- Bitcoin slipped below the $50,000 support early on Monday as stock markets around the world tumbled and bonds rallied amidst recession fears.

- The crypto market noted $1.06 billion in liquidations in the past 24 hours, per Coinglass data.

- Bitcoin crashed alongside US stocks even as the 30-day Pearson correlation with the Nasdaq composite and S&P 500 is negative.

- Bitcoin could extend losses by another 12% and sweep liquidity below $47,000 before beginning a recovery.

Crypto market capitalization dipped by 15% in the past 24 hours, according to CoinGecko data, down to $1.89 trillion at the time of writing on Monday. Bitcoin suffered a steep correction alongside the S&P 500 and the Nasdaq Composite despite having a negative 30-day correlation, per IntoTheBlock data.

Bitcoin dipped under $50,000, and the biggest cryptocurrency by market capitalization is likely to extend losses further.

Data from Coinglass shows that 24-hour liquidations in crypto exceed $1 billion, one of the biggest liquidation events since the FTX exchange collapsed.

Market participants remain uncertain whether this is the end of Bitcoin’s bull run.

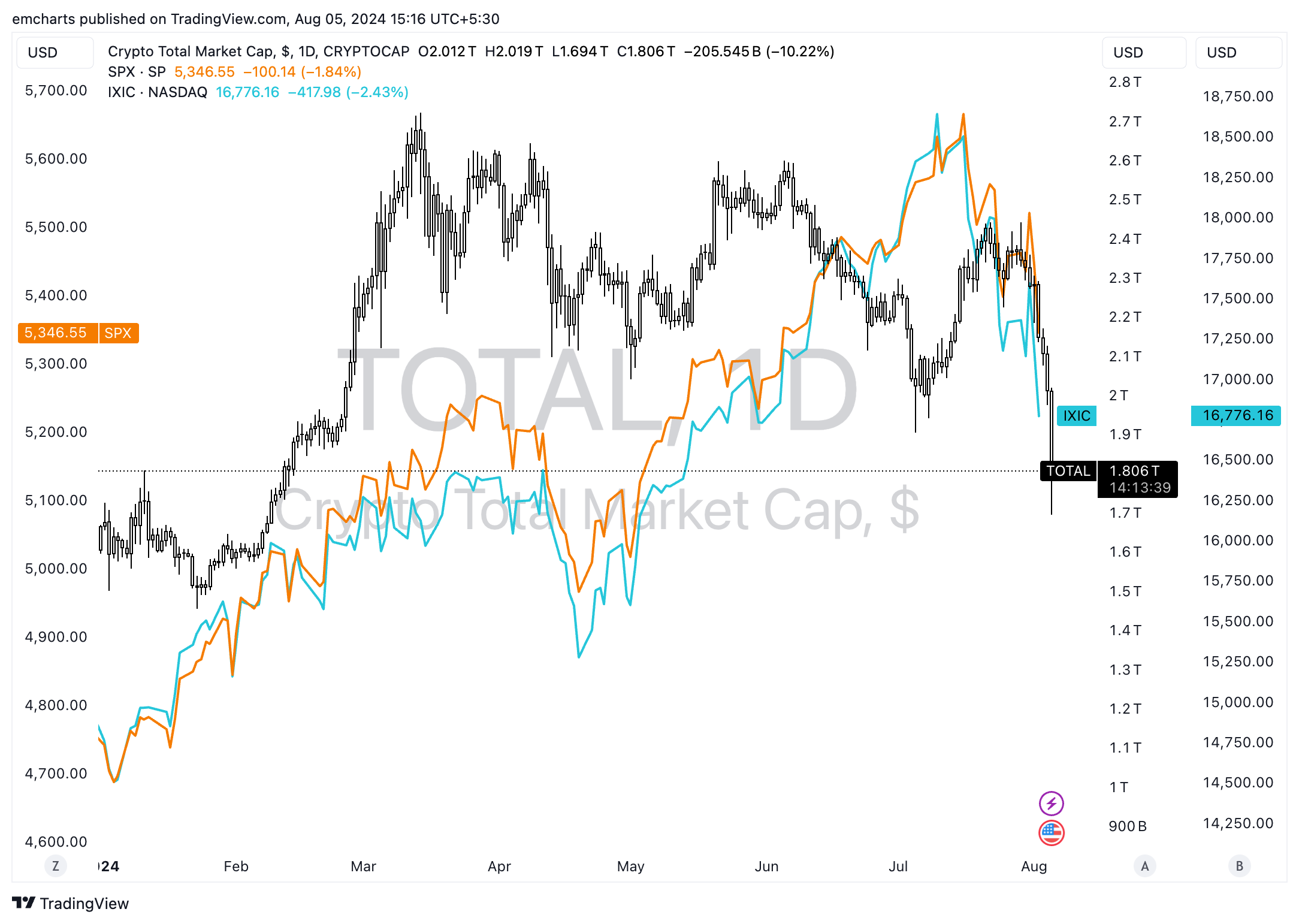

Crypto market capitalization, S&P 500, and Nasdaq composite

The chart below shows the drop in crypto market capitalization alongside the correction in the S&P 500 and the Nasdaq Composite. After the recent US Federal Reserve meeting, there has been a negative impact on both stocks and risk assets like Bitcoin and cryptocurrencies.

The declines in the chart below show a strong correlation between BTC and S&P 500 since July 31.

Crypto total market capitalization, SPX and IXIC

Stock markets worldwide continue to decline and bonds rally as fears of a recession increase uncertainty among crypto traders. Crypto market noted $1.06 billion in liquidation, one of the largest events since the FTX collapse.

