Bitcoin and US stock market correlation shoots up: Is BTC at Fed’s mercy again?

- Bitcoin price continues to coil up for more than a month, leaving investors guessing its next breakout move.

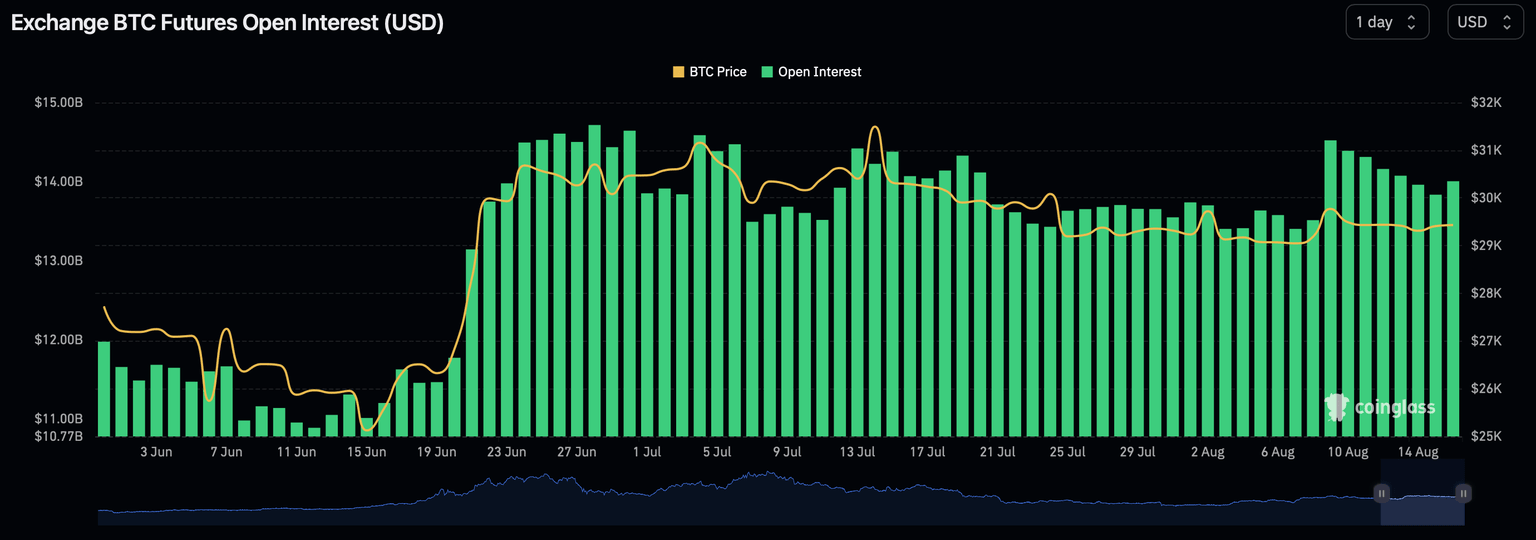

- This rangebound move is accompanied by a spike in open interest and correlation to the stock market.

- Due to this uptick, BTC could be sensitive to upcoming macroeconomic data releases and events.

/stock-market-graph-gm532464153-55981218_XtraLarge.jpg)

Bitcoin (BTC) price action remains boring, but certain elements that directly or indirectly affect it are changing slowly. Previous publications have already discussed the slump in Bitcoin price action, the recent surge in Open Interest (OI), and the drop in volatility to all-time lows.

This article will take a closer look at the rising correlation between Bitcoin price and US tech stocks. It will also discuss the potential reasons behind this uptick and the impact of macroeconomic events on BTC price should this correlation remain high.

Also read: Altcoin mania and Bitcoin ETF approval remain hot topics; here’s what to expect this week

Bitcoin correlation to the US stock market goes up

The correlation between Bitcoin price and stocks, especially the S&P 500, has seen a considerable uptick in the last two weeks. The correlation to the S&P 500 has shot up from -0.73 to 0.08, while the tech-heavy Nasdaq 100 index has gone from -0.52 to 0.21.

The last time the correlation between Bitcoin and the US stock market rose was between June 18 and July 5, when the multi-billion dollar asset management company BlackRock announced its Bitcoin spot Exchange-Traded Fund (ETF) application on June 15. It is logical for the correlation between BTC and US stock markets to rise, especially considering the new capital influx from traditional investors after June 15.

On the other hand, the tech stocks earnings report in June and July have caused the indices to rally, which could also be a reason why the correlation has spiked.

Regardless, a larger time frame picture shows that when this correlation rallied in 2021, macroeconomic events and central bank policies moved crypto markets. If this uptick is short-term, then Bitcoin price and BTC holders have nothing to worry about. But if the correlation between Bitcoin and tech stocks continues to climb higher over longer periods of time, investors need to be careful, considering the delicate nature of the global financial markets and worsening macroeconomic conditions.

BTC-US stock market correlation

The rise in correlation could seriously impact Bitcoin price and the fate of BTC holders. In September, the Fed is set to decide on interest rates in response to the August data. The CME FedWatch Tool forecasts an 88.5% probability of a pause and an 11.5% probability of a 25 basis point hike.

CME FedWatch Tool

Expert’s take on Fed rate hikes and potential rate cuts

Goldman Sachs analysts Jan Hatzius and David Mericle wrote in an August 13 note that the Fed will more likely head in the direction of normalizing interest rates via cuts after they notice a drop in core inflation to their desired level of 2%. The latest release of US economic data showed that inflation rose at a slower-than-expected headline rate of 3.2%. With that in mind, Goldman Sachs analysts are penciling the interest rate cuts to start in the second quarter of 2024.

On the contrary, FXStreet lead analyst Eren Sengezer notes that there is still a possibility that the Fed “could raise interest rates once again in November or December. Sengezer further adds that,

It's too early to say whether there will be rate cuts in 2024, but if they were to happen, I'd say earliest in H2/Q3, 2024.”

He explains that the Fed has been data-dependent and will pivot once “rent prices start to come down, and that's reflected upon inflation.” Even after the Fed is closer to its target, they could leave the “policy rate unchanged, waiting for further evidence of even softer inflation. Once they are convinced, they could start considering rate cuts.”

To summarize, Eren Sengezer notes that the markets are optimistic and think that the Fed has reached its terminal rate. As a result, they are expecting rate cuts and a rally in tech stocks.

However, one month of strong labor market data or another unexpected increase in inflation could quickly change that,” adds Sengezer.

Bitcoin volatility hits fresh lows, open interest remains high

While the uncertainty of Fed’s next step hovers over investors’ heads, Bitcoin (BTC) price continues to consolidate. BTC has been trading inside an $1,800 range for nearly eight weeks. A 6.10% move from wick to wick is the highest daily gain seen for the pioneer crypto in the said time frame. This lack of volatility has been on a downtrend since March 2021 and has recently hit a new all-time low of 0.65%.

BTC/USD 30-day volatility

As explained in a previous article, the volatility void has clearly been affecting investors who are looking at other crypto avenues to make gains.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.