-

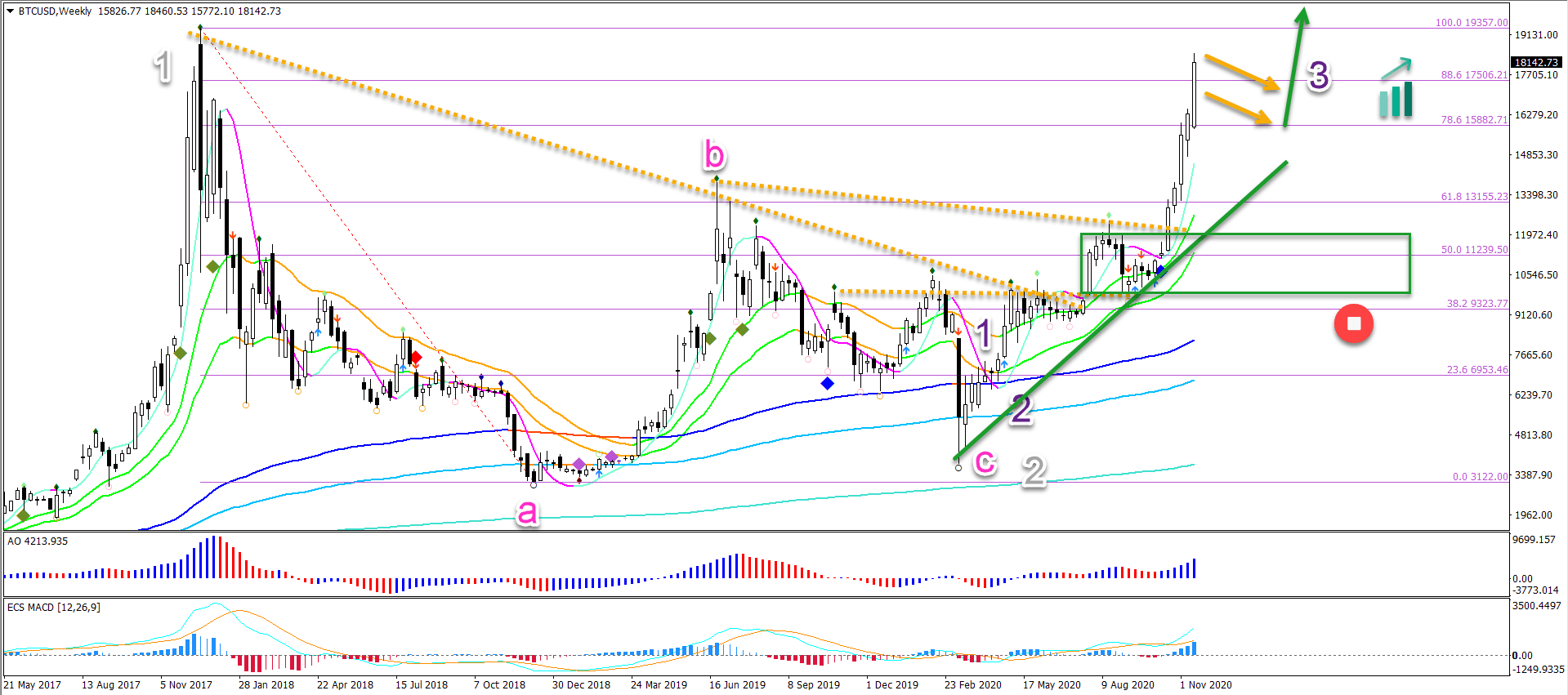

Bitcoin (BTC/USD) is showing massive bullish momentum as expected in earlier analysis. Price action is moving away from the 21 ema zone without hesitation..

-

BTC/USD rocket has broken above the 78.6% and 88.6% Fibonacci retracement resistance levels. Price action will probably test the previous top and all time high soon.

Bitcoin (BTC/USD) is showing massive bullish momentum as expected in earlier analysis. Price action is moving away from the 21 ema zone without any hesitation.Will price action continue or will there be a pauze?

Price Charts and Technical Analysis

The BTC/USD rocket has broken above the 78.6% and 88.6% Fibonacci retracement resistance levels. Price action will probably test the previous top and all time high soon.

But the top is likely to stop price action for a little while:

-

Some minor bearish pullback is expected as bulls take profit.

-

The retracement will probably create a bull flag chart pattern (orange arrows).

-

An immediate breakout above the top without a flag indicates very strong bullish momentum.

- If a flag pattern does appear on the 4 hour or daily chart (does not have to be a weekly chart), then a bullish breakout is expected.

