Bitcoin Cash Price Forecast: BCH to aim for $275 after critical support holds strong

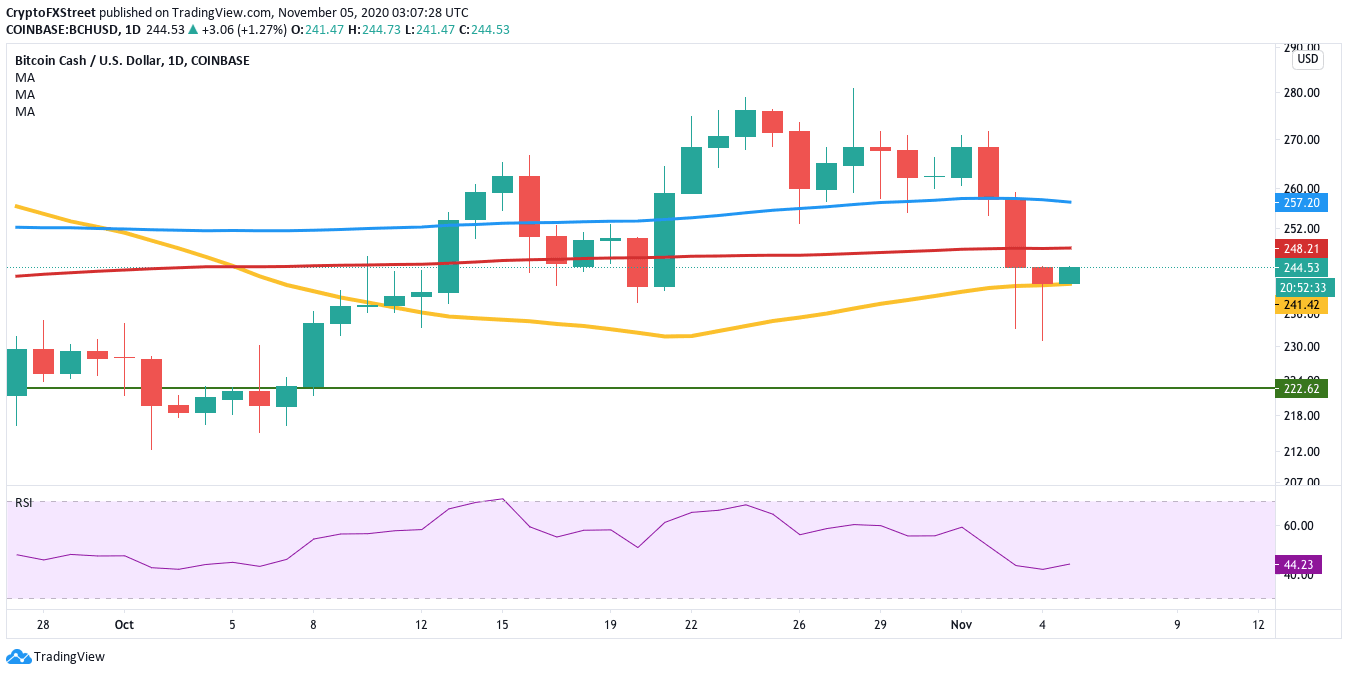

- The price has managed to bounce up from the 50-day SMA.

- Bulls face strong resistance at 100-day SMA and 200-day SMA.

Bitcoin Cash fell from $268.25 to $241.70 in three days between November 2 and November 4. In the process, it broke below the 100-day SMA and 200-day SMA. However, a critical support wall has remained strong, which could swing the fortunes in the bulls’ favor.

The 50-day SMA holds strong

The buyers have bounced BCH up to $245 after bouncing up from the 50-day SMA. Looking at the price history, the 50-day SMA has been a solid support and resistance level. Following this bullish price action, the relative strength index (RSI) has stopped its downward movement and swung up from 41.60 to 43.45.

BCH/USD daily chart

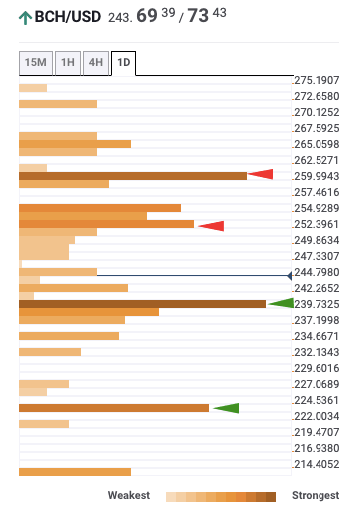

The daily confluence detector helps us visualize healthy levels of support and resistance. As per the detector, we have two strong resistance levels at the 100-day SMA ($257) and 200-day SMA ($248). Upon breaking above these barriers, the price will be able to break into the $275-zone.

BCH daily confluence detector

The bullish thesis holds when looking at Santiment’s holders distribution chart. The number of addresses holding 1,000-10,000 tokens went up from 1,724 on November 1 to 1,755 at the time of writing. Similarly, the number of addresses holding 10,000-1 million tokens rose from 170 on November 2 to 171 at the time of writing.

BCH holders distribution

It should be noted that this thesis holds only if the 50-day SMA doesn’t crumble. If the bears manage to take BCH down, the next viable support wall, as per the daily confluence detector, is at $222.50.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

%20%5B08.59.54%2C%2005%20Nov%2C%202020%5D-637401452496924379.png&w=1536&q=95)