Bitcoin bulls get pushed against monthly pivot, but $50,000 is still on the card for next week

- Bitcoin price takes heavy water as the ship is caught in a storm on financial waters.

- Next week, the BTC price looks set to jump to $50,000 in two phases, depending on a relief rally.

- In the process, market participants can make a small 20% gain.

Bitcoin (BTC) price has had a rough week as global markets turmoil saw the main drivers come from geopolitical tension in Ukraine and the unclear message the Fed has delivered to markets in its Fed minutes. As markets are propped on some excellent news out of Russia or Ukraine, expect investors to shake any nervousness off and get set for a solid week of gains next week, with tailwinds for Bitcoin price action to steam ahead to $50,000.

Bitcoin price still set for new all-time highs, even with regulations on its path

As markets focused merely on Russia and the Fed minutes, a small headline was made this week on Biden set to publish a regulatory framework for cryptocurrencies. Of course, the initial reaction is that any regulation would limit upside and trigger a broad sell-off in the crypto space. But looking beyond the headline, this offers good news for Bitcoin and its peers as it will take quite some nervousness away and should see more investor flow and funds joining in for the long run as the future path of cryptocurrencies will become more transparent and legal.

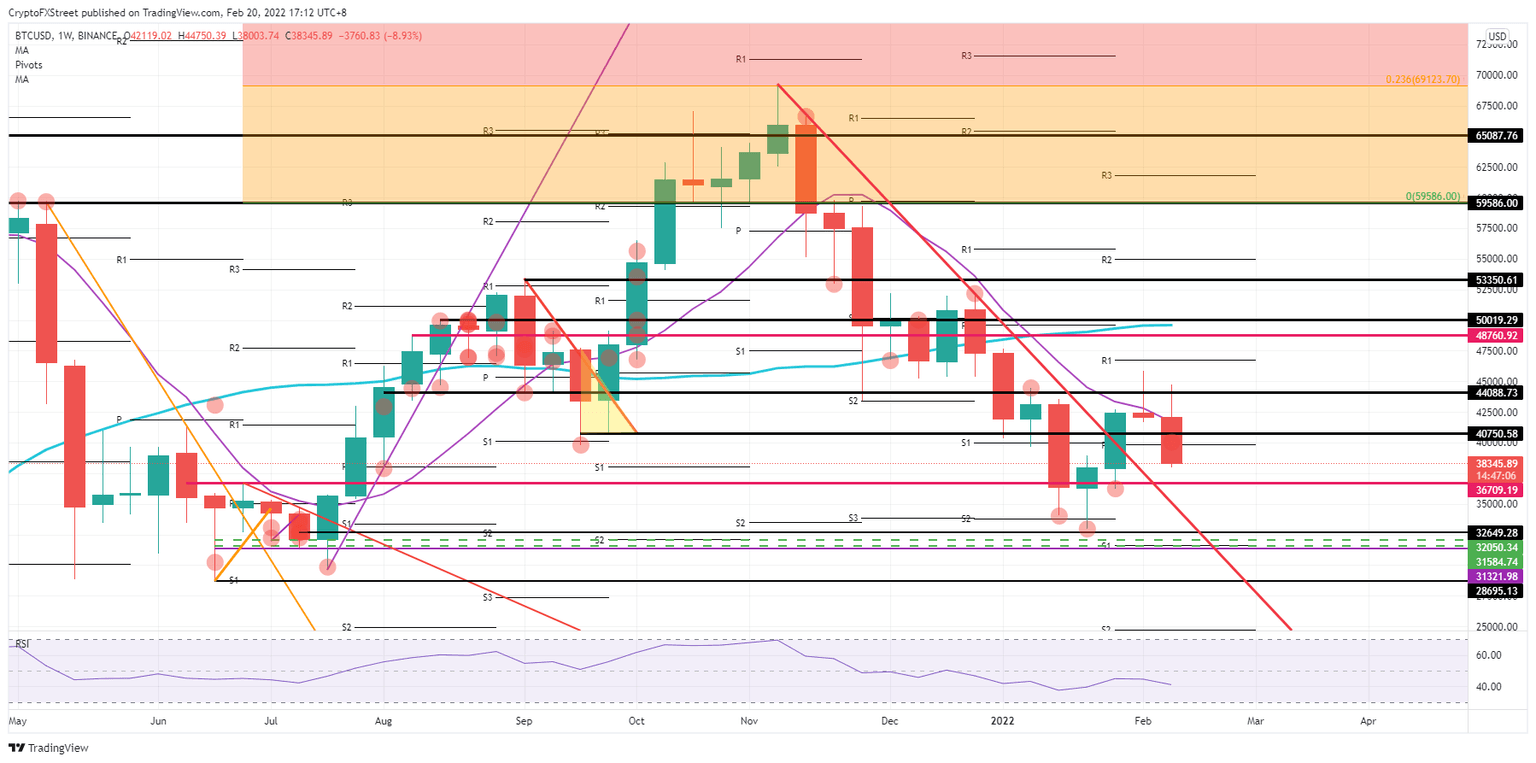

As investors will look beyond the Fed minutes and will see the legal framework from Biden as a positive element, expect to see BTC price to be funded at the monthly pivot around $39,880. Expect a quick bounce and test back to $44,088. From there, it will be a straight cut next week towards the week to hit $48,760-$50,020 with the 200-day Simple Moving Average (SMA) in between.

BTC/USD weekly chart

As with the upside, there could be a downside as well. As Russia already laid out a path where only citizens could hold Bitcoin, but it would be illegal to mine at, a similar framework in the US would be a considerable setback to some big tech firms and local miners in the states. That would see BTC collapse against the monthly pivot at $39,880. A break below it would see a nosedive sell-off towards $36,709.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.