Bitcoin Cash Price Analysis: BCH sits on top of strong support barrier – Confluence Detector

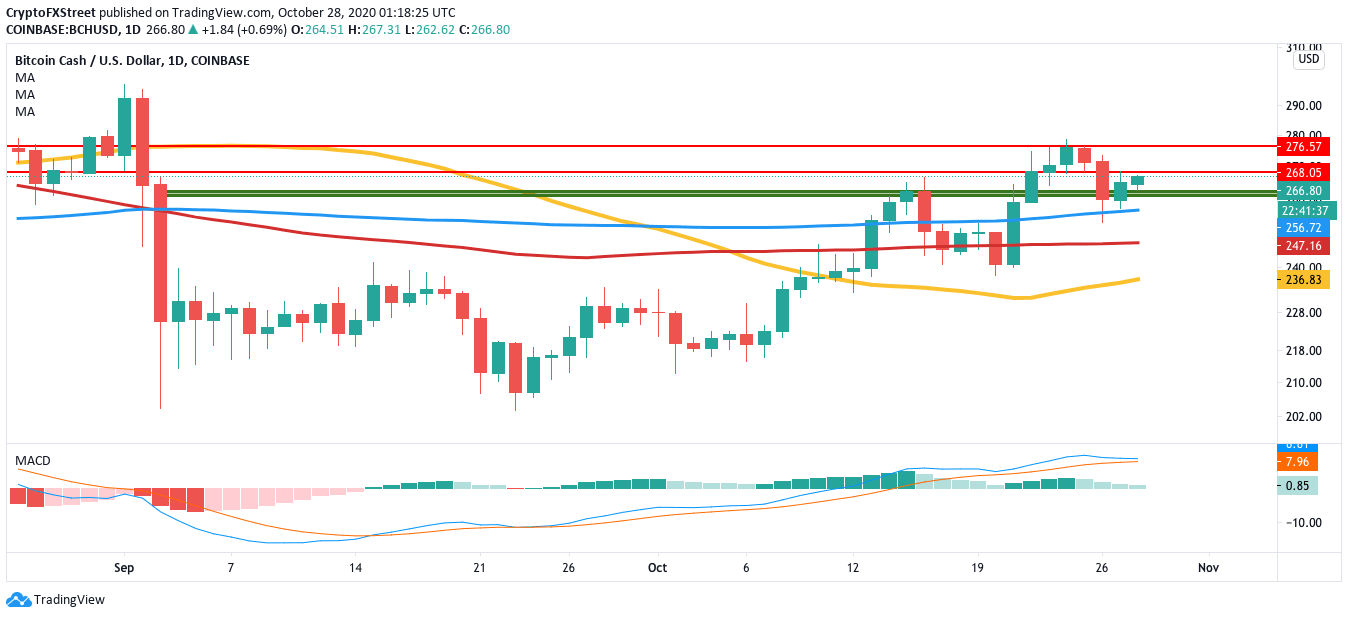

- The MACD in the daily chart for BCH shows sustained bullish momentum.

- The 3-day BCH chart has flashed a sell signal in the TD sequential with a green nine candlestick.

