- Bitcoin price consolidates between $62,000 and $64,700 key levels, indicating a period of indecision among traders.

- Arkham intelligence data reveals that dormant wallets are beginning to move, while Lookonchain data indicates a significant accumulation by whales.

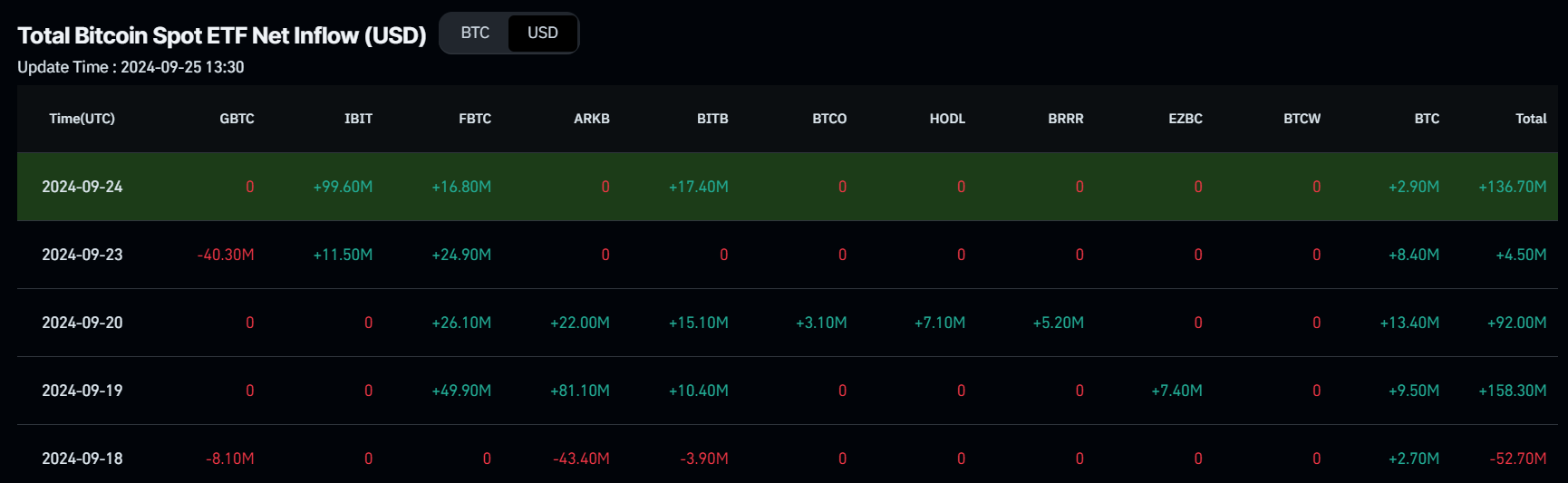

- US Spot ETFs record an inflow of $136.70 million on Tuesday.

Bitcoin (BTC) trades slightly down around $63,800 at the time of writing on Wednesday, consolidating within the $62,000 and $64,700 key levels for the sixth day in a row. There are signs of indecision among traders as dormant wallets begin to move, some whales accumulated, and the US Spot Exchange Traded Fund (ETF) recorded more than $136 million inflow on Tuesday.

Bitcoin dormant whales are active

Akham intelligence data shows dormant wallets are on the move. A 13-year-old whale wallet, which had remained inactive since mid-2011, transferred 20 BTC valued at $1.27 million to the Bitstamp exchange on Tuesday, marking its first movement since the coins were initially received. During the same period, another whale wallet holding $77 million worth of BTC also move 5 BTC to Kraken. This wallet still holds 1215 BTC worth $77 million and has been mining since 2009, one month after the Bitcoin launch. This whale woke up around three weeks ago and has moved 10 Bitcoins to Kraken in 3 separate transactions.

The third early Bitcoin whale, which mined Bitcoin around the same time, was active last week. After 15 years of dormancy, it woke up to move $16 million of BTC.

This movement by early dormant wallets could spark Fear, Uncertainty, and Doubt (FUD) among the traders, as the wallets are generally moving BTC into centralized exchanges that are likely to sell. Investors must be cautious about such activity.

ANOTHER ANCIENT BITCOIN WHALE MOVES $3M BTC

— Arkham (@ArkhamIntel) September 24, 2024

A 13 year old whale with $3.17M BTC from mid-2011 woke up today.

This wallet has not made a single move since receiving the coins 13 years ago.

