- BTC jumped above critical $10,000 amid strong rally across the board.

- Experts believe that this development will serve as a trigger for strong upside momentum.

Bitcoin smashed above psychological $10,000 and stopped within a whisker of $11,000 during early Asian hours on Saturday. At the time of writing, the first digital asset is changing hands at $10,750, having gained over 10% in recent 24 hours. Altcoins follow the king, though Bitcoin (BTC) remains an uncontested growth leader of the day.

We may be in for another strong rally as the price settled above $10,000. Earlier this month a prominent Bitcoin bull Tom Lee said that a sustainable move above this handle would trigger a FOMO (Fear Of Missing Out) rally and take Bitcoin towards $40,000 within months.

George McDonaugh from blockchain and cryptocurrency investment firm KR1 also gives importance to the $10,000 barrier.

"When we reach $10,000 the world will be hit with a slue of headlines and those that thought it was a passing fad will raise an eyebrow and log it mentally that its something they should look into. This is how the cycle continues and I expect prices to surge after this mental marker is reached," he commented recently.

Bitcoin's technical picture

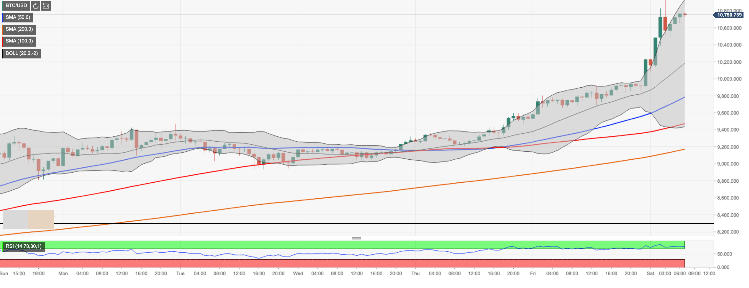

Meanwhile, looking technically, Bitcoin (BTC) has entered a consolidation phase as the bulls need to take a breath before another assault at the crucial $11,000 barrier strengthened by the recent high and the upper boundary of 1-hour Bollinger Band. Once it is cleared, the sky will be the limit.

On the downside, the correction from an overbought territory may take the price towards the support created by the upper line of 1-day Bollinger Band at $10,340. A sustainable move below this handle will open up the way towards the next bearish aim of $10,000.

BTC/USD, 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Cardano Price Forecast: ADA bulls target double-digit gains as bullish bets increase among traders

Cardano (ADA) price hovers around $0.74 at the time of writing on Thursday after a recovery of over 4% so far this week. On-chain data hints at a bullish picture as ADA’s stablecoin market cap rises while its bullish bets increase among traders.

GameStop's plan to issue $1.3 billion convertible notes to buy Bitcoin could boost crypto market and meme coins

Video game retailer GameStop announced on Wednesday that it plans to issue senior convertible note offerings worth $1.3 billion. The company aims to use part of the proceeds from the offerings to buy Bitcoin.

Stablecoin mania kicks off as Wyoming and Fidelity join the race

According to Governor Mark Gordon, the state of Wyoming has joined the race for a stablecoin, following plans to launch WYST, a US Dollar-backed token in July.

Toncoin traders target $10B valuation as Elon Musk integrates Grok AI into Telegram

Toncoin price rose 3% on Wednesday despite crypto market inflows subsiding after a two-day rally.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.