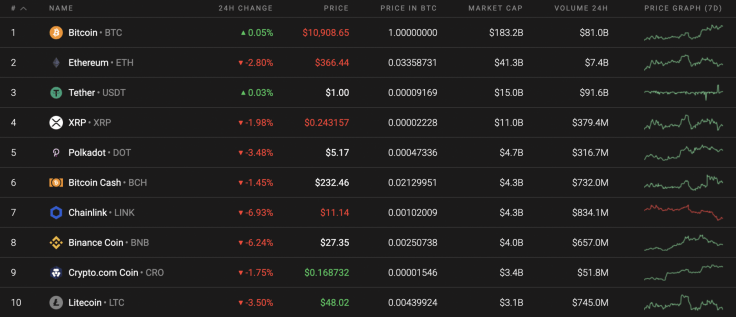

The bullish mood has turned bearish as almost all of the Top 10 coins are red. Bitcoin (BTC) is trying to remain in the green zone, rising by 0.05% over the last day.

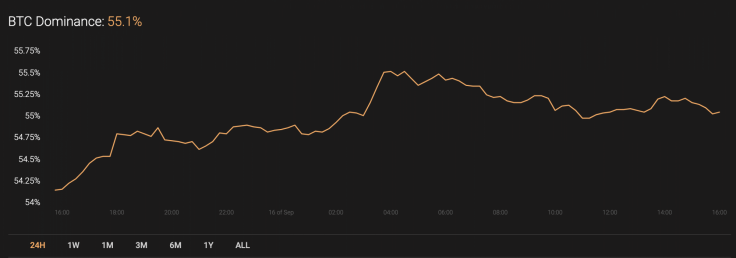

The decline of most of the altcoins has positively affected the market share of Bitcoin (BTC), which has increased by 1% and now accounts for 55.1%.

The relevant Bitcoin data for today

-

Name: Bitcoin

-

Ticker: BTC

-

Market Cap: $201,927,701,737

-

Price: $10,920.28

-

Volume (24h): $34,371,398,129

-

Change (24h): 0.16%

The data is relevant at press time.

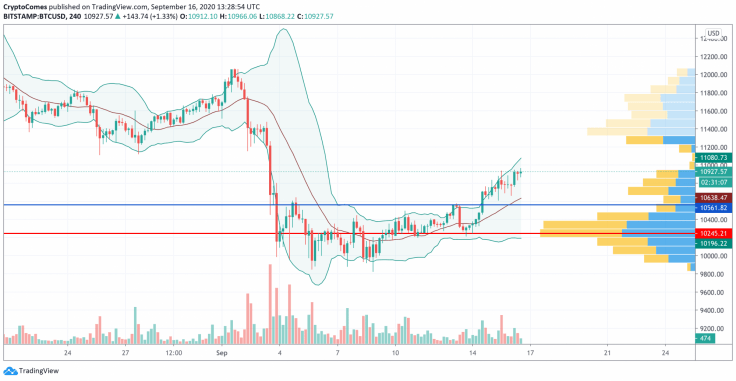

BTC/USD: Can traders expect a false breakout of the $11,000 mark?

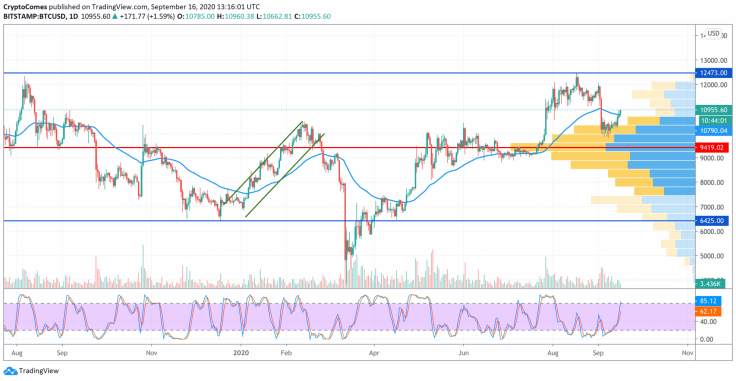

Yesterday, buyers managed to pierce the daily EMA55 and set a weekly high around $10,940. However, sellers paused the recovery in the Bitcoin (BTC) price and did not allow the pair to gain a foothold above the level of $10,800.

Today, the rollback from the daily moving average EMA55 is not over yet. During the day, the pair may decline to the support of $10,500. If this level stops sellers, the attempt to break through the daily average price level will be repeated and the maximum is expected in the resistance area of $11,200.

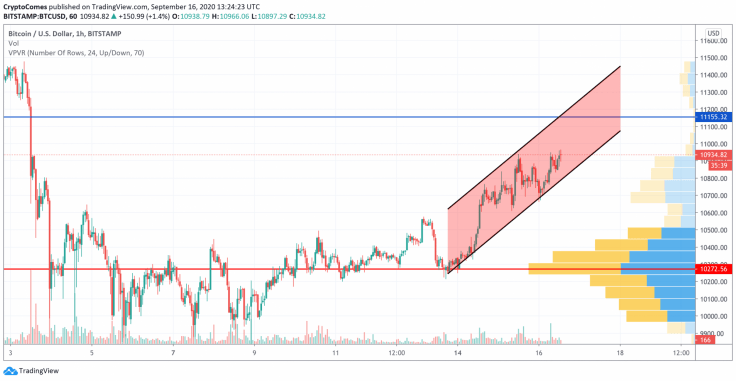

On the hourly chart, Bitcoin (BTC) keeps trading within the rising channel formed a few days ago. The trading volume remains high, however, liquidity is decreasing, which means that a reversal will start soon.

The endpoint of the growth might be the "mirror" level at $11,150, where bears may seize the initiative.

However, on the 4H time frame, the picture is bearish. The rise of Bitcoin (BTC) from $10,500 has not been supported by a rising trading volume, which means bulls are unlikely to update local peaks. Applying the Bollinger Bands indicator on the chart, a decline from around $11,000 may end at $10,500, where most of the liquidity is focused. Such price action is relevant through the end of the week.

Bitcoin is trading at $10,942 at press time.

Any financial and market information given on U.Today is written for informational purposes only. Conduct your own research by contacting financial experts before making any investment decisions.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.