Are traders likely to see Bitcoin (BTC) above $10,000 this month?

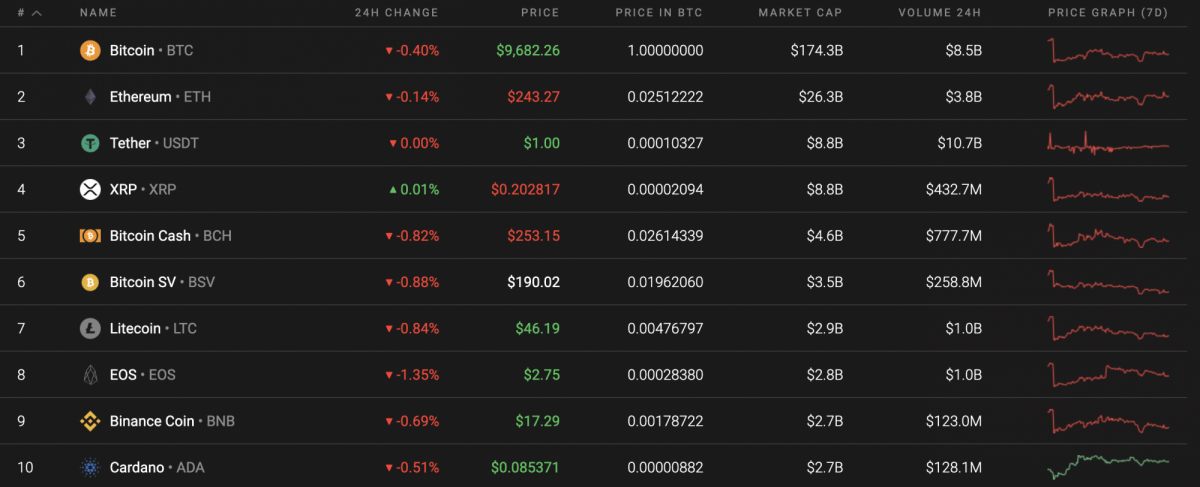

June 9th has started with a negative mood on the cryptocurrency market. Most coins from the top 10 list are in the red zone. XRP is the only one trying to remain bullish, having risen by 0.01% since yesterday.

Top 10 coins by Coinstats

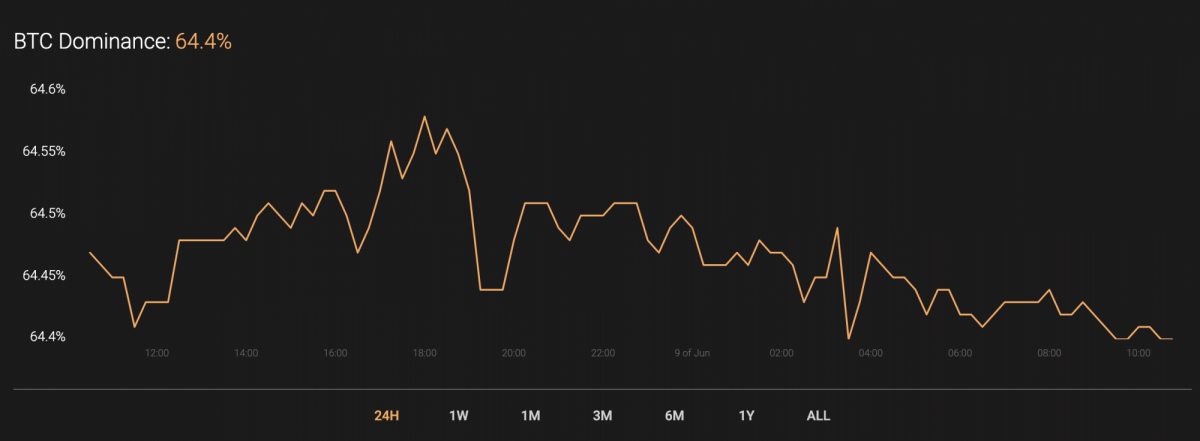

The decline of most of the cryptocurrencies has not affected the dominance rate of the main crypto, which remains at the same level at 64.4%.

BTC’s market share

The relevant data for Bitcoin is as follows.

Name: Bitcoin

Ticker: BTC

Market Cap: $178,464,060,180

Price: $9,699.65

Volume (24h): $22,958,180,494

Change (24h): -0.42%

The data is relevant at press time.

BTC/USD: Is it still possible to reach $10,000?

