Bitcoin brings a victory to Mike Novogratz

- Mike Novogratz says that he has won a bet against Roubini about Bitcoin price.

- BTC/USD stays in the range during the slow holiday season.

The CEO of Galaxy Digital, Mike Novogratz, recently announced that he had won a bet against crypto critic Nouriel Roubini.

He told Roubini during a panel discussion at the SALT 2019 conference in Las Vegas back in May:

Bitcoin is at $6,000 now. If at Christmastime it's above $6,000, you have to wear a shirt that says, 'I love bitcoin.' If it's not, I will wear a T-shirt saying, 'Nouriel was right.

Notably, Roubini is unlikely to put on a T-shirt saying 'I love bitcoin' as he has never accepted the bet. Moreover, he said that he didn't care about the cryptocurrency and its valuations.

Bitcoin's technical picture

Meanwhile, Bitcoin is changing hands at $7,180, mostly unchanged both on a day-to-day basis and since the beginning of Friday. The first digital coin navigated safely through the Christmas time. While Bitcoin has retreated from the recent high of $13,990, it is still twice as high as in January.

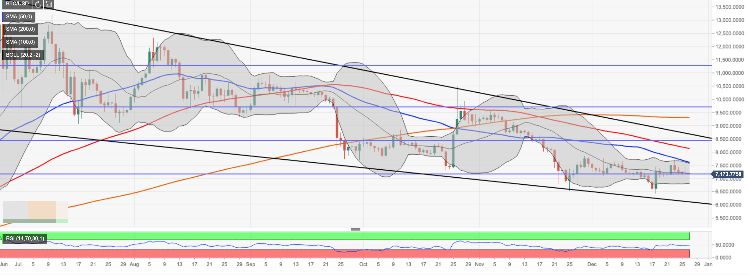

From the technical point of view, the important local resistance is created by $7.500-$7,600 area that contains SMA50 (Simple Moving Average) weekly, SMA50 daily and the upper line of the daily Bollinger Band. It has stopped the recovery on several occasions recently. Once it is cleared, Bitcoin bulls will bump into another brick wall of $7,800, followed by psychological $8,000 and SMA100 daily at $8,150. We will need to see a sustainable move above this handle for the upside to gain traction.

On the downside, a retreat below $7,000 will increase the selling pressure and push the price towards $6,800 ( the lower line of the daily Bollinger Band). Then comes $6,450 (the lowest level of the previous week) and $6,150 (the lower edge of the long-term downside wedge-formation).

Considering that the daily RSI (Relative Strength Index) is flat and in a neutral position, there is a chance that the coin will stay in the current range until the New Year.

BTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst