Bitcoin and Ethereum transaction fees have declined down to $7.20 and 4.80 respectively.

The transaction fees of Bitcoin and Ethereum have slumped to six-month lows as the markets cool after the recent crypto downturn.

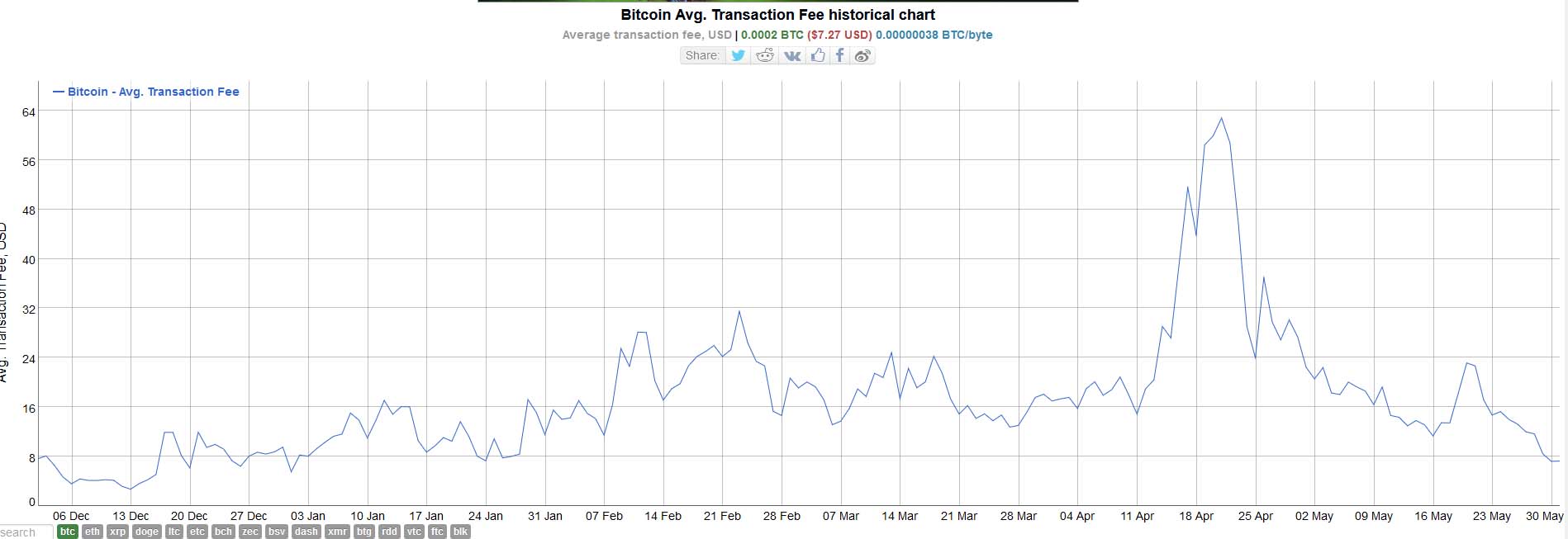

According to BitInfoCharts, the average price of performing a transaction using Bitcoin has fallen from an early-April all-time high of $62.77 to around $7.20 — an 88% drop over just six weeks.

