Bitcoin and Ethereum price recovers following the chinese authorities clampdown on miners

The global cryptocurrency industry is fast plummeting as the duo of Bitcoin (BTC), and Ethereum (ETH) continues to lead market losses in the wake of regulatory clampdown of crypto-related activities in China. The combined crypto market capital is down from more than $2.7 trillion earlier in the second quarter to $1.31 trillion at present.

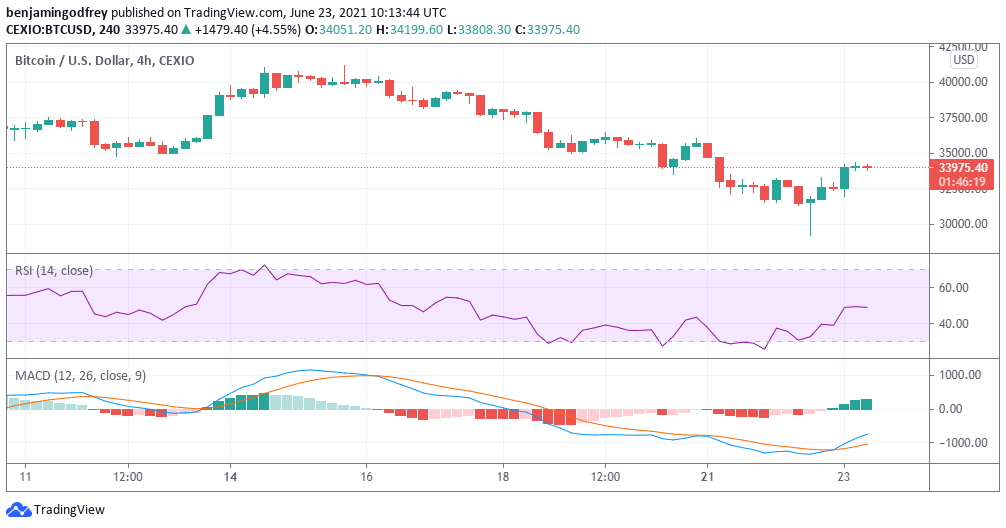

Bitcoin seeks to maintain support at $31,000

The premier digital currency is seeing extreme price volatility around the $33,000 price level as bear forces have pushed prices down 4 major support levels in the past week. Bitcoin is currently changing hands at $33989, up 7.08% at the time of writing according to data from CEX.IO. Miners in China are evacuating at the strong arm request from Beijing, a situation that is complemented by the ban of crypto transactions amongst the country’s biggest banks.

The entire Fear, Uncertainty, and Doubt (FUD) created by the Chinese clampdown have caused an overselling in Bitcoin. The potential uptrend we are seeing is ignited by the migration of miners from China to Kazakhstan hit the ecosystem. If market buyers succeed in keeping prices above the $33,000 resistance level, we may see a price reversal to $42,000 in the near to mid-term.

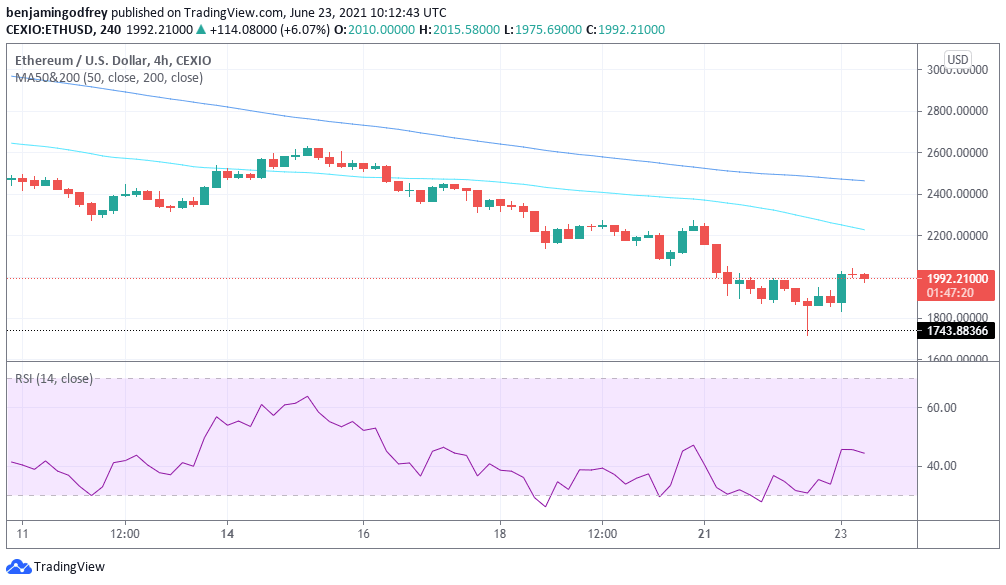

Ethereum’s fall below $2,000 can pose a challenge to mid-term growth

The revived buyup in Ethereum, leading to a gain of 6.01% to a price of $1992.41 at the time of writing, has returned the coin back on track after it fell to a level not seen since May 23. Despite Ethereum on-chain activities becoming more attractive to use per reduction in gas fees, users are largely shunning transactions that can spike growth. Likely, the recent uptick in price can help reverse this trend.

Ethereum’s price is currently trading well below its 50, and 200-day Moving Averages, dimming the potential and hopes of a longer-term run in price. The drop below the $2,000 psychological level can keep prices down this range in the near term, while the hopes of correction can usher the price back up to its 7-day high of $2,554.63 in the short to mid-term.

Author

Konstantin Anissimov

CEX.IO

Konstantin is a businessman with skills in corporate governance, strategic management, customer relations, partnership negotiations and international sales. Graduated the Executive MBA program at the University of Cambridge.