Bitcoin Cash price dives as tokens flood exchanges ahead of its upcoming hard fork

- Bitcoin Cash price dropped by 6% in the past four days away from its upcoming hard fork.

- Bitcoin Cash will undergo a protocol upgrade on Sunday, November 15, 2020, which will result in a hard fork.

Bitcoin Cash price has been declining over the last days, with BCH currently trading at the $257 zone, down from a recent high of $278 ahead of an upcoming network hard fork, taking place next Sunday, November 15. Currently, Bitcoin Cash has two competing protocols, BCHN and Bitcoin ABC. However, BCHN is strongly favored, with 85% of block miners. A new infrastructure Funding Proposal has stirred some controversy for BCH, resulting in the upcoming hard fork.

On November 15, the two camps will implement their versions of the proof-of-work protocol upgrade, thus likely resulting in two separate chains, where the chain with the most mining power will ultimately win out with exchanges and miners.

It seems that the world's most popular exchanges like Binance, Coinbase, or Kraken will be supporting BCHN after a hard fork. Some exchanges might also list the other version of the hard fork depending on specific conditions.

Can BCH profit from the upcoming fork?

There has been a massive spike in BCH coins' inflow to exchanges in the past week. So far, this seems not to have affected Bitcoin Cash price too much as it continues trading at $257, but the coins flood might not be a bad indicator.

Over 1 million Bitcoin Cash has been sent to exchanges in the last seven days ahead of the hard fork on 15 November, driving the BCH price relative to BTC even lower.

— Philip Gradwell (@philip_gradwell) November 11, 2020

Track daily BCH exchange inflows here: https://t.co/kxrZt6Jvai pic.twitter.com/SobmbY1eRK

Although a spike in the inflow of coins to exchanges is usually seen as a bad metric for the bulls, in this specific scenario, it could be a positive factor. A lot of investors might want the upcoming forked coins, which means an increase in buying pressure. Something similar happened to Bitcoin ahead of the BCH hard fork in August 2017, when the flagship cryptocurrency saw a 40% price increase in the following weeks.

