Bitcoin Cash Chart Analysis: Downside appears compelling amid bearish technical set up

- BCH/USD is back to the red zone, in a familiar range on Sunday.

- No. 5 coin looks vulnerable amid bearish technical setup.

- Hourly RSI pierced 50.00 from above, more losses likely?

Bitcoin Cash (BCH/USD) is seeing aggressive selling over the last hour, after having witnessed a volatile session late Saturday. Holiday-thinned trading conditions across the crypto board triggered a $7 rally in the coin in a matter of 15 minutes. The price hit fresh weekly highs at $229.31, in an unusual spike. Saturday. The bulls failed to sustain at higher levels, as the bears appear to fight back control in Sunday’s trading so far. The digital asset has returned to the familiar range around $222, down over 1.30% on a daily basis while on track to book 2.20% weekly gain. The market capitalization for BCH/USD stands at $4.12 billion.

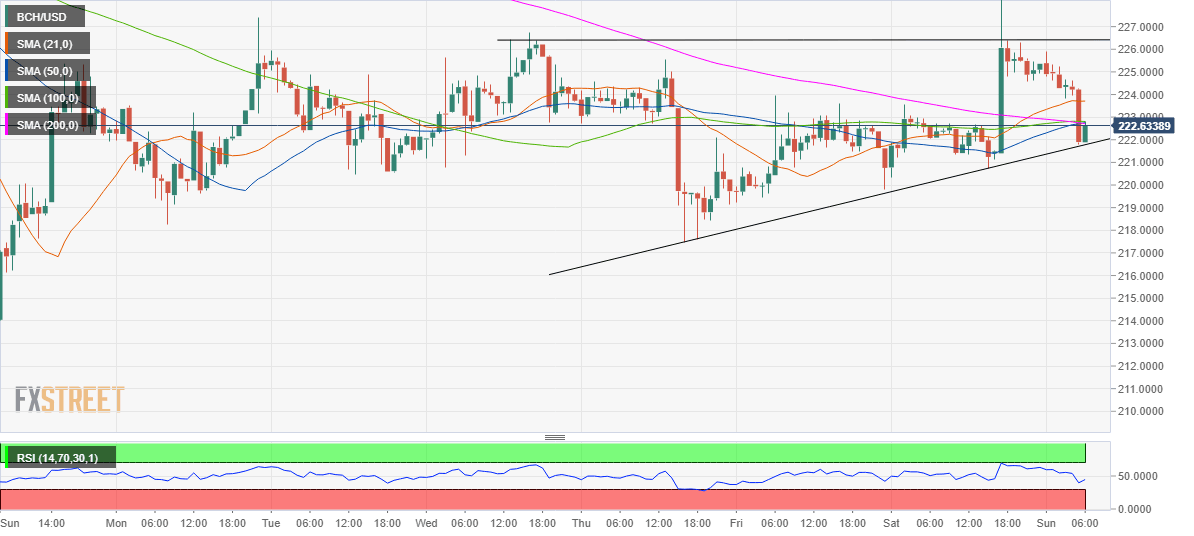

BCH/USD: Hourly chart

The coin is teasing an ascending triangle on the hourly chart this Sunday, with the pattern target of $213 in sight should the price close the hour below rising trendline support of $221.78.

On its way to the said target, BCH/USD bulls could find support near Thursday low of $217.46. The pair remains vulnerable as the hourly Relative Strength Index (RSI) has pierced the 50 midline from above to now trade in the bearish territory at 42.40.

Also, the fifth most favorite coin has slipped below all the major hourly Simple Moving Averages (HMA).

The minor recoveries should meet fresh supply at $222.80, where a cluster of support-turned-resistance of the 200, 100 and 50-HMAs are stacked up. A breakthrough the latter, the price could confront the 21-HMA barrier at $223.70 on its way to retest the 227 level.

BCH/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.