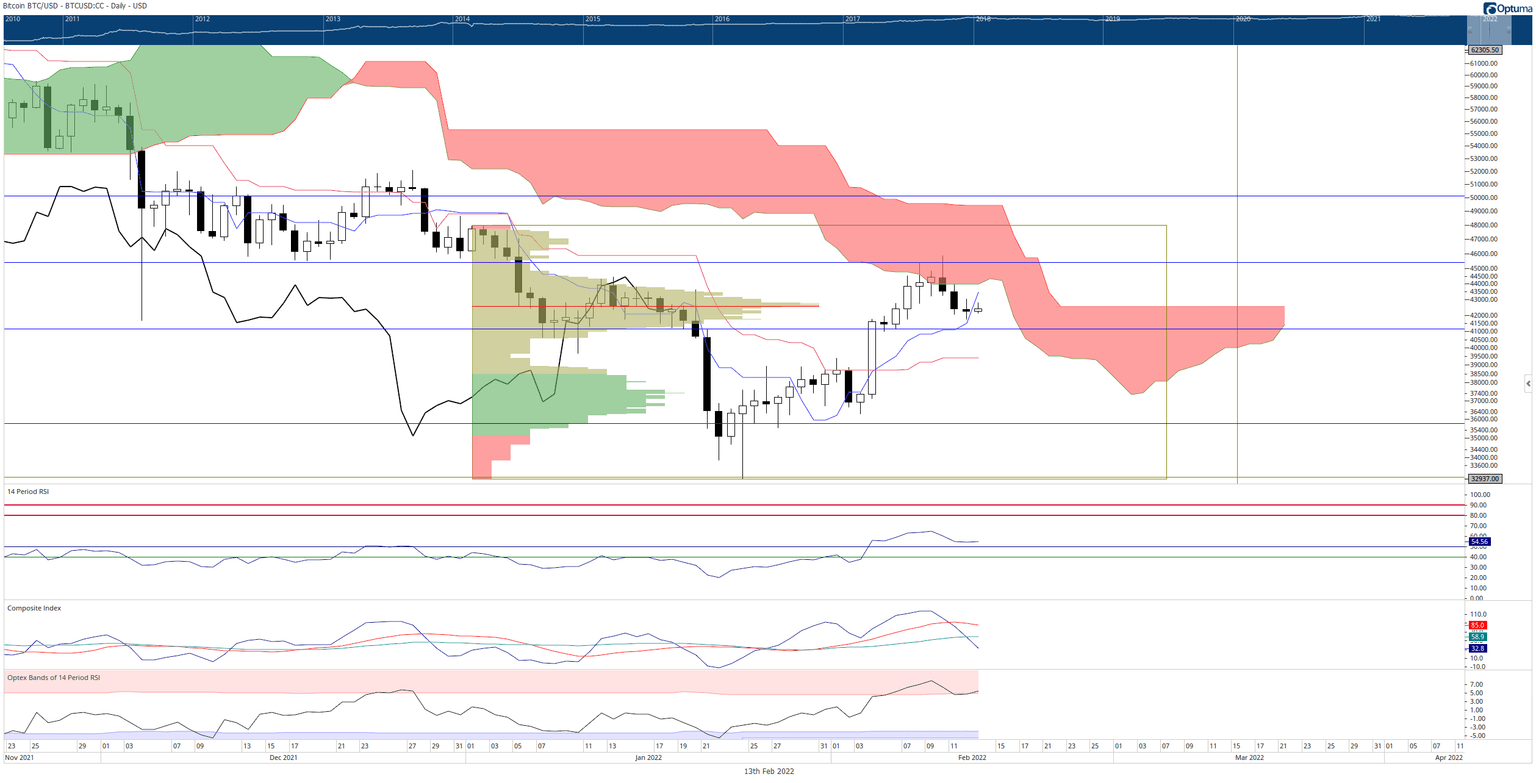

Bitcoin bulls eye another test at $45,000, BTC awaits buyers to regain momentum

- Bitcoin price returns to equilibrium within the Ichimoku Kinko Hyo system.

- Another week of sideways price action is probable given the significant gains required for BTC to begin a new uptrend.

- Downside risks remain very real and could be significant.

Bitcoin price dropped below a critical Ichimoku level on Thursday and extended the drop throughout Friday and Saturday. However, this pullback is probably due to a return to equilibrium within the Ichimoku Kinko Hyo system.

Bitcoin price returns below the Cloud, Ichimoku gap-fill complete

Bitcoin price has spent seven days with a significant gap between the bodies of the daily candlesticks and the Tenkan-Sen. This is significant because gaps between candlestick bodies and the Tenkan-Sen don't often last long – often correcting back to each other in four to six periods.

This gap-fill between the candlestick bodies and the Tenkan-Sen returns price action to a level of equilibrium in the Ichimoku system. There are two methods in which this return to equilibrium occurs; the first is by price action returning to the Tenkan-Sen. The second and rarest is a return to equilibrium over time. In that scenario, Bitcoin price generally trades sideways, and the Tenkan-Sen slowly returns to price over time.

There were two scenarios for Bitcoin price identified on Friday. The first was a return to equilibrium over time, involving a sideways trading range between $43,000 and $44,00.The second and most likely was for Bitcoin price to return to the Tenken-Sen at $41,000. The latter of the two scenarios played out for Bitcoin price.

BTC/USD Daily Ichimoku Kinko Hyo Chart

If bulls want to capitalize on this return to equilibrium, then they will need to maintain the $40,000 to $41,000 zone as support. Bitcoin price action gives bulls only a few more days to rally Bitcoin above the bottom of the Ichimoku Cloud (Senkou Span A), currently at $44,000. Failure to return inside the Cloud could indicate a bearish continuation setup that would see Bitcoin price retest the 2022 lows near $33,000.

However, it should be noted that If Bitcoin price were to consolidate within the $40,000 to $41,000 range, it could be positioning for an Ideal Bullish Ichimoku breakout. Bulls would need to close Bitcoin above the Cloud near $50,000 to achieve an Ideal Bullish Ichimoku Breakout today. But by February 20, that can be achieved with a daily close at or above $42,750.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.