Bitcoin at $5,000 charts begin to pop up on Twitter, how likely is such a massive correction?

- Bitcoin price suffered a massive correction losing 15% of its value since Wednesday.

- Some analysts are predicting that BTC could even reach $5,000.

It’s not uncommon to see considerable corrections in the market after massive rallies like the one Bitcoin is experiencing. Around $80 billion were wiped out from the market in less than 24 hours, and some analysts believe the price could go even lower.

What’s the next target for Bitcoin price?

After a 15% downward correction, many analysts are posting their ideal levels and their thoughts about the pullback. Although massive corrections between 20-30% are not uncommon when Bitcoin is in a bull rally, they could be the first sign of a potential reversal.

Dyme, a popular crypto analyst on Twitter, says he is not yet prepared to go full bearish mode on the flagship cryptocurrency but believes it is likely dropping towards the 0.382 Fib. retracement level at around $13,500.

Dyme’s lowest level for Bitcoin seems to be approximately $5,433, which would still be a higher low than the crash during the coronavirus pandemic.

I'm not prepared to be fully beartarded but these are the levels I'm watching. pic.twitter.com/XMkkNgv5m7

— Dyme - cope posting only until further notice (@CryptoParadyme) November 26, 2020

Other analysts are not as pessimistic and believe BTC is doing something similar as it did before the 2017 massive rally to the all-time high. It seems that the Bitcoin price had several 34% corrections after reaching all-time highs throughout 2017.

Quick, before my wife see's me posting.

— Bob Loukas (@BobLoukas) November 26, 2020

Most have a short memory. Remember in Jan 2017 just shy of #Bitcoin ATH's, boom 34% decline. The 2 months later a sharp rally, new ATH's, and double boom 34% decline.

Never a one way street. pic.twitter.com/Z7THwjZVVb

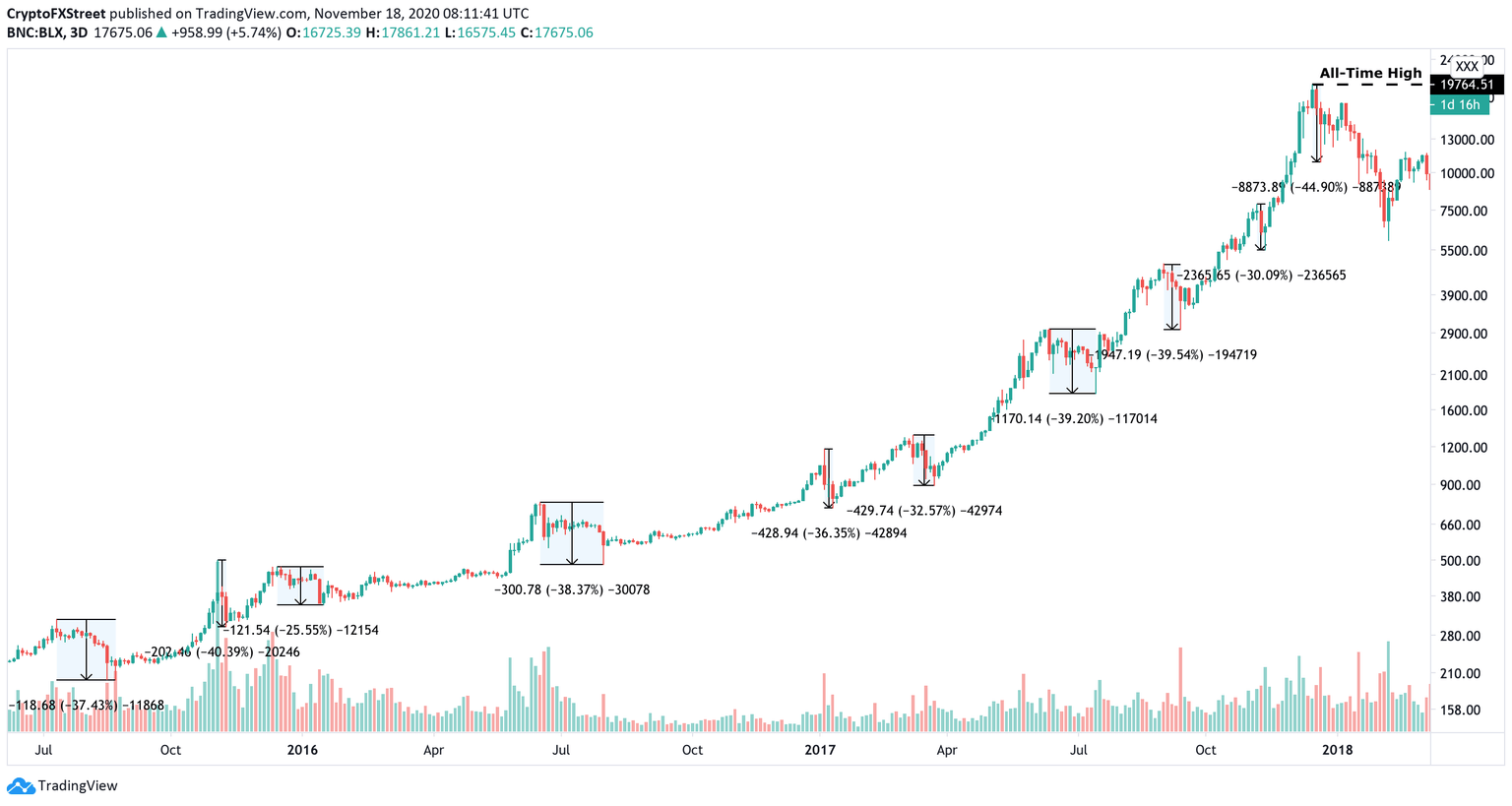

As discussed in one of FXStreet latest articles, the pioneer cryptocurrency is prone to suffer major corrections during bull rallies. Such pullbacks usually end up lasting a few weeks before the next high. The current retracement is only around 17%, which is significantly lower than the 30-40% nosedives seen between 2015 and 2017.

Therefore, the ongoing correction could either lead to lower prices or it just may not be a major one.

BTC/USD Corrections Between 2015 and 2017

On the weekly chart, the TD Sequential indicator has just presented a sell signal for the first time since June 1, 2020. On the monthly chart, this indicator is also on the verge of posting the same call, in the form of a green nine candlestick. This can be perceived as a major indication of further losses on the horizon.

BTC/USD Weekly and Monthly Charts

IncomeSharks, another prominent analyst, states that Bitcoin has already dropped into his buy zone, which seems to be located at around $16,000.

Now, the chartist is preparing for a rebound towards $19,000 or higher.

$BTC still looks good to go up. Instead of shorting I'm placing buys in this zone. Hoping to catch a wick if we drop. But for now I'm still buying some here on this dip and think this might hold. Always have a plan where you are glad for the price to go in either direction. pic.twitter.com/IzI0nT1LGa

— IncomeSharks (@IncomeSharks) November 26, 2020

The In/Out of the Money Around Price (IOMAP) chart adds credence to this theory. Based on this on-chain metric, the area between $16,163 and $16,684 may serve as stable support.

Here, roughly 330,000 addresses had previously purchased more than 200,000 BTC.

BTC IOMAP by IntoTheBlock

Breaking below this significant demand barrier could lead to the next major support barrier at around $15,417, where over 400,000 addresses bought 275,000 BTC.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.