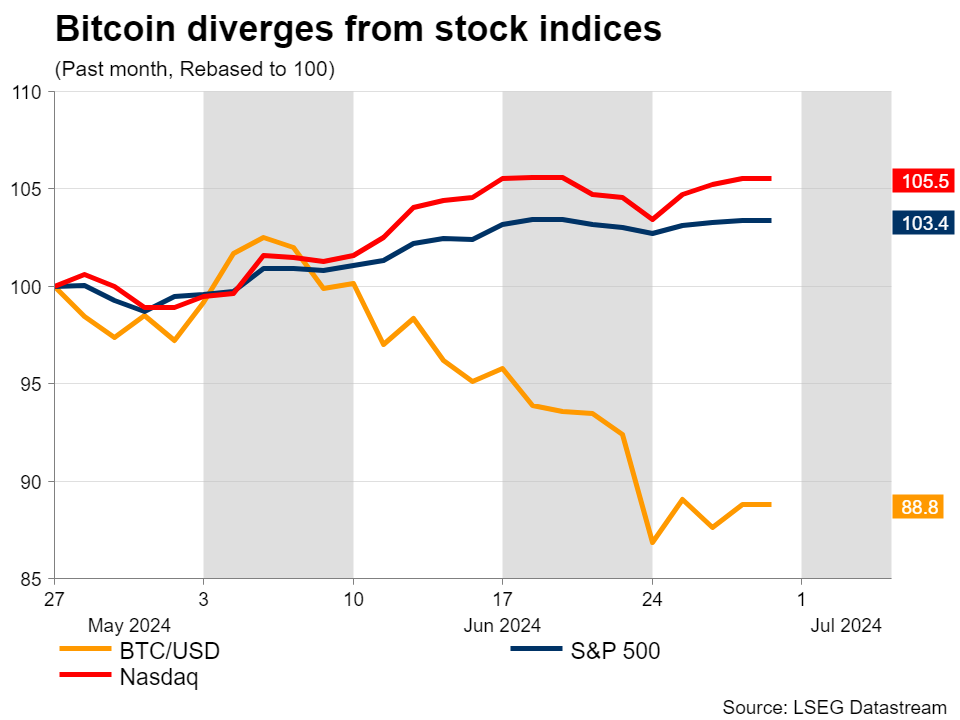

Cryptos’ correlation with equities has weakened lately.

-

Ethereum and Solana boosted by ETF speculation.

Bitcoin under selling pressure

The crypto market is clearly not in its best shape lately, with Bitcoin shedding a significant part of its 2024 rally and temporarily breaking below the $60,000 psychological mark to a more than one-month low. The bad news started when the Fed’s updated dot-plot indicated one rate cut for the year as the prospect of higher interest rates is negative for risk-sensitive assets.

Meanwhile, last week’s three-day tech selloff led by Nvidia spilled over to the crypto space, applying further downside pressure on digital assets. Interestingly, stocks have managed to bounce back from this recent slide, in contrast to cryptos, underscoring once again the recent correlation break between those two assets.

On the ETF front, it is clear that demand is cooling in the absence of fresh catalysts. Bitcoin spot investment products just experienced their largest two-week outflow since their initiation, suggesting that despite the initial surge in institutional interest, the road to mass adoption might be bumpy.

Mt Gox and altcoin ETFs on the spotlight

Just recently, a Japanese crypto exchange, Mt Gox, that was hacked in 2014 announced that it is on track to partially refund its customers. Crypto traders are expecting this move to increase selling pressure on Bitcoin because essentially the incoming supply was out of circulation for more than 10 years. Moreover, even if beneficiaries are reimbursed with an increment of their positions, the value today might be massive compared to what it was in 2014, which may potentially entice them to sell to realise those unprecedented profits.

Besides that, Bitcoin has been slightly outshone by Ether and Solana lately as increased speculation regarding their corresponding ETFs has brought them to the headlines. Investors are expecting spot Ethereum ETFs to start trading in early July, an outcome that could trigger a rally in the second-largest cryptocurrency, should Bitcoin’s history serve as an example. We shouldn’t forget that Ether has not surpassed its previous cycle highs.

Solana’s price rose significantly on news that the well-known fund manager VanEck has filed an application for the launch of an ETF based on that digital coin. However, the SEC’s approval of a Solana ETF seems uncertain as such an action would open the door for similar investment products to be launched for smaller cryptos. This would raise the risk of the public getting access to assets that could be easily manipulated, leading to severe losses for inexperienced investors.

Is Bitcoin headed for a test of the 200-day SMA?

BTCUSD (Bitcoin) has been experiencing a vast selloff since the beginning of June, temporarily breaking below the $60,000 psychological mark. Although the price managed to halt its retreat just shy of the 200-day simple moving average (SMA), it has been rangebound in the past few sessions unable to stage a recovery.

Should Bitcoin fall back below the $60,000 psychological level, immediate support could be found at the March-April support of $59,600. Sliding beneath that floor, the price could challenge the June low of $58,400.

On the flipside, if buying pressures re-emerge, the price could advance towards $64,500, a region that has acted both as resistance and support in 2024. Conquering that zone, the bulls could attack the April resistance of $67,270.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400. The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead.

Binance Chain completes $914M BNB token burn, hinting at a potential rally

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.