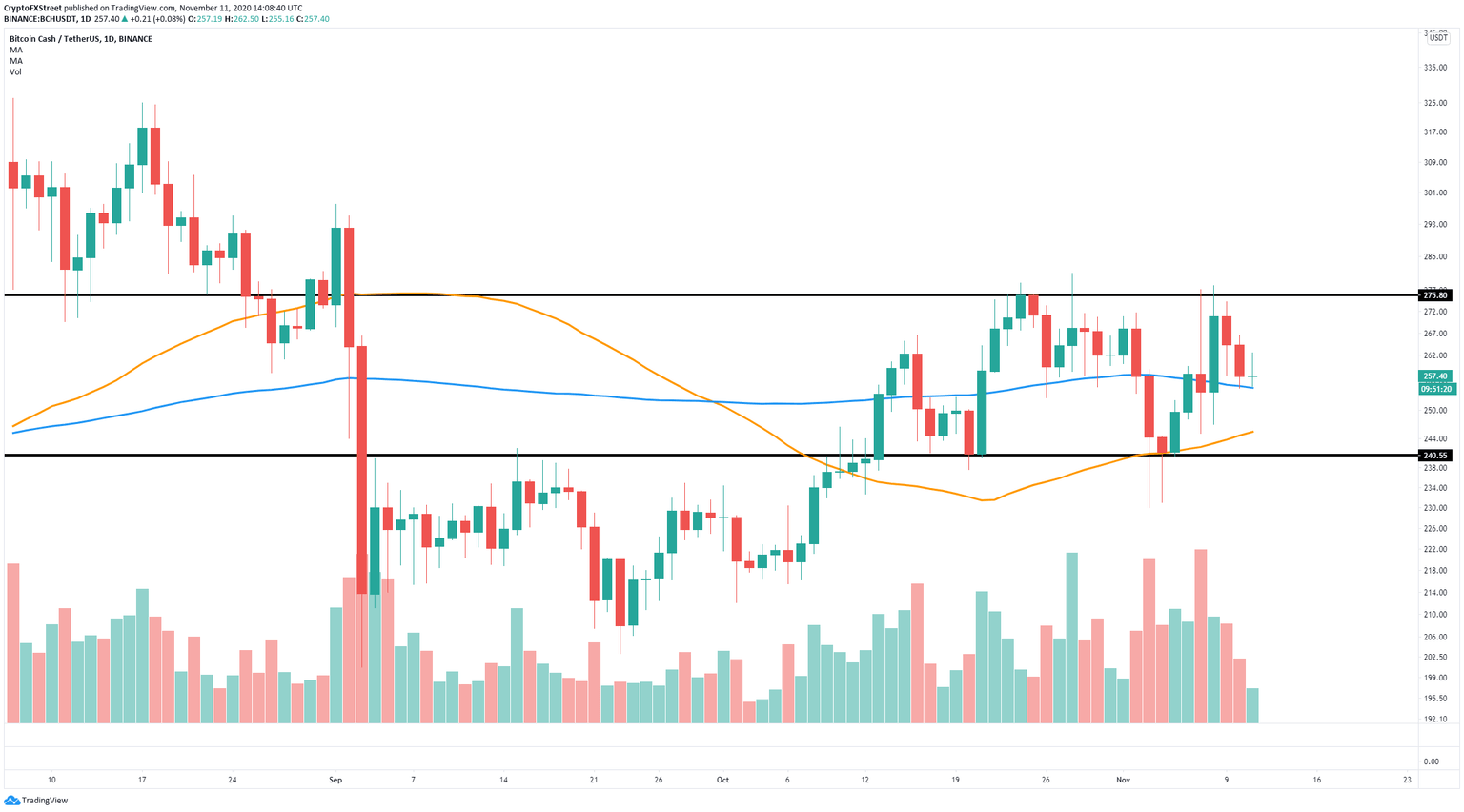

BCH/USD daily chart

Technically speaking, Bitcoin Cash price seems to be bounded between $240 and $275 for the past month. Currently, the 100-SMA is acting as a strong support level at $255. A bounce from this level can drive Bitcoin Cash price towards the upper line at $275.

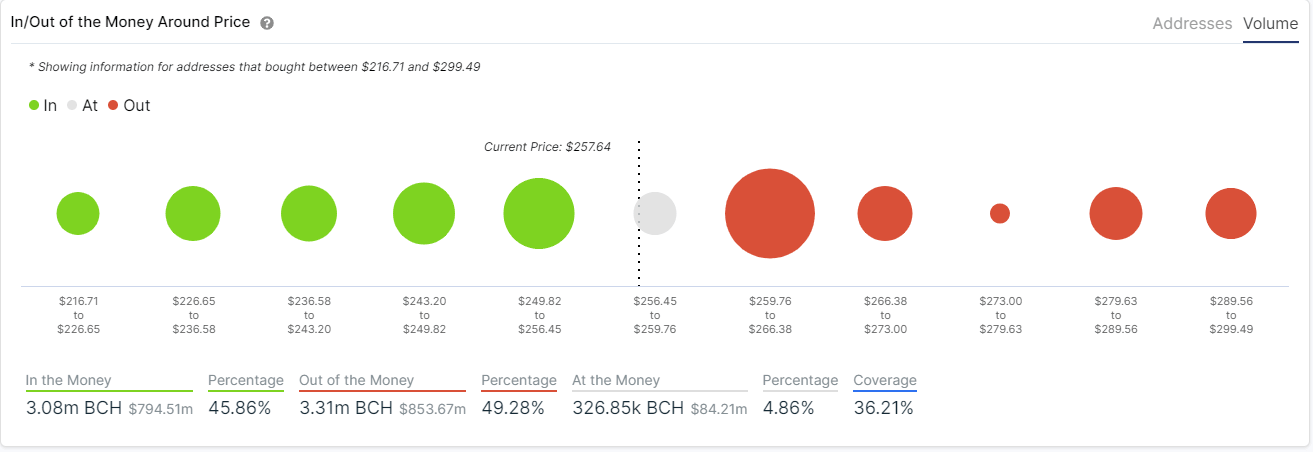

BCH IOMAP chart

According to the In/Out of the Money Around Price chart (IOMAP), the most vigorous resistance area is located between $259 and $266 with 1.69 million BCH purchased. A breakout from this point can push Bitcoin Cash price to $300.

On the other hand, slipping below the 100-SMA at $255 would be a notable bearish sign with two initial price targets of $245 and $240. A breakdown from the lower line at $240 could push Bitcoin Cash price to $215.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.