- The sellers have so far nearly canceled out all the gains that the buyers made yesterday

- BCH has two healthy support levels at $227 and $225.

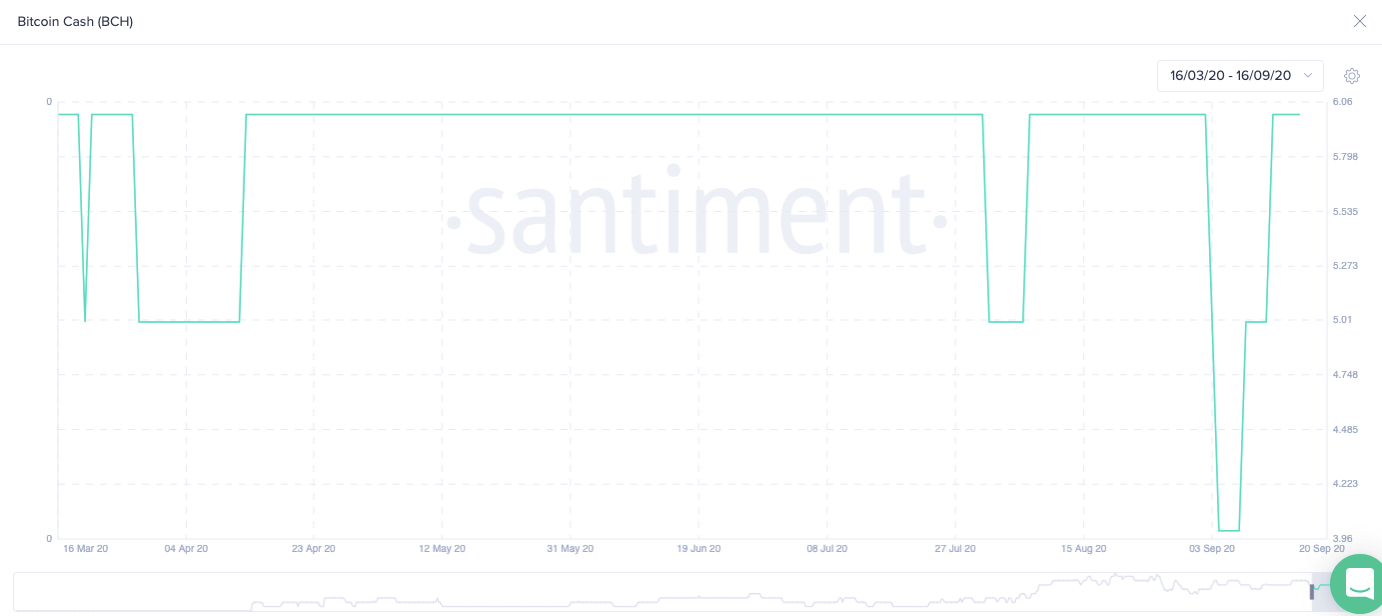

BCH/USD bulls were in full control of the market for the last two days. During this period, they were able to take the price up from $222.50 to $235. The number of holders with 100,000 - 1 million BCH coins had gone up from four to six in the previous ten days, which may have affected the price.

However, following this bullish price action, the price failed at the $235 resistance line and has since fallen down.

BCH/USD daily chart

After failing at the $235-level, the bears took over the market and dropped the price to $229.35. The sellers have nearly canceled out all the gains that the buyers made yesterday. The RSI is trending around the neutral zone, which means that BCH/USD can drop even more before it becomes undervalued.

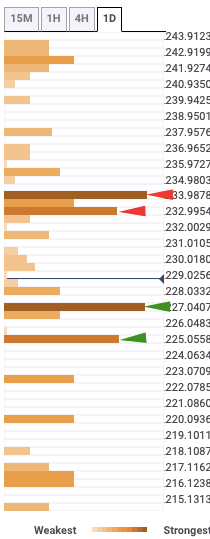

BCH/USD daily confluence detector

The confluence detector is a pretty handy tool that shows us healthy resistance and support levels. This helps determine the upside and downside potential of the asset. When it comes to BCH/USD, there are two strong resistance levels at $233 and $235. The former has the monthly Pivot Point one support-one, while the latter has the weekly Pivot Point resistance-one.

On the downside, BCH has two healthy support levels at $227 and $225. The former has the one-week Fibonacci 61.8% retracement level, while the latter has the one-day Previous low.

BCH is soon going to go through a consolidation period as the holders prepare themselves for a third fork in four years.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637358259911979739.png)