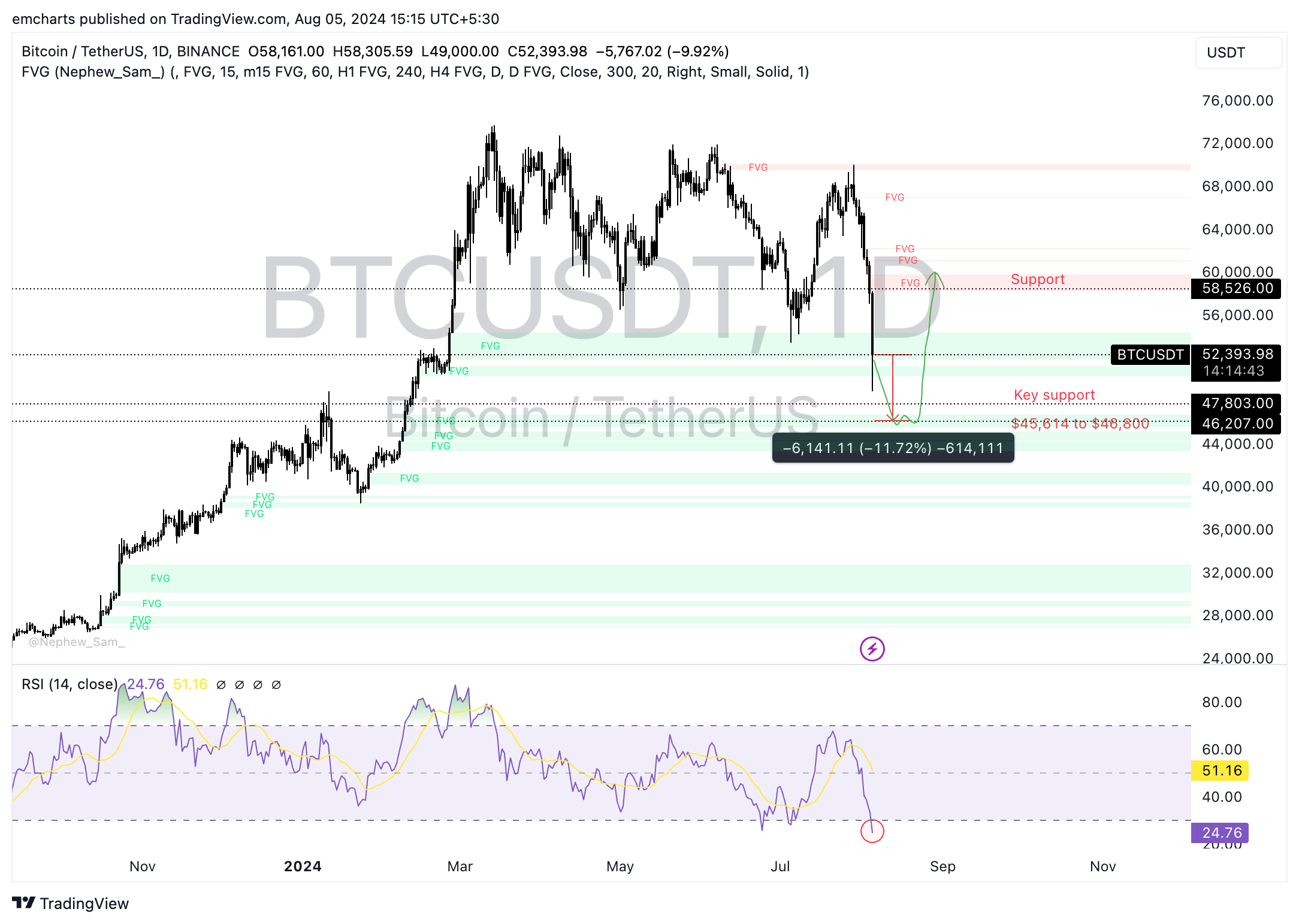

Bitcoin could extend its losses further

Bitcoin’s price dipped under $50,000, a key psychological support level for the largest cryptocurrency by market capitalization. BTC could extend its losses by nearly 10% and sweep liquidity in the Fair Value Gap (FVG) between $45,614 and $46,800.

Bitcoin could sweep liquidity at $46,207 before beginning a recovery rally.

The Relative Strength Index (RSI) indicator reads 24.76, as BTC is currently in the “oversold” zone. When RSI is under 30, it generates a buy signal for the asset. Sidelined Bitcoin traders could consider entering the trade, based on this indicator.

BTC/USDT daily chart

A daily candlestick close above key previous support, now resistance, at $58,526, could invalidate the bearish thesis for Bitcoin.

Bitcoin doesn’t look like “The New Gold” says analyst

Joe Weisenthal of Bloomberg says that Bitcoin’s "store of value" thesis no longer stands. The analyst was quoted in a recent tweet:

Bitcoin doesn't look like The New Gold. It looks like 3 tech stocks in a trenchcoat.

9) The Bitcoin "store of value" thesis is getting blown up right now.

— Joe Weisenthal (@TheStalwart) August 5, 2024

Bitcoin doesn't look like The New Gold. It looks like 3 tech stocks in a trenchcoat. pic.twitter.com/cY77hvXagL

Mikko Ohtamaa, co-founder of Trading Protocol, asks Weisenthal not to confuse short-term volatility with a store of value thesis.

It's difficult not to confuse short-term volatility with store of value thesis.

— Mikko Ohtamaa (@moo9000) August 5, 2024

If you cherry pick time window you can make any asset look bad.

