$1.9 billion in BTC options are set to expire on Feb. 24, and bulls are well positioned to profit despite the Federal Reserve's intention to cool off the U.S. economy.

Bitcoin's 16% price gain between Feb. 13 and Feb. 16 practically extinguished the bears' expectation for a monthly options expiry below $21,500. As a result of the abrupt rally, these bearish bets are unlikely to pay off, especially since the expiry occurs on Feb. 24. However, bulls were not counting on the strong price rejection at $25,200 on Feb. 21 and this reduces their odds of securing a $480 million profit in this month’s BTC options expiry.

Bitcoin investors' primary concern is a stricter monetary policy as the U.S. Federal Reserve (FED) increases interest rates and reduces its $8 trillion balance sheet. Feb. 22 minutes from the latest Federal Open Market Committee's (FOMC) meeting showed that members were in consensus on the most recent 25 bps rate hike and that the FED is willing to continue raising rates as long as deemed necessary.

St. Louis FED President James Bullard told CNBC on Feb. 22 that a more aggressive interest rate hike would give them a better chance to contain inflation. Bullard said,

"Let's be sharp now, let's get inflation under control in 2023.

If confirmed, the increased interest rate pace would be negative for risk assets, including Bitcoin, as it draws more profitability for fixed-income investments.

Even if the newsflow remains negative, bulls still can profit up to $480 million in Friday's monthly options expiry. However, bears can still significantly improve their situation by pushing the BTC price below $23,000.

Bears were not expecting Bitcoin to hold $22,000

The open interest for the Feb. 24 monthly options expiry is $1.91 billion, but the actual figure will be lower since bears expected prices below $23,000. Nevertheless, these traders were surprised as Bitcoin gained 13.5% between Feb. 15 and Feb. 16.

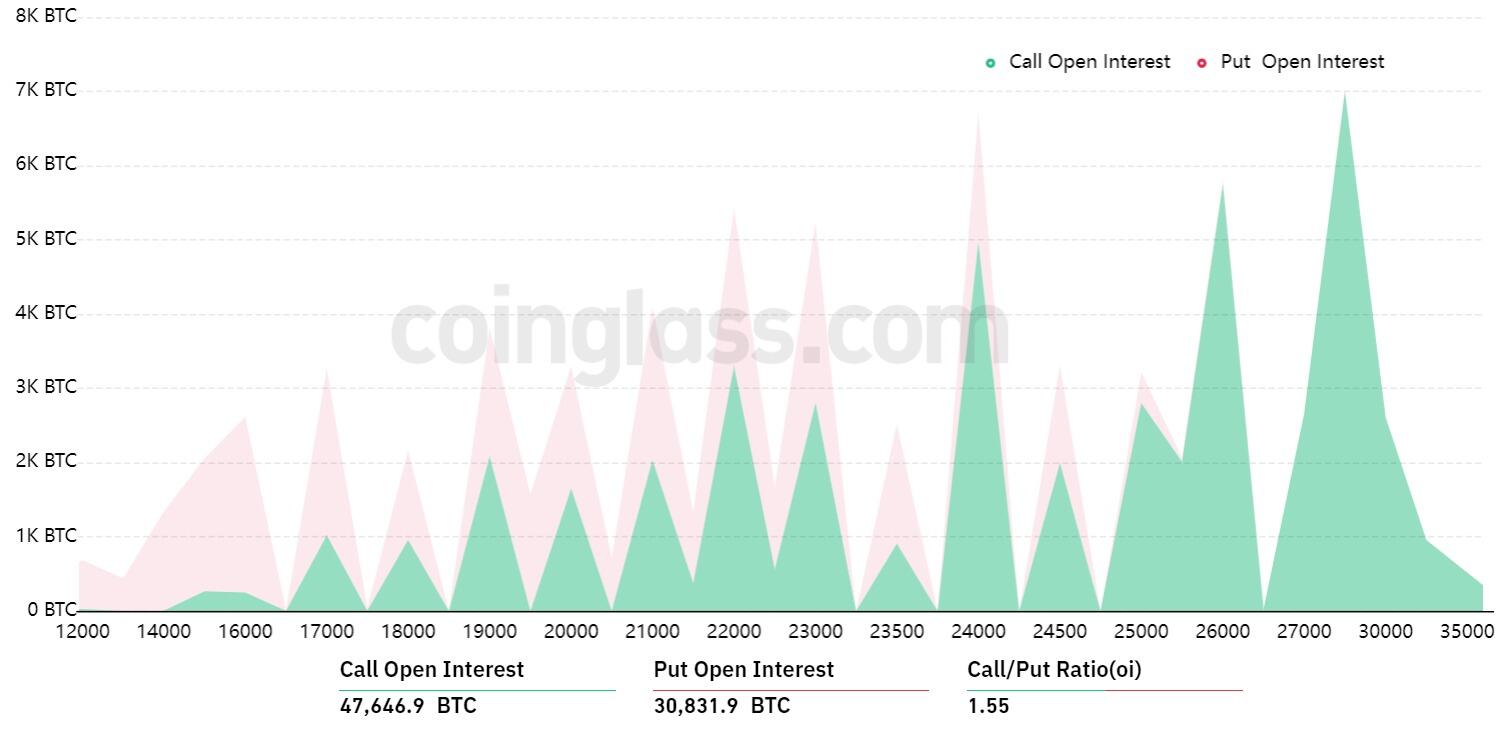

Bitcoin options aggregate open interest for Feb. 24. Source: CoinGlass

The 1.55 call-to-put ratio reflects the imbalance between the $1.16 billion call (buy) open interest and the $750 million put (sell) options. If Bitcoin's price remains near $24,000 at 8:00 am UTC on Feb. 24, only $125 million worth of these put (sell) options will be available. This difference happens because the right to sell Bitcoin at $22,000 or $23,000 is useless if BTC trades above that level on expiry.

Bulls aim for $23,000 to secure a $155 million profit

Below are the four most likely scenarios based on the current price action. The number of options contracts available on Feb. 17 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $22,500 and $23,000: 12,500 calls vs. 10,700 puts. The net result favors the call (bull) instruments by $40 million.

- Between $23,000 and $24,000: 16,200 calls vs. 7,600 puts. The net result favors the call (bull) instruments by $200 million.

- Between $24,000 and $24,500: 21,100 calls vs. 5,200 puts. Bulls increase their advantage to $385 million.

- Between $24,500 and $25,000: 23,200 calls vs. 3,600 puts. Bulls dominate by profiting $480 million.

This crude estimate considers the call options used in bullish bets and the put options exclusively in neutral-to-bearish trades. Even so, this oversimplification disregards more complex investment strategies.

For example, a trader could have sold a call option, effectively gaining inverse exposure to Bitcoin above a specific price, but unfortunately there's no easy way to estimate this effect.

The FED's tightening policy is the bears’ best shot

Bitcoin bulls must push the price above $24,500 on Feb. 24 to secure a potential $480 million profit. On the other hand, the bears' best-case scenario requires a 3.5% price dump below $23,000 to minimize their losses.

Considering the negative pressure from the FED's desire to weaken the economy and contain inflation, bears have good odds of improving their situation and settling with a $40 million loss on Feb. 24. This movement might not be successful, but it is bears' only way out of multi-million losses on the BTC monthly options expiry.

Looking at a broader time frame, investors still believe the FED is destined to reverse the current monetary policy in the second half of 2023 — possibly paving the way for a sustainable rally ahead of the April 2024 Bitcoin block reward halving.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.