-

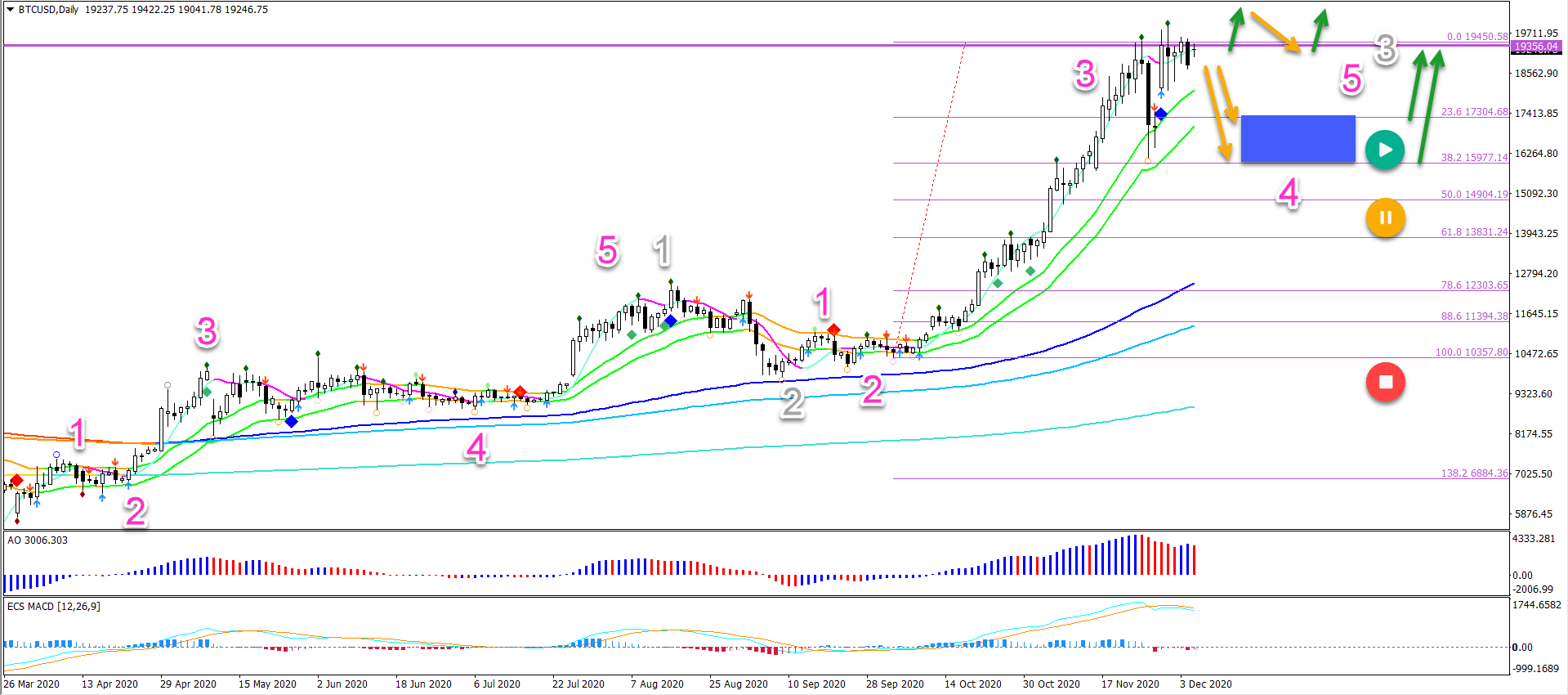

Will price be able to break above the key resistance? Or is the uptrend over and ready for a reversal?

-

Bitcoin has been testing the previous top around $19,000 for 10 daily candles in a row. But so far, the bulls have not succeeded to break it.

-

The BTC/USD’s hesitation to break could indicate an extended wave 4. In that case, price action is expected to test the shallow Fibonacci retracement levels.

Price Charts and Technical Analysis

The BTC/USD’s hesitation to break could indicate an extended wave 4 (pink). In that case, price action is expected to test the shallow Fibonacci retracement levels.

A bullish bounce is expected at those Fibs and support zone (blue box). This is a significant confirmation… Why?

-

Because it would indicate the development of a larger wave 3 (grey) and uptrend continuation.

-

A break below the 50% Fibonacci level would pauze (yellow circle) the trend temporarily and a very deep reversal would invalidate it (red circle).

The other likely scenario is an immediate breakout above the previous top. In that case, it would be good to see a break, pullback and continuation. This pattern helps avoid false breakouts. Plus there is also a round level resistance at the $20,000 mark.