They have just transferred 20 BTC ($1.27M) to Bitstamp. https://t.co/hQe43GgYtm pic.twitter.com/HnvbZbgDHK

Lookonchain data shows that two whales accumulated $219 million worth of BTC on Tuesday. The first whale accumulated $154.43 million in BTC, while the second whale accumulated 1,015 BTC worth $64.47 million. Whale accumulations like these are generally considered a positive sign and show investors confidence in Bitcoin.

Whales are accumulating $BTC!

— Lookonchain (@lookonchain) September 24, 2024

2 whales have withdrawn 3,463 $BTC($219M) from #Binance in the past 12 hours!

Address:

bc1q57rcscs6ztj0xnslwkt4nervxkpen07h9h2jnr2hkwlg3lwuljrsdwt2m2

12993NM9fV8dSSQgbWDZSBVgqtPw4DaAXS pic.twitter.com/Ux4YXKrZ20

Moreover, institutional flows rose on Tuesday. According to Coinglass’s data, the US spot Bitcoin ETF experienced an inflow of $136.70 million on Tuesday. This is a positive sign for Bitcoin, as such inflows suggest that institutional investors are actively accumulating the cryptocurrency.

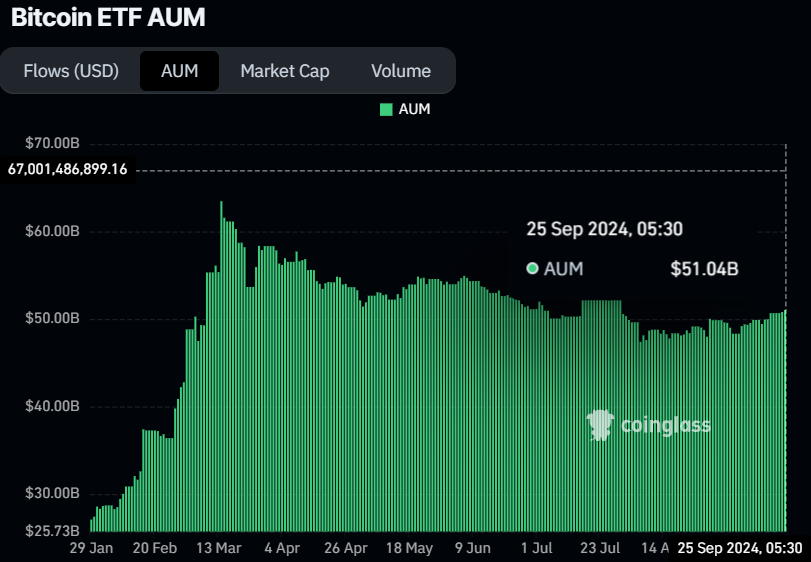

Additionally, the total Bitcoin reserves held by the 11 US spot Bitcoin ETFs, Asset Under Management (AUM), have reached $51.04 billion, the highest level since July 30.

Bitcoin Spot ETF Net Inflow chart

Bitcoin ETF AUM

Santiment’s Exchange Flow balance metric also shows a positive sign for Bitcoin. This metric shows the net movement of Bitcoin into and out of exchange wallets. A rise in this metric indicates more BTC has entered the exchanges than exited, hinting at selling pressure from investors. Conversely, a fall in the metric indicates that more BTC left the exchange than entered, indicating less selling pressure from investors.

As in Bitcoin’s case, the metric fell from 2,099 BTC on Monday to -7,510 BTC on Tuesday. This fall indicates increasing confidence among investors as holders remove BTC tokens from exchanges and store them in cold wallets.

%20[13.42.21,%2025%20Sep,%202024]-638628613240721902.png)

Bitcoin Exchange Flow balance chart

Bitcoin bulls set sights on $70,000 amid ongoing consolidation

Bitcoin's price has been consolidating between the $62,000 and $64,700 key levels for over six days after rallying 7.5% last week. As of Wednesday, it trades slightly down at $63,854 after retesting its upper consolidation level of $64,700.

If Bitcoin’s price breaks above this consolidating range around $64,700, it could first rise to retest its daily resistance level at $65,379. A successful daily close above this level could extend the rally by 7% to retest its July 29 high of $70,079.

The Relative Strength Index (RSI) on the daily chart points downwards, trading at 62, reflecting the decrease in bullish momentum. For Bitcoin to break above the consolidating zone, the RSI must rise and head towards its 70 level. However, traders should be cautious if it exceeds the overbought level 70.

BTC/USDT daily chart

However, if BTC breaks and closes below the consolidation zone around $62,000, it could decline 7% to retest its September 17 low of $57,610.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.