Bitcoin beats out final resistance as Ethereum returns to $2K

Bitcoin (BTC) briefly hit $60,000 on April 2 in the latest installment of its slow grind back to all-time highs.

BTC/USD 1-hour candle chart (Bitstamp). Source: Tradingview

BTC price taps $60,000

Cointelegraph Markets Pro and TradingView showed bullish tendencies remaining overnight for BTC/USD, with local highs of $60,110 on Bitstamp.

A correction brought the pair down nearer to $59,000, circling $59,500 at the time of writing.

The sustained higher levels mean that Bitcoin has effectively canceled out the flash crash from earlier this week, while still continuing to trade in a defined corridor.

For popular trader Crypto Ed, the outlook was for $60,000 to disappear as resistance based on fading selling pressure on exchanges. Higher than $70,000, however, may have to wait longer.

"I mentioned BTC target $73k and ETH $2300," he wrote on Friday.

"From what I see now, ETH is on track. BTC not convinced yet it will reach that target in this cycle but I do think we'll see a strong push above 60k (soonish)."

Others are more optimistic, with short-term estimates including $68,000 and $73,000 and 2021 targets exceeding $288,000.

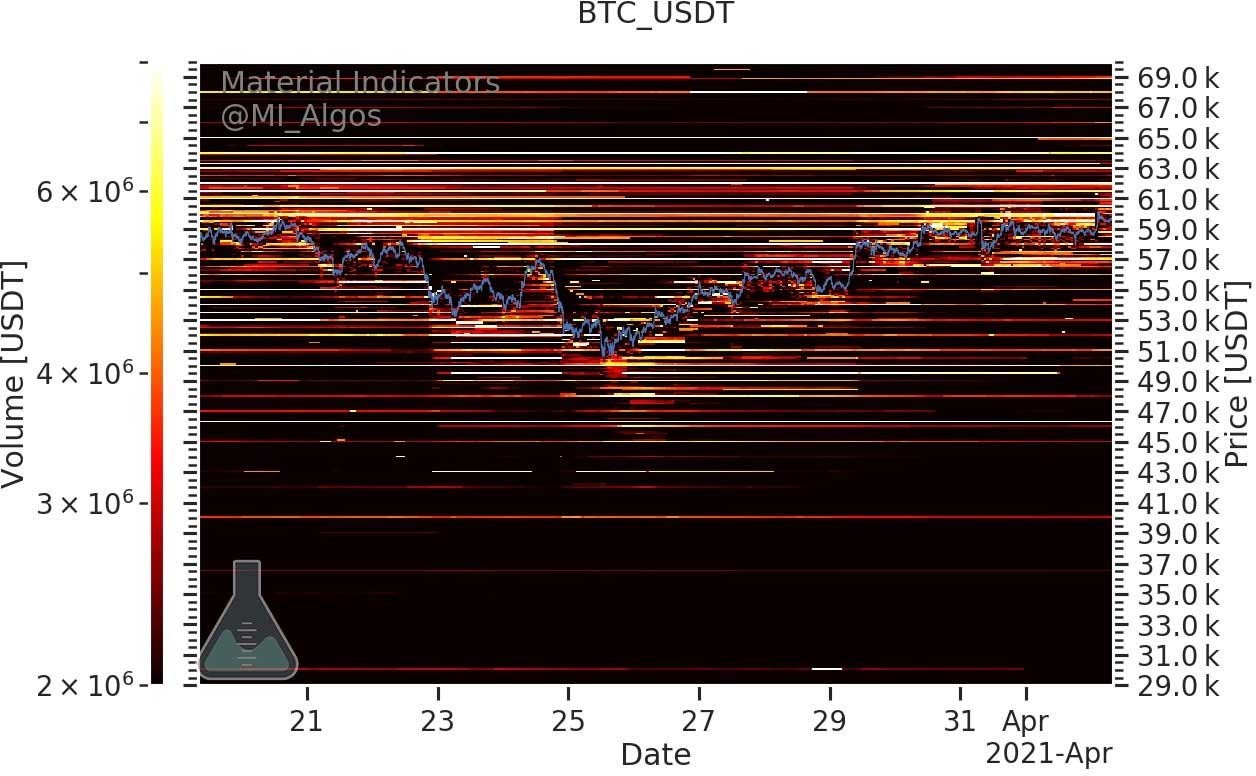

BTC/USDT buy and sell levels (Binance) as of April 2. Source: Material Indicators

"The ~$57,500 area rejected BTC in February. But it looks like BTC turned this exact same level into support a couple of days ago," fellow Twitter trader Rekt Capital added.

"Now it's about follow-through from here. And we're seeing some follow-through today."

Ether at $5,000 "inevitable"

Crypto Ed touching on Ether (ETH) comes as the largest altcoin by market cap touched $2,000 for the first time since Feb. 20.

After dipping in line with Bitcoin price action, ETH/USD returned to form over the past week, seeing almost constant higher highs on daily timeframes to near its historic record of roughly $2,040.

ETH/USD 1-hour candle chart (Bitstamp). Source: TradingView

As Cointelegraph reported, price targets for Ether are now more bullish than ever, and include $2,600 next, with $5,000 and even $10,000 in play.

The amount of ETH held by exchanges, like BTC, has been dropping sharply this year.

ETH exchange reserves vs. ETH/USD. Source: CryptoQuant

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.