Bitcoin: Born to be different, but turning into just another asset?

It seems that what began in 2009 as an innovative currency solution merely became a hot asset class that draws capital every day. When digital assets first appeared, they were out of touch with traditional assets, but as they become more mature now with crypto adoption on the rise, they begin to move in sync with traditional markets.

With the total market capitalization of crypto assets having exploded from a little more than $20 billion in January 2017 to almost $2 trillion currently, investors and regulators are scratching their heads trying to understand how they fit into established market models.

There has been a lot of money flowing into crypto from traditional markets these past couple years. During that time, traditional markets and cryptocurrency markets converged. As a risky asset, crypto was logically classified alongside stocks. It is evident from various indicators that tech stocks and Bitcoin are strongly correlated at this point.

Therefore, factors affecting stocks like the Fed’s policy tightening, soaring inflation, and high unemployment also weigh on crypto. It's a risk-off sentiment across the board currently, so we're seeing this in crypto as well.

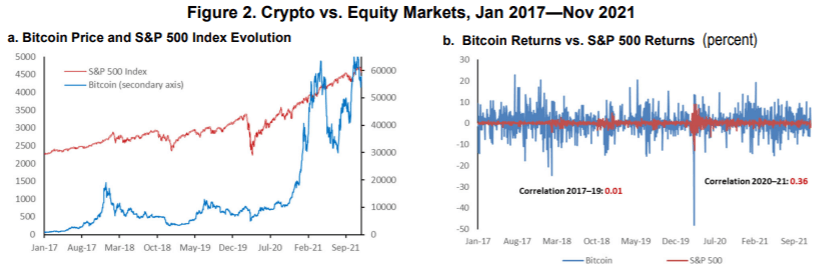

According to the report by the International Monetary Fund, crypto and stock markets have become increasingly interdependent. Compared with pre-pandemic years, the correlation between Bitcoin price volatility and S&P 500 index volatility has grown by more than four-fold, while Bitcoin's contribution to the variation in S&P 500 index volatility increased by roughly 16 percentage points during the post-pandemic period. There is a similar pattern for returns, with a significant increase in the correlation between Bitcoin and S&P 500 returns, as well as in spillovers from BTC returns to S&P 500 returns.

In light of this, the IMF states that crypto assets may no longer be considered as fringe assets, and their extreme volatility could threaten financial stability. Finally, the report says, regulators need to closely monitor crypto market activity and how financial institutions are exposed to these assets, and come up with policies that can mitigate the risks posed by crypto price spillovers.

Source: The IMF Global Financial Stability Notes. Cryptic Connections: Spillovers between Crypto and Equity Markets

At its March meeting, the Federal Reserve is expected to raise interest rates by up to 0.5%. Crypto and traditional market watchers agree that the interest rate hike will affect both markets significantly.

In my previous articles, however, I said that this negative effect may be delayed and is unlikely to happen until late 2022. We will have to wait and see how Bitcoin and other cryptocurrencies react since it isn't something we've seen before.

Traditional investors tear their hair out over crypto pullbacks

The phenomenal growth in cryptocurrencies attracted retail and institutional investors alike. However, they tend to approach it with a more traditional investment perspective as opposed to long-term holders of this nascent asset class.

The iconic Hide The Pain Harold meme best describes how painful it is to hodl during severe market declines. That's a completely new experience for traditional investors.

It was for that reason why there was so much fear on the market and various analysts writing that we were in the bear market when the price of Bitcoin fell nearly half from its high in just two months.

Crypto veterans must have been amused by all the fuss, since they understand that this is a normal correction for the crypto market. Savvy crypto investors seemed unfazed and kept holding.

The current correction can be compared to the consolidation phase we saw from May to July of 2021. Based on the technical analysis, the weakness is likely to last until anywhere near late February, after which we might see a new BTC rally that will take it to new heights, with ripple effects on other top cryptocurrencies. However, there are always unforeseen factors to take into account.

Final thoughts

Cryptocurrency has recently drawn a lot of beginners who are getting the hang of it. What they need to know is that fluctuations in crypto markets are as normal as in traditional markets, except that they are much more volatile. With crypto's gradual transition towards traditional assets, volatility may become less extreme in the future. For now, it remains what it is.

When cryptocurrency prices move downward, it is a good time to buy. Buying at the top won't help your gains grow. Obviously, this is not the case for too risky newly released coins that haven’t proven themselves yet. If they are based on some technological breakthrough, rather than just hype, then they have a good chance of success. Additionally, it’s vital to follow the DYOR rule here as well, and to invest no more than you can afford to lose – just as in traditional markets.

This article is for educational purposes only. The investment in cryptocurrencies is highly risky, so those who are able to sustain a loss of their entire investment should only enter into it.

Author

Mike Ermolaev

Independent Analyst

Mike Ermolaev is the founder of Outset PR. The agency helps tech companies, especially blockchain and Web3 projects, get the desired recognition thanks to its wealth of media connections.