- Bitcoin Cash price has seen a massive explosion in the past week jumping from a low of $333 to $464.

- The digital asset faces one last resistance level before $500.

Bitcoin Cash has been inside a steady and robust uptrend since September 2020. In total, the digital asset has risen by more than 130% but hasn’t yet beaten the 2020-high of $498 established on February.

Bitcoin Cash faces one critical resistance level

BCH is currently trading at around $440 after significant continuation in the past 24 hours from an initial breakout above $360 on January 3. The digital asset now faces very little resistance ahead according to various indicators.

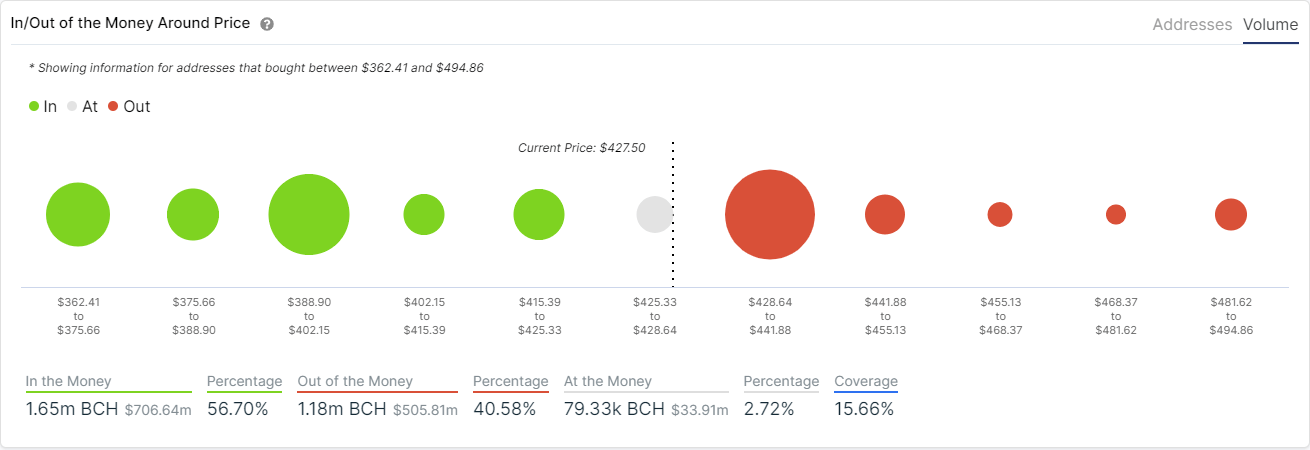

BCH IOMAP chart

According to the In/Out of the Money Around Price (IOMAP) chart, Bitcoin Cash has established a strong resistance area between $428 and $441. A breakout above this range can quickly push Bitcoin Cash price towards $500.

