- Bitcoin price has had difficulty staying above $50,000.

- With BTC bulls back in charge, other cryptocurrencies are enjoying the positive spillover effect.

- The only target, for now, should be Bitcoin back above $50,000.

Bitcoin price (BTC) has had a tough couple of days as bulls could not keep price action above $50,000. With market sentiment now back in their corner, bulls are hitting the bears where it hurts and squeezing them out of their position. This way, the path is being cleared to regain $50,000.

BTC buyers are getting in at every opportunity, and the only way is up for Bitcoin price

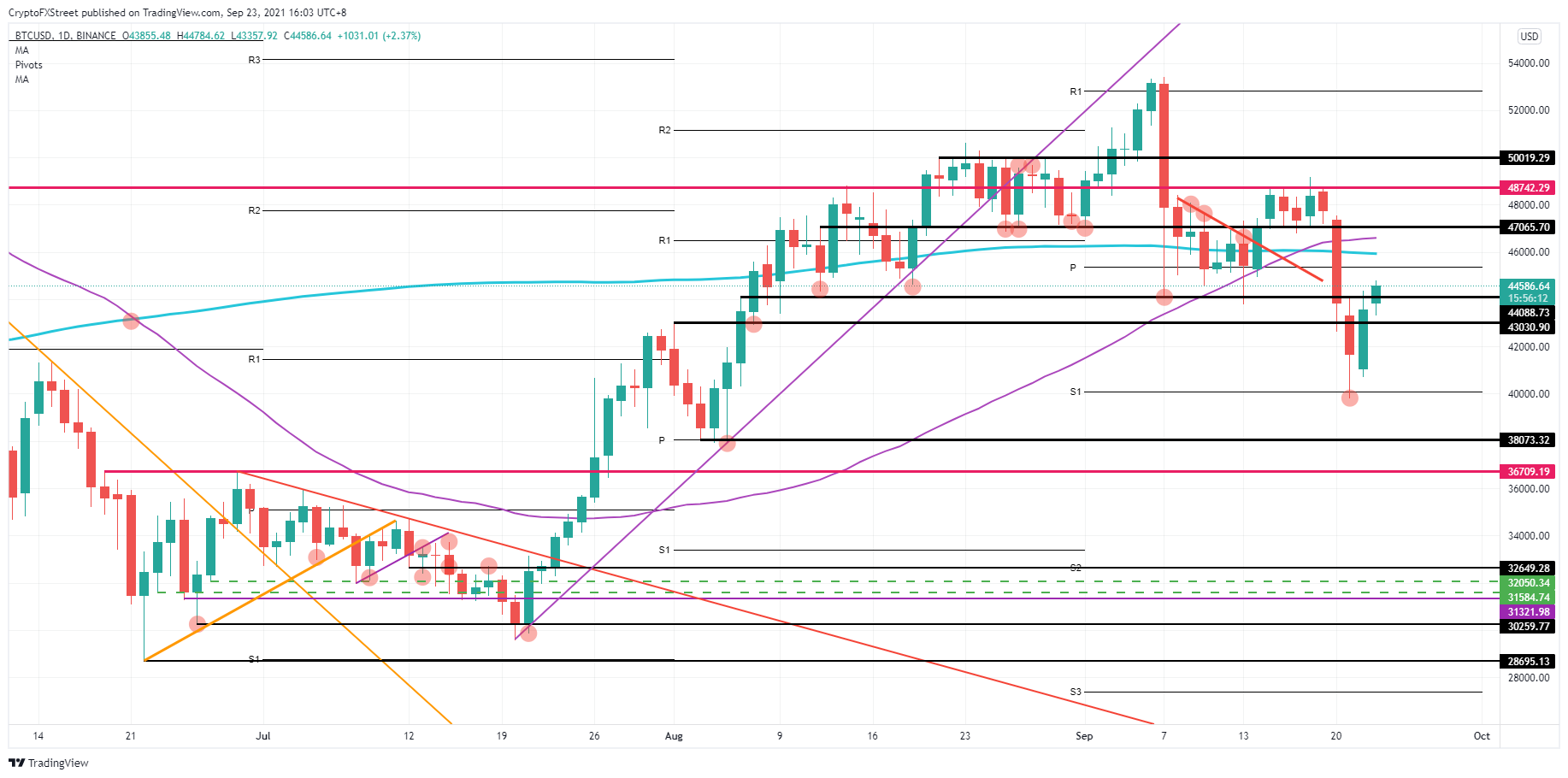

Bitcoin price was not in a good place the past few days as bulls were unable to keep price action above $50,000. With price action fading in BTC and bulls getting more and more stopped out of their longs, sellers were able to regain price action and pushed prices further downward. Sellers hit a curb at $40,000, around the monthly S1 support level. Buyers stepped in around there and bought the dip as BTC looked interesting at a discount.

Since Wednesday, BTC bulls have been back in the game and got a little bit of help from FED-chair Jerome Powell as price action got lifted further to the upside after his dovish remarks. With overall risk-on sentiment in global markets, bulls get a free ride and have the possibility to ramp prices further up in Bitcoin.

BTC/USD daily chart

Bitcoin price will, however, face a few issues to the upside, with both the 55-day Simple Moving Average (SMA) at $46,640 and the 200-day SMA at $45,990 causing some short-term resistance. With this regained momentum and the uptrend again very much in play, expect these levels to form no issue in reclaiming the $50,000 marker.

As sentiment can quickly shift in a matter of a few events or price action starts to fade, expect sellers to go for a retest of $40,000. That level will probably not hold, and sellers will get the chance to push for $38,070. That level looks excellent for support and would attract quite a lot of bulls excited for another chance to buy the dip.

Like this article? Help us with some feedback by answering this survey:

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.