Bitcoin average transaction fees - BitInfoCharts

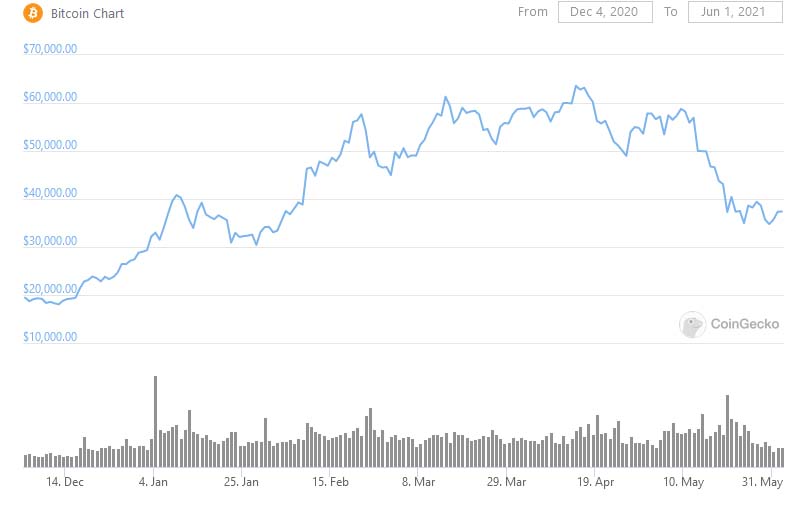

The falling Bitcoin transaction fees appear to have been driven by a decline in overall market activity, with daily volumes evaporating from more than $67 billion on May 10 to $30 billion as of this writing, according to CoinGecko.

The meteoric 2021 crypto bull-run has seen the average transaction fees associated with using Bitcoin or the Ethereum mainnet frequently skyrocket to unprecedented levels in recent months.

In February 2021, Bitcoin’s fees nearly tripled in two weeks following a Feb. 8 announcement that Tesla added $1.5 billion worth of Bitcoin to its balance sheet.

The news sparked a surge in crypto speculation, with the price breaking its former high of $40,000 before topping out at $54,410. Data from CoinGecko shows that 24-hour volume for BTC increased by nearly double from $57 billion on Feb. 7 — the day before Tesla’s announcement — to $101 billion on Feb. 23.

The average price of Bitcoin fees again surged into a record high of $62.77 on April 21 after the price of BTC spike to tag a local top of $64,804 on April 14. Bitcoin’s fees peaked on April 21 sparked by an increase in market activity as the markets began showing weakness, as traders raced each other to cash out near the highs.

Bitcoin price chart - CoinGecko

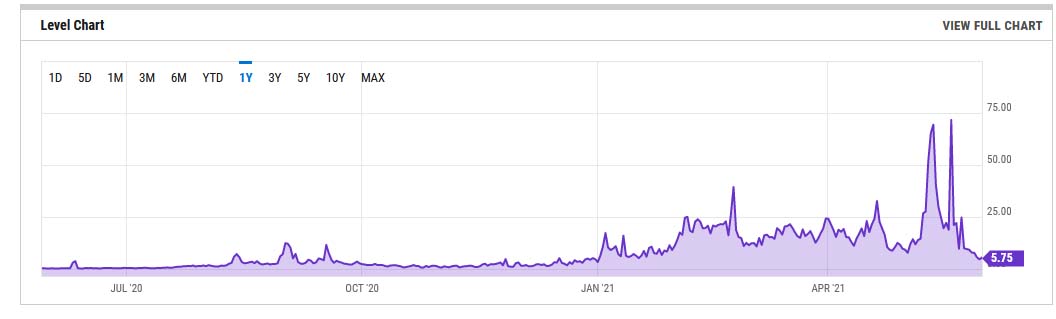

Data from YCharts also shows that average Ethereum fees have dropped from May 20’s record high of $72.21 to just $4.80, a 93% reduction in less than two weeks.

Ethereum average transaction fees - YCharts

Increasing adoption of Ethereum-powered decentralized finance and nonfungible tokens saw average fees increase from $3.50 at the beginning of the year to new highs of nearly $40 by the end of February.

While developers sought to discipline the fee markets through April’s Berlin hard fork, a speculative frenzy surrounding Shiba Inu and other ERC-20 dog tokens drove further congestion on the Ethereum mainnet, again pushing fees to record highs last month.

Ethereum’s transaction fees last established a new all-time high of $71.21 on May 19, with Cointelegraph reporting that a rush of traders racing to exit leveraged positions on-chain amid plummeting crypto prices was responsible for the hike.

Complex smart contract transactions incurred fees of more than 10 times the average at the peak of the market turmoil, with CoinShares CSO, Meltem Demirors, reporting claiming to have paid more than $1,000 for a single transaction.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.