The classic end of a Bitcoin bull run, a "mania top," has not appeared yet, while fundamentals are unchanged in their outlook, says Willy Woo.

Bitcoin (BTC) is still "halfway" through its current bull market and this week's price dip turned out to be a "win" for hodlers, according to on-chain analyst Willy Woo.

In the latest edition of his market updates which he made publicly accessible, the popular statistician outlined multiple factors which all suggest that Bitcoin is anything but bearish.

Woo: BTC price did not reach "mania top"

BTC/USD recovered strongly after hitting lows of $30,000 on Wednesday, preserving its gains after the sharpest recovery in its history.

"Are we in a bull market? Long range macro indicators like NVT ratio are very healthy, that remains unchanged," Woo wrote.

"So yes, this is not a mania top which all BTC bull markets end in, price is BELOW fundamentals, not above it. We are still halfway."

NVT, or network value to transaction ratio, is a popular metric which aims at identifying profitability among hodlers. As Cointelegraph reported earlier this week, even before the dip, NVT was signalling a buying opportunity at price levels around $42,000.

NVT price, which Woo calls an "organic" valuation of Bitcoin, still lies at $55,000, which along with stock-to-flow based projections of $60,000 suggests that BTC/USD is considerably undervalued.

The largest cryptocurrency may already have the tools it needs to regain its lost ground — thanks to a shakeout of leveraged traders and the now muted effects of Elon Musk tweeting negative comments.

In fact, the dip may have been just what Bitcoin needed.

"Newish whales dumped out, retail bought a chunk of the dip, coins getting more distributed, I'll take that as a win," Woo added.

Bitcoin funding rates history. Source: Bybt.com

Notably, the sharp drop to $30,000 resulted in Bitcoin funding rates flipping negative across the board to record lows, which could provide fuel for a massive short squeeze.

"That cleanse set up Bitcoin for $100k. Funding rates largely reset," commented Messari analyst Mira Christanto on the latest Bitcoin funding rate data. She added:

"The shakeout before the breakout."

$4 billion irrational trades disappear

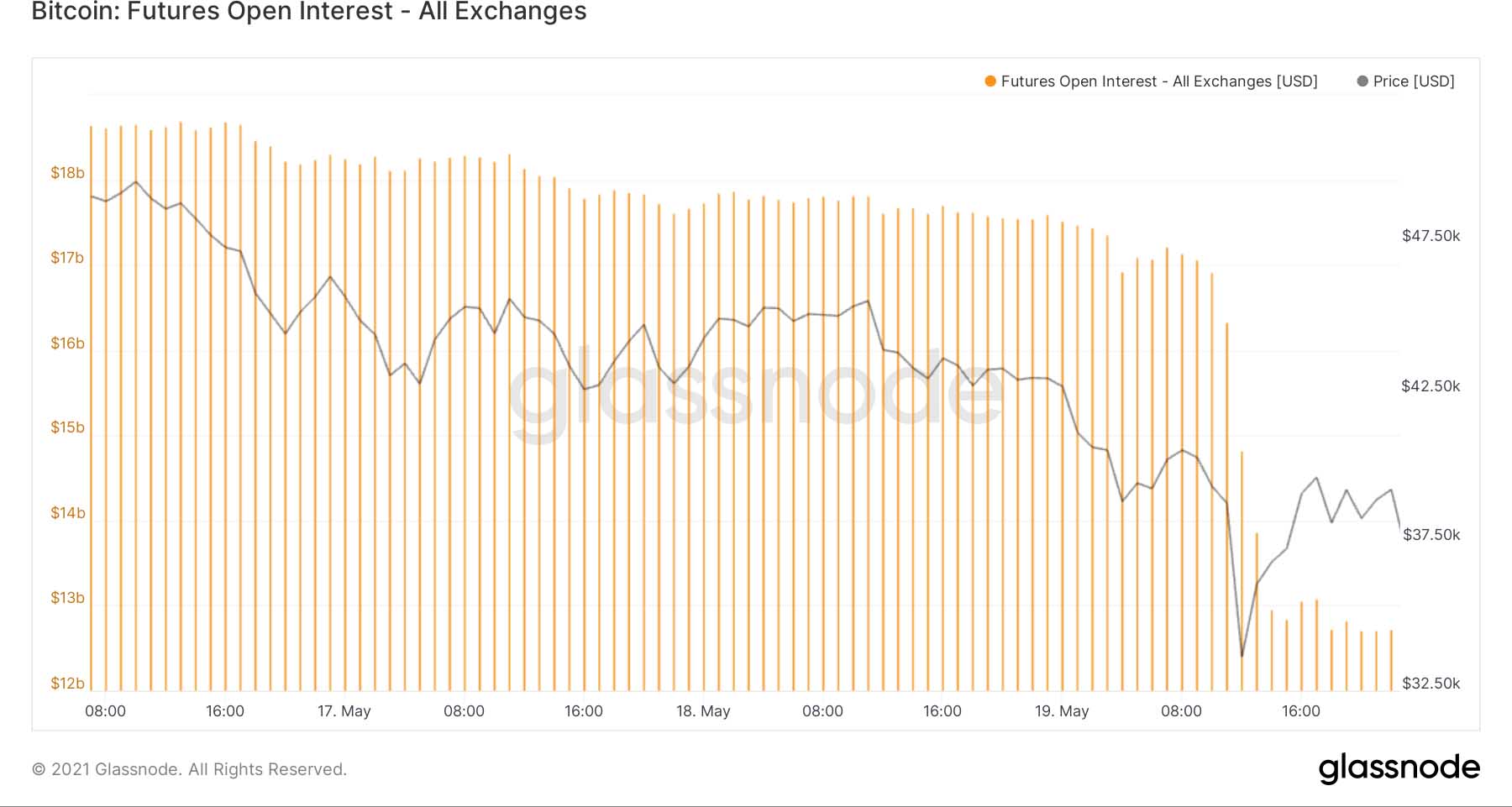

On the topic of a trader shakeout, fresh data from Glassnode shows just how much leverage was flushed from the market on the to $30,000 and back to $40,000.

Over the course of the day, open interest in Bitcoin futures fell from above $17 billion to below $13 billion and stayed at those levels.

"Goodbye leverage," analyst William Clemente commented on the figures.

Bitcoin futures open interest chart. Source: William Clemente/ Twitter

For new buyers entering the space, Blockstream CEO Adam Back meanwhile had some cautionary words.

"Thoughts on leverage. *don't*!" he summarized in a series of tweets.

"Better just hodl, dca, cold store. if you're gonna use leverage for fun/profit, you're increasing risk a lot. do it with max 10% of coins (or less). never place a leverage trade without a limit stop or implicit stop from small position liquidation."

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.