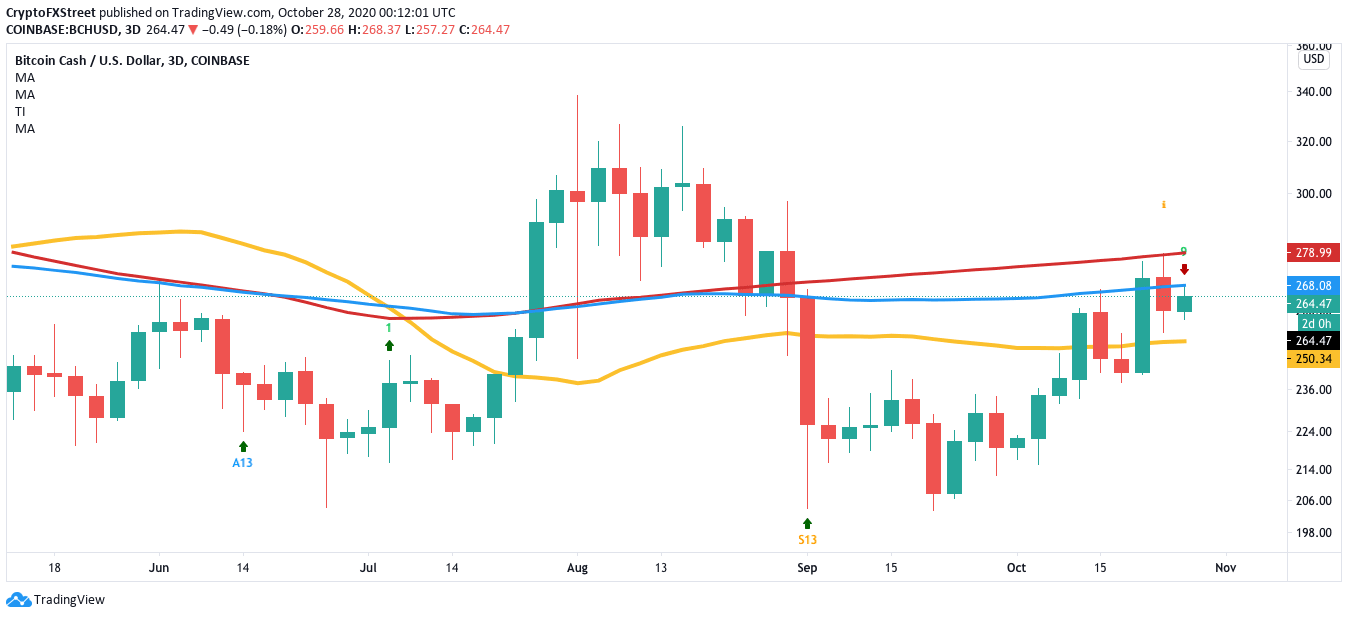

Bitcoin Cash rose from $240 and rose to $276 between October 21 and October 24. After that, the price dropped to ~$260, found support at the 100-day SMA and has gone up to $266.50, as of writing. Currently, BCH has two resistance walls upfront at $268 and $276. The MACD shows sustained bullish momentum.

BCH/USD daily chart

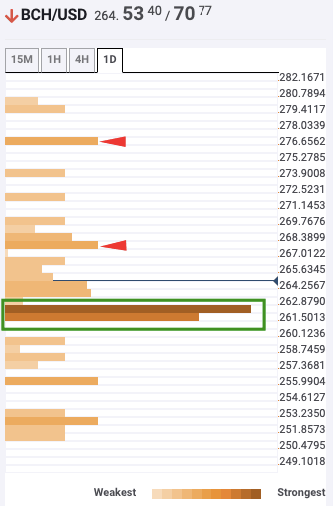

The daily confluence detector helps us visualize strong resistance and support levels. As per the tool, $268 and $276 has moderate resistance. If the buyers somehow manage to break past these barriers, they should reach $300.

BCH daily confluence detector

Another positive sign is the fact that the whales have been busy strengthening their positions. The number of addresses holding 10,000 - 100,000 tokens has gone up from 164 to 170 between October 25 and October 27. This is an extremely positive sign for the overall ecosystem.

BCH holders distribution

The Flipside: Can the bears take over?

While the overall outlook looks good for the bulls, there may be a short-term bearish correction around the corner. The 3-day chart for the Bitcoin fork has flashed the TD sequential indicator's sell signal via the green nine candlestick. This could see a price downturn to the 50-bar SMA ($250).

BCH/USD 3-day chart

Key price levels to watch

For the buyers, the $276 resistance line is crucial. Breaking past this level should give them a free path to $300.

The sellers will look to capitalize on the sell signal in the 3-day chart and drop the price to the 50-bar SMA ($250).

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

%20%5B05.41.40%2C%2028%20Oct%2C%202020%5D-637394450730426605.png&w=1536&q=95)