- BCH/USD went up from $318.35 to $325.30 in the early hours of Wednesday.

- The Elliott Oscillator has charted five bullish sessions in a row.

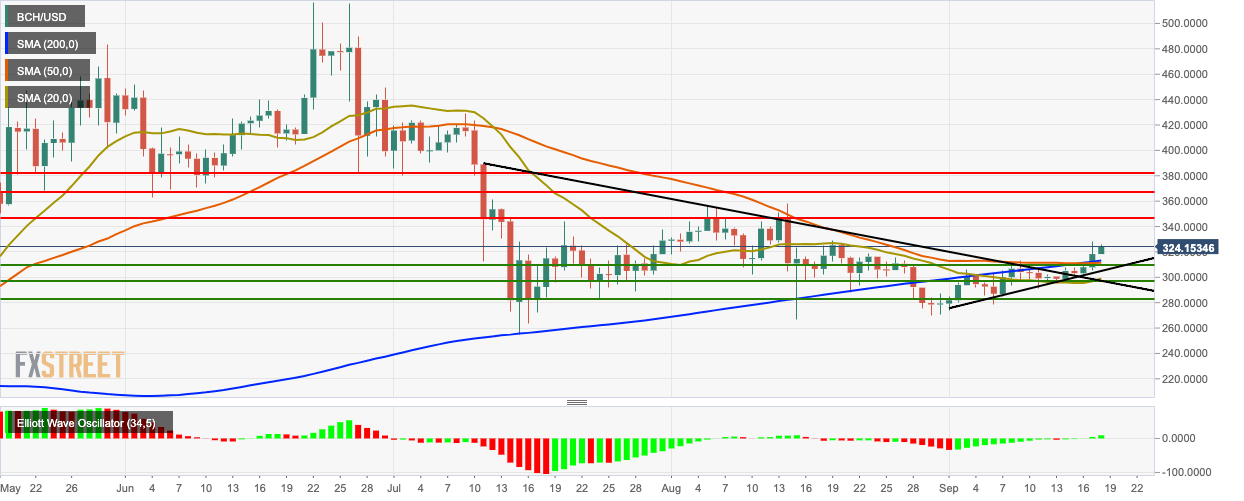

BCH/USD daily chart

BCH/USD has managed to chart three straight bullish days in a row. Bitcoin Cash has gone up from $318.35 to $325.30 today. The market had a bullish breakout from the triangle formation and is trending above the 200-day Simple Moving Average (SMA 200), SMA 50 and SMA 20 curves. The Elliott Oscillator has charted five bullish sessions in a row.

BCH/USD four-hour chart

The four-hour BCH/USD chart went up to $323.85, where it met resistance and dropped to $318.35. The bulls then re-entered the market and took the price back up to $325.30. The four-hour price is trending above the 20-day Bollinger Band, indicating that BCH/USD is currently overpriced. The Relative Strength Index (RSI) indicator has crept back into the overbought zone after exiting it.

BCH/USD hourly chart

The hourly BCH/USD has found support on the upward trending line. The hourly price is also trending above the SMA 20, SMA 50 and SMA 200 curves. The Moving Average Convergence/Divergence (MACD) line was about to cross over the signal line before they both diverged and started trending parallelly to each other.

Key Levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin holds $87,000 as markets brace for volatility ahead of April 2 tariff announcements

Bitcoin (BTC) holds above $87,000 on Wednesday after its mild recovery so far this week. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as the market absorbs the tariff announcements.

Shiba Inu rallies as trading volume rises 228% amid increase in bullish bets

Shiba Inu price extends its gains by 8% and trades at $0.000015 at the time of writing on Wednesday, rallying over 15% so far this week. On-chain data shows that SHIB’s trading volume rose 228% in the last 30 days, bolstering the platform’s bullish outlook.

BTC, ETH, and XRP could face volatility as Trump’s “Liberation Day” nears

Bitcoin (BTC) price hovers around $87,000 on Wednesday after recovering 4% in the last three days. Ethereum (ETH) and Ripple (XRP) find support around their key level, suggesting a recovery on the cards.

BlackRock’s BUIDL fund launch on Solana platform while Fidelity files for spot Solana ETF

Solana price hovers around $142 on Wednesday after recovering by 7% so far this week. BlackRock’s BUIDL fund launches on the Solana platform. Fidelity files for a spot Solana ETF with Cboe.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637043698416994741.png)

-637043697765263836.png)