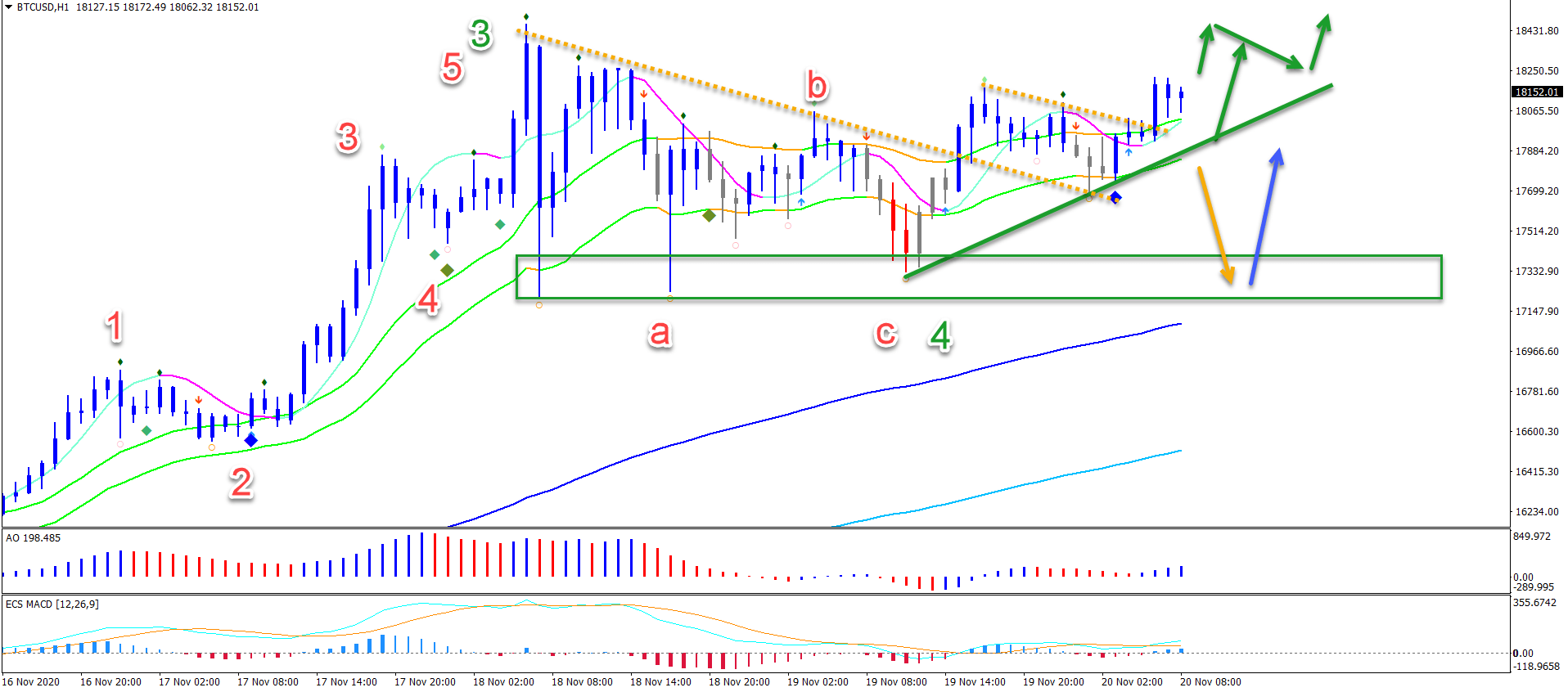

On the 1 hour chart, price action is moving sideways. This seems to be an ABC (red) pattern in wave 4 (green).

Price action broke above the 21 ema zone and used it as a bouncing spot. Now the price is above the 21 ema. A breakout above the Fractal could indicate an immediate upside (green arrow).

A bearish breakout below the 21 ema, however, could indicate a deeper retracement (orange arrow). This could indicate an extended wave 4 (green).

The analysis has been done with the ecs.SWAT method and ebook.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

Crypto Today: Traders discuss Solana futures and Ethereum Hoodi update as Bitcoin price stalls at $83,000

Amid a 2% decrease in market capitalization, crypto trading volume surges 42% to $87.2 billion in the last 24 hours, signalling active capital rotation. Bitcoin price stagnates below $85,000 as Gold enters a record rally to $3,000 ahead of the US Fed rate decision.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, XRP gain as MicroStrategy buys $10.7 million BTC

Bitcoin (BTC) daily price chart shows signs of recovery in the largest cryptocurrency. Strategy, one of the largest corporate holders of Bitcoin, acquired another 130 BTC last week, according to an announcement on Monday.

Top Formula 1 crypto sponsors rally, racing fans gain from Binance Coin, OKB, ApeCoin and Crypto.com

The 2025 Formula 1 season kicked off in Australia last week with a lineup of crypto sponsors for half of the teams. Racing giants are powered by sponsors like crypto exchanges Binance, OKX, ApeCoin, and Crypto.com, among other NFT and trading platforms.

SEC pumps brakes on altcoin ETFs, institutional interest remains

The US SEC postponed its decisions on several spot altcoin ETF applications this week, including those for Litecoin, XRP and Solana. A K33 Research report shows there is consensus but the agency is waiting the confirmation of Trump’s nominee for SEC Chair.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.