There was a lot of leverage in Bitcoin trade and it gets unwound with everything else.

BITCOIN PLUMMETS 18% AMID JAPAN’S RATE HIKE: CRYPTO MARKET LOSES $500 BILLION

— *Walter Bloomberg (@DeItaone) August 5, 2024

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: Bearish technicals, on-chain indicators signal 68% potential crash

XRP faces increasing bearish sentiment from macro, micro and fundamental factors in April. Weak on-chain indicators ranging from network growth, total supply and active addresses reinforce an impending crash.

Bitcoin Price Forecast: Tariff volatility sweeps over $200 billion from crypto markets

Bitcoin price hovers around $83,000 on Thursday after it failed to close above the $85,000 resistance level the previous day. Volatility fueled by Trump’s tariffs swept $200 billion from total market capitalization, liquidating over $178 million in BTC.

SOL is the winner as Solana chain turns into battleground for meme coin launchpad and DEX

Solana (SOL) gains nearly 2% in the last 24 hours and trades at 118.28 at the time of writing on Thursday. A Decentralized Exchange (DEX) and a meme coin launchpad built on the Solana blockchain have waged a war for users and compete for the trade volume on the chain.

Shibarium, built for the Shiba Inu blockchain, reaches 1 billion in transactions in 18 months after its launch

Shibarium, a Layer-2 blockchain for the Shiba Inu ecosystem, reaches 1 billion transactions 18 months after its launch. This milestone reflects growing adoption and Shibarium’s robust performance.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.