Bitcoin Cash Price Analysis: BCH bulls remain in control as network readies itself for system upgrade

- Bitcoin Cash will have a scheduled upgrade in a little over a month’s time on November 15, 2020.

- The price is currently facing repeated rejections at the 200-day SMA.

All eyes are on Bitcoin Cash and the brewing drama between Bitcoin Cash ABC and BCHN as the network preps for a scheduled upgrade on November 15, 2020. The main bone of contention between the two groups lies in Bitcoin Cash ABC’s insistence upon using the highly controversial "Infrastructure Funding Proposal" (IFP) coinbase rule. The rule states that nearly 8% of the coinbase reward would be set aside for infrastructure development, which has rubbed many miners the wrong way.

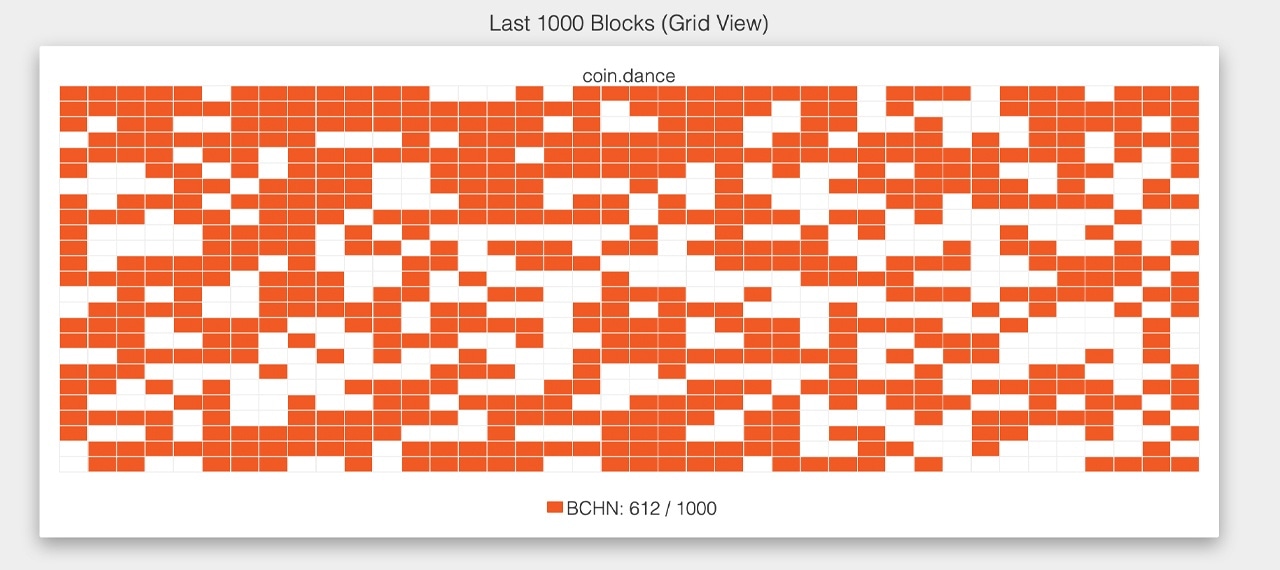

This has resulted in a massive migration with many node operators and miners starting to switch over to the Bitcoin Cash Node (BCHN) client. As per Coin Dance, 612 out of the last 1,000 blocks were mined using the BCHN software towards the end of September.

That’s the situation as it stands right now. With a little over a month left for the upgrade, well-known exchanges like Poloniex have started to give their customers the options to split their Bitcoin on Poloniex and receive equal amounts of Bitcoin Cash ABC (BCHA) and Bitcoin Cash Node (BCHN).

to 2018

— Poloniex Exchange (@Poloniex) October 9, 2020

Pre-fork trading for #Bitcoin Cash is now available!

Claim #BCHA and #BCHN with your $BCHABC on #Poloniex and start trading our new pre-fork markets in our #Innovation Zone. $USDT and $BTC pre-fork markets are now open in post-only modehttps://t.co/MoB3mYGoCb pic.twitter.com/e2JoM4w4bw

The technical picture

BCH dropped from $290 to $207.50 between September 2 to September 23 and has since recovered to $242. Currently, the peer-to-peer electronic cash is trapped between the 50-day SMA and 200-day SMA.

BCH/USD daily chart

The bulls will need to break above the 100-day SMA and 200-day SMA to sustain the upward movement and aim to flip the $290 resistance line into a support level. This line is extremely crucial since it triggered the September 2 price crash.

The MACD shows increasing sustained bullish momentum, which should ideally give them enough firepower to continue its movement. However, the price is currently getting repeatedly rejected at the 200-day SMA ($245). As per the IOMAP, 78,000 addresses had previously purchased a little over 660,000 BCH at this level.

BCH IOMAP

According to IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP), if the buyers manage to clear past this level, they will face another moderate-to-strong resistance level at $270 before they can make a charge for the $290 resistance line.

The Flipside: What if the 200-day SMA stays strong?

If the buyers face further rejections at the 200-day SMA, they will eventually run out of steam and open the bears' gates to take over. The price is sitting on top of two healthy support levels, as per the IOMAP.

The first level lies at the 50-day SMA ($235). According to the IOMAP, 98,000 addresses had previously purchased ~670,000 BCH at this level. If the bears manage to break below this level, they will face a significant support wall at $225. At this level, 135,000 addresses had previously purchased 1.7 million tokens.

These two support levels seem strong enough to absorb any buying pressure as of now, effectively capping the downside at $225. A further break below this could be disastrous as it may take BCH below the $200-level.

Key price levels to watch

The bulls need to break above the 200-day SMA ($245) and prevent it from doing any further damage to the digital asset’s growth. Upon breaking past this level, the buyers will want to aim for the $290 resistance level and re-enter the $300-zone.

On the downside, BCH has two healthy support levels at the 50-day SMA ($235) and $225. These levels are strong enough to absorb any excessive selling pressure.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637381618202775433.png&w=1536&q=95)