Bitcoin bulls are on the offensive; is a correction ahead?

Monthly bullish outside candle

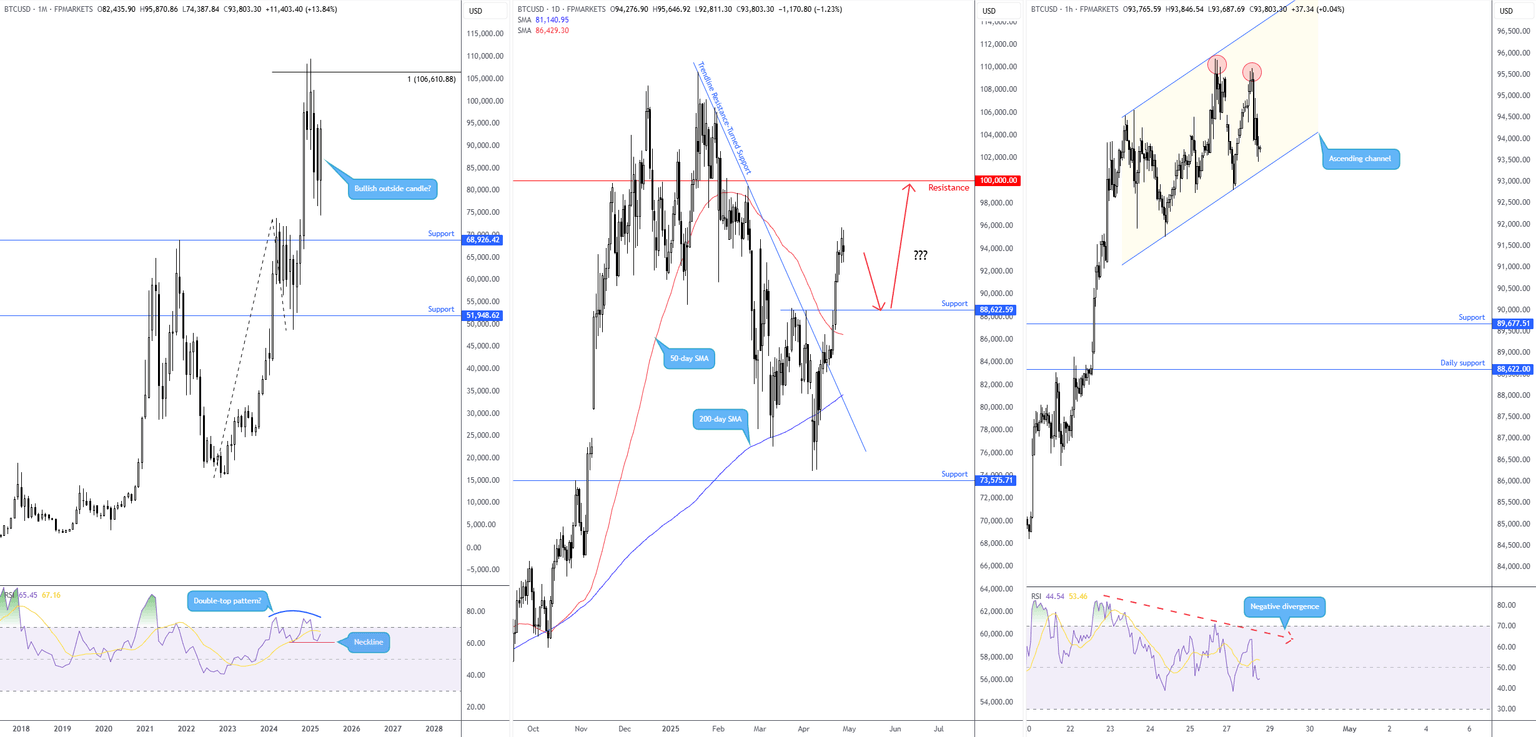

Versus the US dollar (USD), Bitcoin (BTC) is poised to snap a two-month decline and pencil in a bullish outside candle on the monthly chart (textbook engulfing candles focus on the candle’s real bodies rather than upper/lower wicks). Additionally, it is important to observe that the Relative Strength Index (RSI) failed to break the neckline of a double-top pattern, circling above the 50.00 level and indicating bullish interest.

Daily support calls for attention

Across the page on the daily timeframe, since coming within a stone’s throw of testing support at US$73,575, BTC/USD bulls have been on the offensive. Running above the 200- and 50-day simple moving averages at US$81,139 and US$86,425, respectively, as well as trendline resistance (taken from the all-time high of US$109,580) and resistance from US$88,622 (now possible support), this has unearthed the widely watched US$100,000 barrier as a possible upside target.

With monthly flow on the verge of establishing a bullish outside candle, and scope for additional outperformance evident on the daily chart to at least US$100,000, a retest of US$88,622 as support could prompt a bullish scenario. Consequently, a possible downside move in the short term might be on the table before targeting US$100,000 as per the red arrows.

H1 ascending channel in view

On the H1 chart, price action has been carving out an ascending channel since last week, taken from US$91,713 and US$94,676. This has helped identify slowing momentum, visible through price action, which was unable to reach the upper channel on two occasions (red circles). Decreased appetite for higher levels can also be observed through the RSI trending lower since hitting highs of 82.00.

Given the above chart studies, I feel a breakout beneath the current H1 channel would help reinforce the possibility of downside towards at least H1 support at US$89,677, conveniently sited nearby daily support mentioned above at US$88,622. And, assuming a move lower to the said support area, I would then expect bulls to attempt to make a stand and aim at higher levels: at least US$100,000.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,