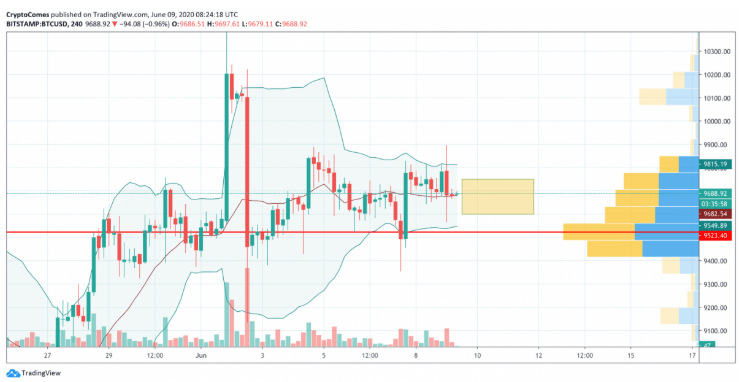

On the hourly chart, Bitcoin (BTC) made a false breakout of the $9,900 mark. The decline over the past 24 hours of the main crypto has amounted to 0.42%

BTC/USD chart by TradingView

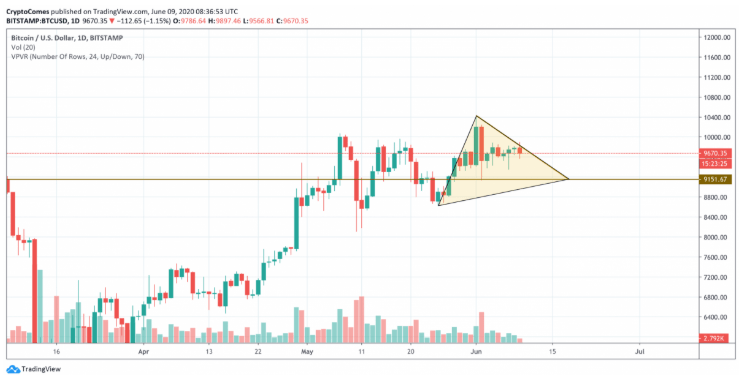

Even though the bullish scenario has not yet fallen apart, there is strong resistance at $9,900 that is preventing Bitcoin (BTC) from moving forward. Thus, the trading volume is decreasing and mostly dominated by sellers. In this case, one should not also exclude the possibility of a retest of the $9,600-$9,650 zone shortly.

BTC/USD chart by TradingView

On the 4H time frame, there is no dominance from bulls or bears. The liquidity is high enough. However, trading volume is too low to push the rate higher. Summing up, the more likely scenario for the next days is a sideways trend in the yellow area between $9,600 and $9,750.

BTC/USD chart by TradingView

Bitcoin (BTC) is about to finish its bullish trend as 'fuel' for further growth is running out. Such a statement is confirmed by the declining trading volume and falling heights.

If bulls cannot seize the initiative, the next stop is $9,150. In this case, the Triangle pattern will be formed and the bearish trend will start.

Bitcoin is trading at $9,672 at press time.

Any financial and market information given on U.Today is written for informational purposes only. Conduct your own research by contacting financial experts before making any investment decisions.

Recommended Content

Editors’ Picks

SEC Crypto Task Force plans to establish digital asset regulatory sandbox

The Securities & Exchange Commission's (SEC) Crypto Task Force met with El Salvador's National Commission on Digital Assets (CNAD) representatives to discuss cross-border regulation and a proposed cross-border sandbox project.

DeFi Dev Corp buys additional 65,305 SOL amid broader institutional interest: Solana price slides below $150

Solana (SOL) price faces growing overhead pressure and slides below $150 to trade at $148 at the time of writing on Thursday. The sudden pullback follows the crypto market's edging higher on improving investor sentiment, which saw SOL climb to $154 on Wednesday.

Uniswap Price Forecast: UNI whale moves 9 million tokens to Coinbase Prime

Uniswap (UNI) price hovers around $5.92 at the time of writing on Thursday, having rallied 12.8% so far this week. According to Wu Blockchain, data shows that the address potentially related to the Uniswap team, investor, or advisor transferred 9 million UNI to the Coinbase Prime Deposit on Thursday.

Tron DAO announces $70B USDT supply: Here's how TRX price could react

TRON’s USDT circulation just surpassed $70 billion, signaling rising network utility as TRX price approaches a technically significant breakout. On Wednesday, TRON DAO confirmed that the circulating supply of Tether (USDT) on its blockchain has surpassed $70 billion.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.