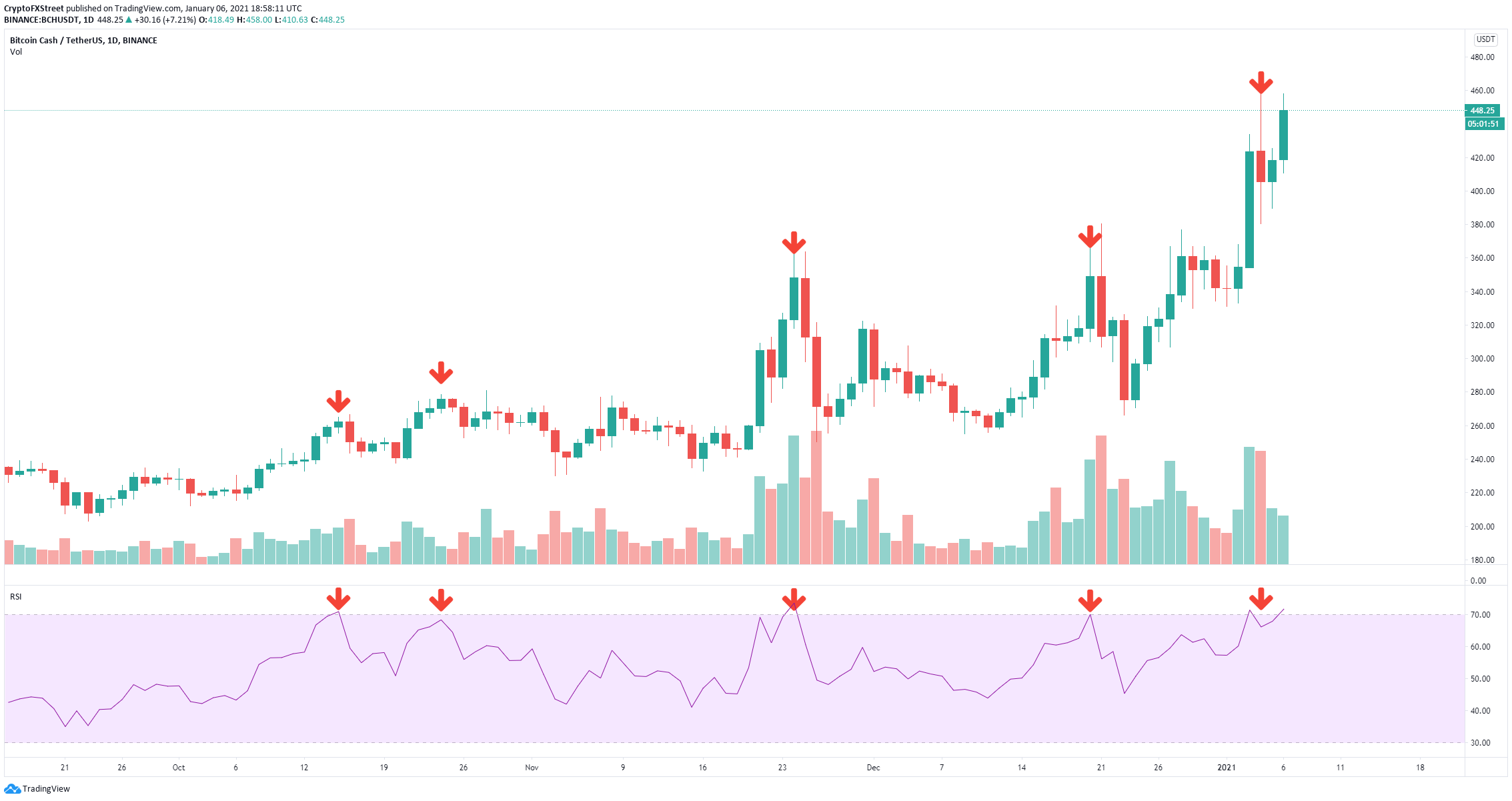

BCH/USD daily chart

However, on the daily chart, the RSI is overextended, which indicates a pullback is nearby. In the past several months, the overbought RSI has been an accurate indicator of temporary tops for Bitcoin cash.

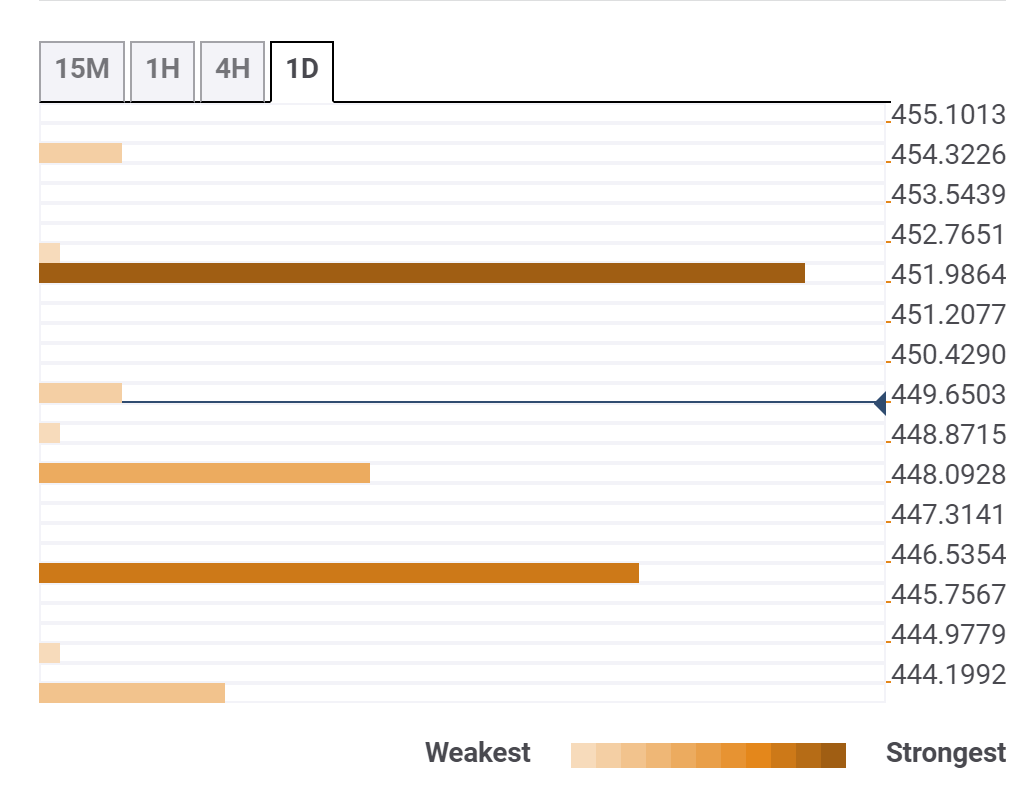

BCH Confluence Levels

The confluence detector shows weak support below at $448 which is the Pivot Point on the daily and $445 which coincides with the Pivot Point 1 Week R3 and the previous hourly low.

On the way up, the most significant resistance level seems to be located at $452 where the 10-SMA on the 15-minutes chart is located and the Pivot point 1 Month R2.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP Price Prediction: XRP battles tariff turbulence amid MVRV buy signal

Ripple (XRP) seeks stability in a volatile crypto landscape influenced by macroeconomic factors, including reciprocal tariffs. The international money transfer token hit a low of $1.64 on Monday after opening the week at $1.92, representing a 14.5% daily drop.

Trade war escalates crypto market downturn amid President Trump's new tariff announcement

The cryptocurrency market extended its decline on Monday, stretching its market capitalization loss to $250 billion since the US slapped tariffs on international trading partners.

Chinese Yuan devaluation could drive Chinese capital flight into Bitcoin– says Arthur Hayes

BitMEX co-founder Arthur Hayes highlighted a potential Chinese Yuan devaluation in his X post on Tuesday, suggesting it could drive Chinese capital flight into Bitcoin. Arthur says this trend worked in 2013 and 2015 and can work in 2025.

Crypto whales buy 874 billion SHIB as Shiba Inu price plunges to lowest in 13 months

Shiba Inu (SHIB), one of the most talked-about meme coins in the cryptocurrency space, took a sharp nosedive on Monday, plunging below the $0.00001 threshold for the first time since February 2024.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.