Bitcoin and Ethereum options market shows mixed signals, whales add to bearish positions

- Bitcoin price hovered at a high of $44,000, and Ethereum sustained above $2,300 early on Friday.

- Options data shows whales are adding to their bearish positions at a time when market sentiment is bullish.

- Greeks.live analysts said options delivery data points at potential plunge risks in crypto.

Bitcoin price sustained above $44,000 on Friday, and 87% of BTC holders are currently profitable. Similarly, Ethereum price is $2,308 on Binance, after the altcoin’s recent breakthrough past the $2,300 barrier.

Options data analysts at Greeks.live observed that the market is showing mixed signals. Analysts noted that whales have added to their bearish positions in BTC and ETH while the sentiment among market participants is neutral to bullish. This requires traders to be wary of downside risk when trading these cryptocurrencies.

Also read: Three altcoins poised for bullish break: Fantom, MATIC and DENT

Options market show mixed signals to traders

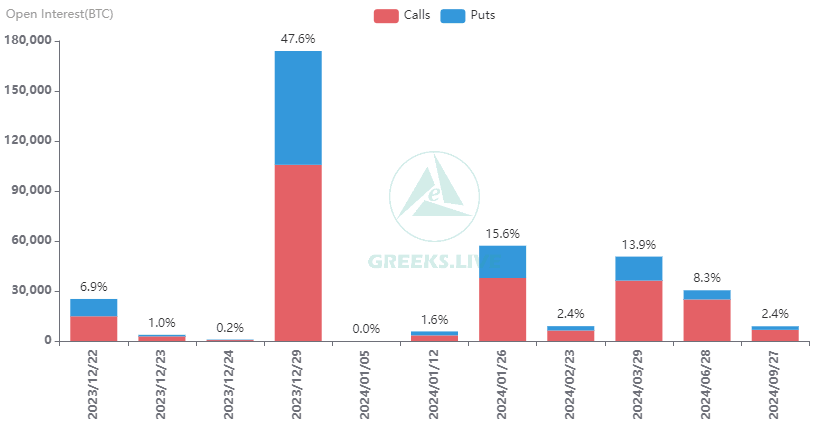

On December 22, according to Greeks.Live options data, 25,000 BTC options and 217,000 ETH options are about to expire. For Bitcoin, the biggest pain point is $42,000 and for Ethereum it is $2,200.

With the massive spike in cryptocurrency prices throughout December, rise in inscriptions (a new way to write and store arbitrary data in blockchains), and a large number of protective put options being traded this week, analysts point at potential “plunge risks” in cryptocurrencies.

The optimism surrounding the Bitcoin Spot ETF increased as Fox Business reported that sources close to the Securities and Exchange Commission (SEC) stated that an approval is likely by January 10. With the odds of a Spot BTC ETF approval being significantly higher than they have been in years, there is an increase in positions in January, large-scale positions are still in progress.

Bitcoin Open Interest data. Source: Greeks.Live

On Friday, analysts noted two block trades with an exercise price of $3,000 being completed with a total nominal value of $34 million. Large wallet investors are buying ETH call options in large volumes, owing to the altcoin’s strong correlation (3-month correlation is 0.86 as seen on Macroaxis) with Bitcoin and the upcoming bullish catalysts for BTC:

- Likely approval of Spot Bitcoin ETF in January 2024

- BTC halving in April 2024

Analysts warned traders of a possible sudden plunge in asset prices as Christmas holidays are around the corner, European and American traders are less likely to participate in many transactions. The declining liquidity in the market could result in a sudden surge or decline in crypto prices.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.