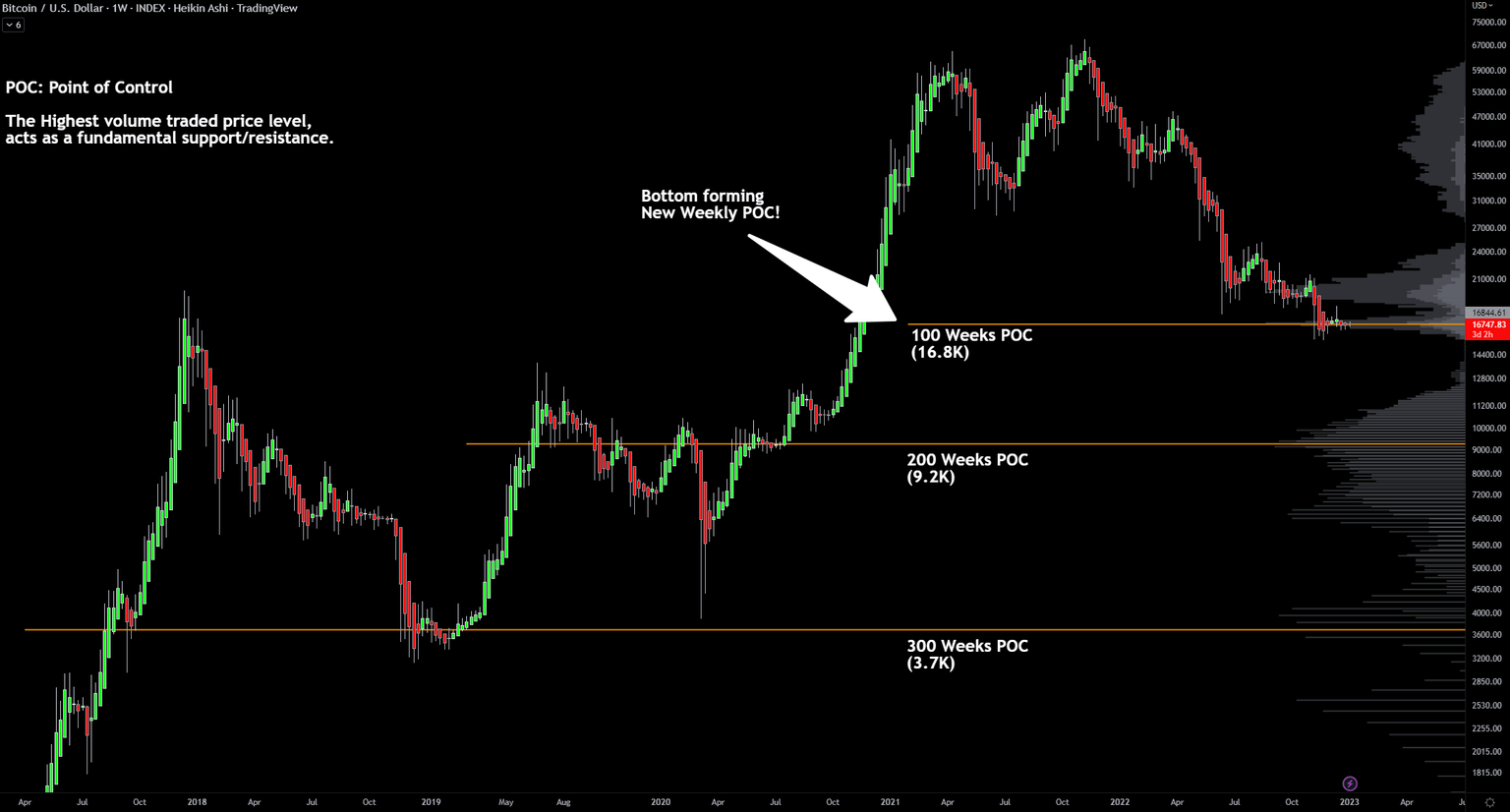

Bitcoin attracts mega whales with new moves, finds support at the $16,800 level

- Bitcoin price is prepared to break out of its triangle formation after establishing new support at the $16,800 level.

- The cryptocurrency has attracted large wallet investors to its network with a new 100-week point of control below the $17,000 level.

- Experts believe that the $16,800 level is the new potential bottom for the asset; this is where the most volume has been traded in the last 100 weeks.

Bitcoin, the most significant asset by market capitalization, has witnessed a consistent decline in its volatility over the past eight weeks. Despite declining activity on the Bitcoin network, analysts have identified a potential bottom at the $16,800 level. They believe BTC will likely hold its ground at this volume point of control.

Also read: Bitcoin price holds steady after FOMC minutes release, will BTC rally soon?

Bitcoin establishes new volume point of control below $17,000

Bitcoin, the dominant cryptocurrency with a market capitalization of $356 billion, formed support at the $16,800 level. BTC recently climbed above the 50-day Exponential Moving Average (EMA) and the 200-day EMA. Bitcoin flipped its two long-term moving averages and formed new support at the $16,800 level.

Experts have identified a new 100-week point of control below the $17,000 level. @TrendRidersTR, a crypto analyst and trader, identified the $16,800 level as a critical BTC price support zone.

BTC/USD price chart

As seen in the chart above, the 100-week point of control is at the $16,800 level, the 200-week POC is at $9,200, and the 300-week POC is at $3,700. The POC is a key level for an asset as it represents the highest volume traded level in a cryptocurrency’s chart; it acts as a fundamental support/ resistance level.

The largest asset by market capitalization has been trading in an increasingly narrow trading range since the FTX saga in November 2022. Contrary to popular belief, Bitcoin price could continue its climb against the USD.

The expert was quoted as:

~16.8K is the new 100 Weekly POC for Bitcoin. In simple terms, in the last 100 weeks, this is the level where most volume has been traded, creating a potential bottom formation.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.