Bitcoin Chart Analysis: BTC/USD slides deeper inside a triangle pattern – Confluence Detector

- On a daily chart, BTC/USD moves down from an upper line of a triangle pattern.

- The intraday charts reflect growing market indecision.

Bitcoin tested the upper line of the recent triangle pattern during the weekend, but the upside momentum was not strong enough to take the price above the critical resistance. At the time of writing, BTC/USD is changing hands at $9,530, mostly unchanged both on a day-to-day basis and since the beginning of Monday. The intraday high is registered at $9,612, while the low is reached at $9,446. The first digital coin is moving within the short-term bullish trend amid low volatility.

BTC/USD daily chart

On the intraday chart, BTC/USD is hovering around 1-hour SMA50 amid growing market indecision, which is also confirmed by a flat RSI. The current conditions imply that the price may stay range-bound during the next trading hours. Let’s have a closer look at the strong resistance and support levels to get a clear view of the technical picture.

BTC/USD 1-hour chart

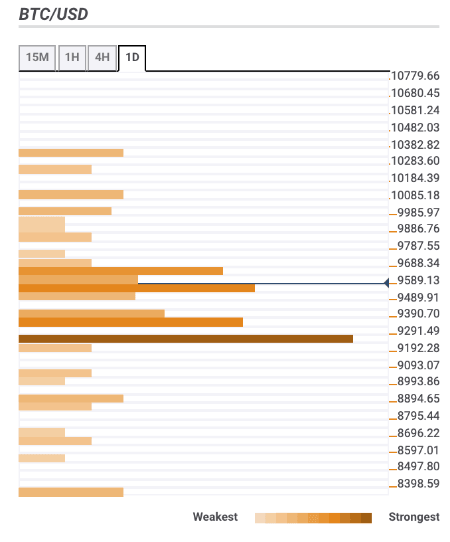

Resistance levels

$9,600 – 23.6% Fibo retracement monthly, the highest level of the previous week

$10,000 – Pivot Point 1-day Resistance 3, the upper line of the daily Bollinger Band, the highest level of the previous month

$10,300 - Pivot Point 1-month Resistance 3

Support levels

$9,500 – 38.2% Fibo retracement daily, the middle line of the 4-hour Bollinger Band, the middle line of the 1-hour Bollinger Band

$9,200 – 4-hour SMA50, 1-hour SMA200, 38.2% Fibo retracement weekly

$9,000 – 61.8.6% Fibo retracement weekly.

Author

Tanya Abrosimova

Independent Analyst

-637266062822314526.png&w=1536&q=95)

-637266062622145540.png&w=1536&q=95)