Bitcoin and stablecoin whales scoop up BTC, USDT, BUSD and DAI: Recipe for crypto Santa Claus rally

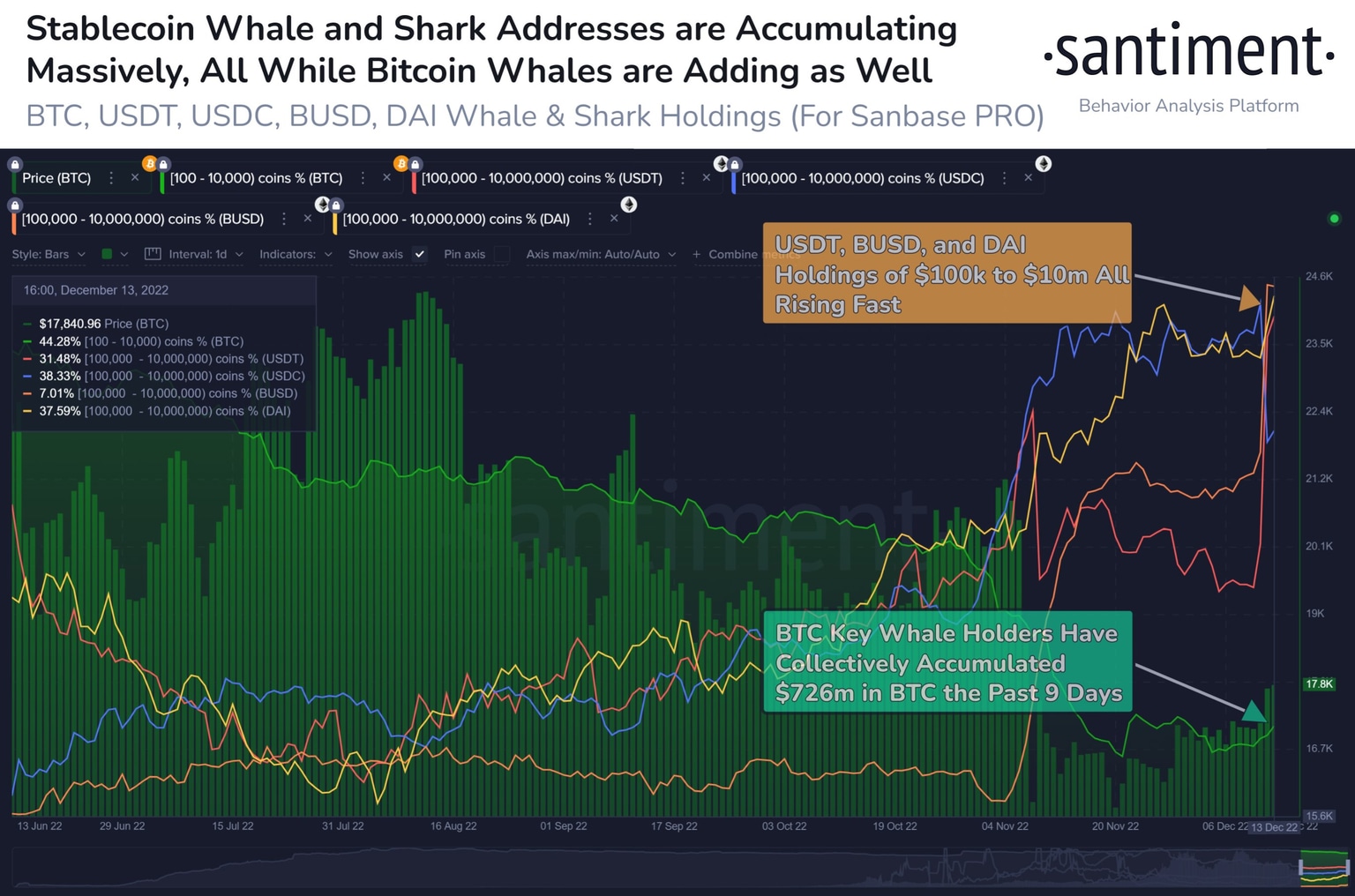

- Bitcoin addresses holding 100 to 10,000 BTC have scooped up $726 million in BTC in the past nine days.

- Stablecoins USDT, BUSD and DAI are being accumulated, signaling a Santa Claus rally is around the corner.

- Bitcoin worth $1.4 billion left exchanges on Wednesday, reducing the selling pressure on the asset.

Bitcoin and cryptocurrencies enjoyed a resurgence in their prices and both BTC and Ethereum jumped to their highest level since the FTX exchange collapse, on Tuesday. Experts at Santiment noted euphoria in the crypto market as Bitcoin and stablecoin outflows increased and whales scooped up assets off exchanges.

Also read: Cryptocurrency prices rally in disinflation trade, Bitcoin bulls fight US CPI jitters

Bitcoin and stablecoin whales accumulated assets in preparation for a price rally

Bitcoin network’s large wallet investors continued massive accumulation of BTC. Exchanges witnessed an outflow of $1.4 billion worth of Bitcoin on Wednesday, according to data from Bitcoin Magazine.

Whales scooped up large volumes of stablecoins, Tether (USDT), Binance USD (BUSD) and DAI in anticipation of an upcoming Bitcoin price rally. Accumulation by whales is considered bullish for the asset.

Bitcoin addresses holding between 100 to 10,000 BTC added $726 million worth of the asset to their portfolio in less than ten days. Data from crypto intelligence tracker Santiment reveals that USDT, BUSD and DAI holdings of whales with between $100,000 and $10,000,000 in stablecoins, are rising fast.

Accumulation of BTC, USDT, BUSD and DAI by whales

Traders’ enthusiasm must stay high and fear low, in order to push Bitcoin’s price higher, according to Santiment’s recent tweet.

Bitcoin Santa Claus rally around the corner?

December is the peak of the holiday season that gave rise to the phrase “Santa Claus” rally. It is a phenomenon where stock markets and cryptocurrencies rally in the days leading up to Christmas. Investors believe December is a lucky month and cryptocurrencies can rally as enthusiasm spreads among traders.

BTC/USD price chart

Bitcoin price is currently in a short term uptrend that started on November 22 (see 4-hour chart above). In the first ten days of December Bitcoin price respected support from the 50-day Exponential Moving Average (50-day EMA) and resistance from the 200-day EMA. On December 13, however, the price broke above both MAs and surged higher. The two moving averages are now meeting at $17.327, a key support level for Bitcoin price. If the 50 EMA closes above the 200 EMA it will also signal a bullish Golden Cross continuation pattern for the asset.

BTC price’s overall trend on the daily and weekly charts, however, remains bearish suggesting the potential threat of more downside. Should Bitcoin price break and close below the bottom of the 4-hour chart channel, at roughly $17,200, it would suggest the short term trend might be changing and falling back in line with the longer term downtrend. A further break below the December 12 low at $16,880 would seal the deal for bears and suggest a continuation lower. A possible downside target after that might be the 61.8% Fibonnaci extension of the height of the channel, at $16,475, or for those with an appetite risk, the 100% extrapolation at $16,065.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.