The Bank for International Settlements (BIS) studied the main motives behind Bitcoin adoption by retail investors.

Bitcoin BTC ↑ $16,831 investors are more likely enticed by the cryptocurrency’s rising prices, rather than their dislike of banks or its perceived use as a store of value, a new report from the Bank for International Settlements (BIS) suggests.

In a “BIS Working Papers” report published on Nov. 14, the central bank body looked into the relationship between Bitcoin prices, crypto trading, and retail adoption.

It studied the drivers of crypto adoption by retail investors using crypto trading app downloads as a proxy for adoption and user investments at the time of download.

It found that “a rise in the price of Bitcoin is associated with a significant increase in new users, ie entry of new investors” and that most retail investors “downloaded crypto apps when prices were high.”

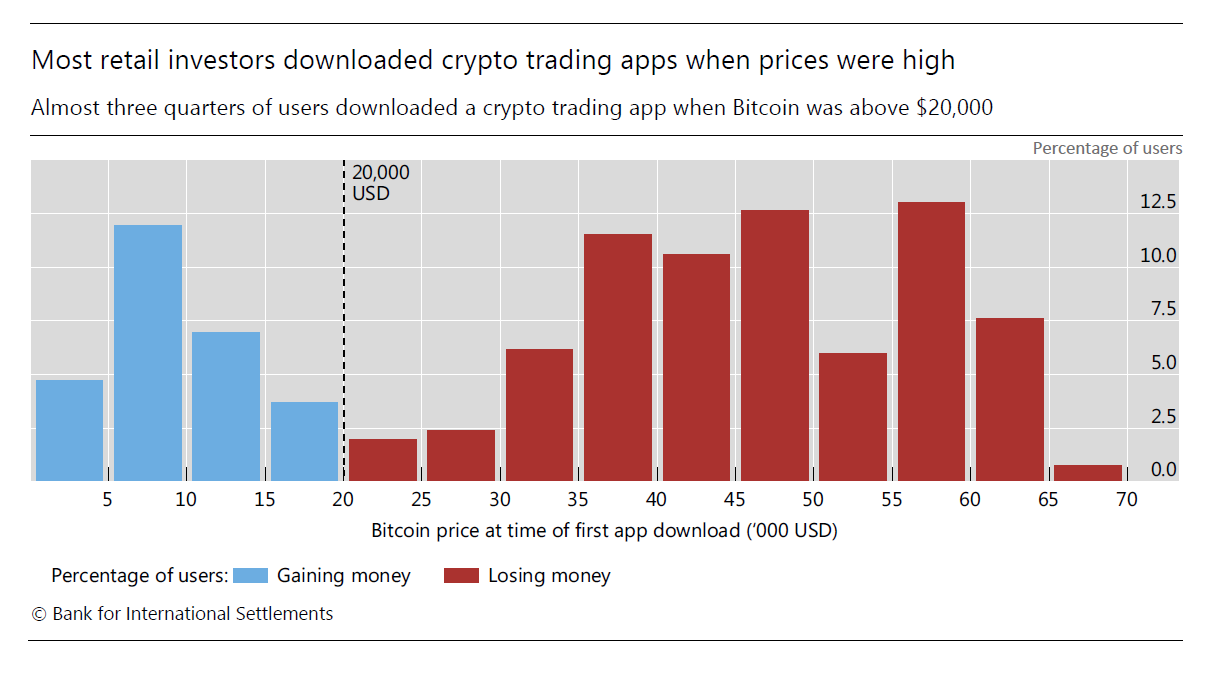

The BIS presented evidence that daily downloads of crypto exchange apps increased with the rapidly rising price of Bitcoin between Jul. and Nov. 2021, peaking when Bitcoin’s price was between $55,000 and $60,000 roughly one month before its Nov. 2021 all-time high of just over $69,000.

It added 40% of crypto app users were men under 35 and were part of the most “risk-seeking” segment of the population, from this, it surmised:

Users [are] being drawn to Bitcoin by rising prices — rather than a dislike for traditional banks, the search for a store of value or distrust in public institutions.

“The price of Bitcoin remains the most important factor when we control for global uncertainty or volatility, contradicting explanations based on Bitcoin as a safe haven,” it added.

The BIS assumed app users purchased Bitcoin at the time of downloading a crypto app and subsequently supposed that up to “81% of users would have lost money” if they had purchased Bitcoin over $20,000.

Daily downloads of crypto-exchange apps by Bitcoin Price at the time of first download. Image: BIS

The BIS’s assumptions seemingly correlate with data from blockchain analysis firm Glassnode, who on Nov. 14 confirmed that just over half of Bitcoin addresses are in profit, reaching a two-year low.

#Bitcoin $BTC Percent Addresses in Profit (7d MA) just reached a 2-year low of 51.881%

— glassnode alerts (@glassnodealerts) November 14, 2022

View metric:https://t.co/ik5IkrdoPk pic.twitter.com/boVDTqG8YL

The BIS added its analysis of blockchain data found as Bitcoin prices rose, smaller users purchased, and “the largest holders (the so-called ‘whales’ or ‘humpbacks’) were selling – making a return at the smaller users’ expense.”

It also documented the geography of crypto app adoption and found between Aug. 2015 to Jun. 2022 that Turkey, Singapore, the United States, and the United Kingdom had the highest total downloads per 100,000 people respectively.

India and China had the lowest, the latter seeing only 1,000 crypto app downloads per 100,000 people with the BIS opining that greater legal restrictions on crypto hamper retail adoption in those countries.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.