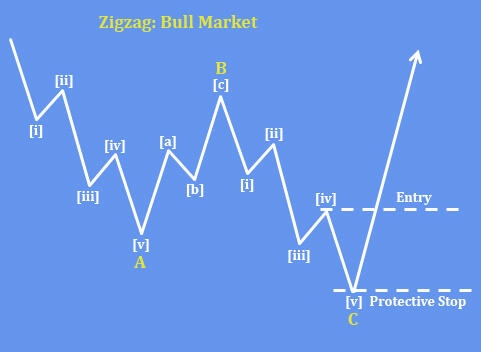

Bitcoin Cash could be in final stages of a correction

Bitcoin Cash with ticker BCH/USD has completed five waves up from the 2023 lows that can be wave I, suggesting that more gains could follow, but after a projected ABC correction in wave II on a daily chart that can be coming to an end, as subwave (C) can be nearing interesting channel support line and equal wavelength of waves A=C that come at 270 – 220 support zone.

BCH/USD daily chart

Bitcoin Cash (BCH) is a decentralized cryptocurrency that was created in 2017 through a fork from Bitcoin (BTC) due to disagreements over the protocol’s future. The goal was to make a cryptocurrency better suited for everyday payments, unlike Bitcoin, which has high fees. Bitcoin Cash has a larger block size of 32MB (as of 2023) compared to Bitcoin’s 1MB, allowing it to scale for global payments.

BCH/USD daily chart

Basic ABC decline shows that Bitcoin Cash can be finishing a correction, while it's approaching the support area by Elliott wave theory.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.