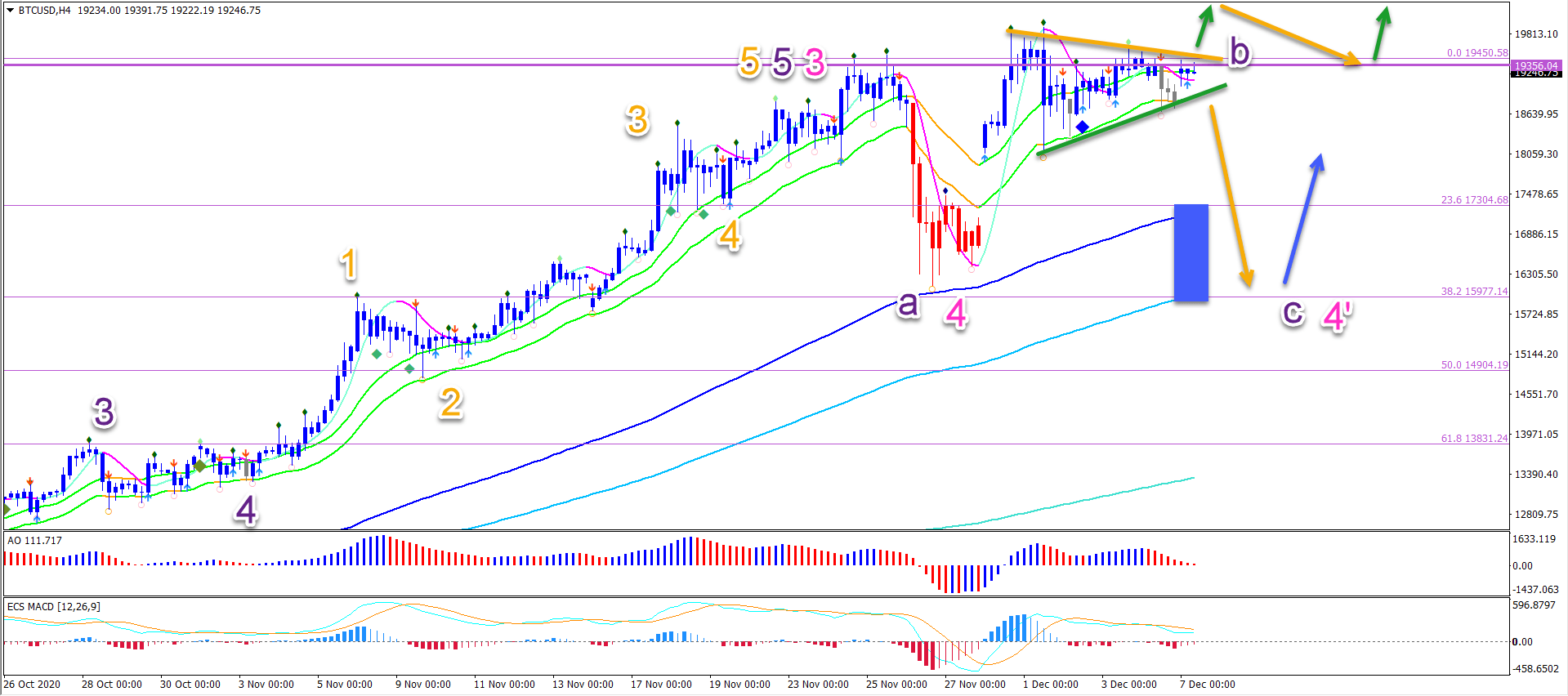

On the 4 hour chart, a break below the support trend line (green) confirms the extension of the wave 4 (pink 4’). The pattern is then completing a bearish ABC pattern (purple).

A bullish breakout should see a break, pullback, and continuation pattern. Otherwise the break remains vulnerable to a deeper retracement.

The analysis has been done with the ecs.SWAT method and ebook.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

The crypto market is stuck in the mud

The crypto market has been hovering in a narrow range for the past four days, adding just over 2.5% over the past seven days to $2.72 trillion. These are levels below the 200-day moving average, indicating that the balance of power is now on the sellers' side.

Fintech and crypto firms push for bank licenses under Trump administration

Fintech and crypto firms seek bank charters under Trump, aiming for growth, lower costs, and legitimacy amid expectations of a more business-friendly regulation.

ETH consolidates below $2,000 as Standard Chartered alters its prediction for 2025

Standard Chartered analysts led by Geoffrey Kendrick lowered the bank's expectations for Ethereum's price in 2025. The bank adjusted its latest prediction, reducing Ethereum's 2025 price target from $10,000 to $4,000.

Solana price faces 50-day resistance as SOL futures debut on CME Group with $5M volume on fifth anniversary

Solana (SOL) stagnated around the $128 mark on Monday despite multiple bullish catalysts. The recent SOL unlocks by Alameda Research, ahead of FTX creditor repayments, have created a persistent bearish overhang since early March.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.