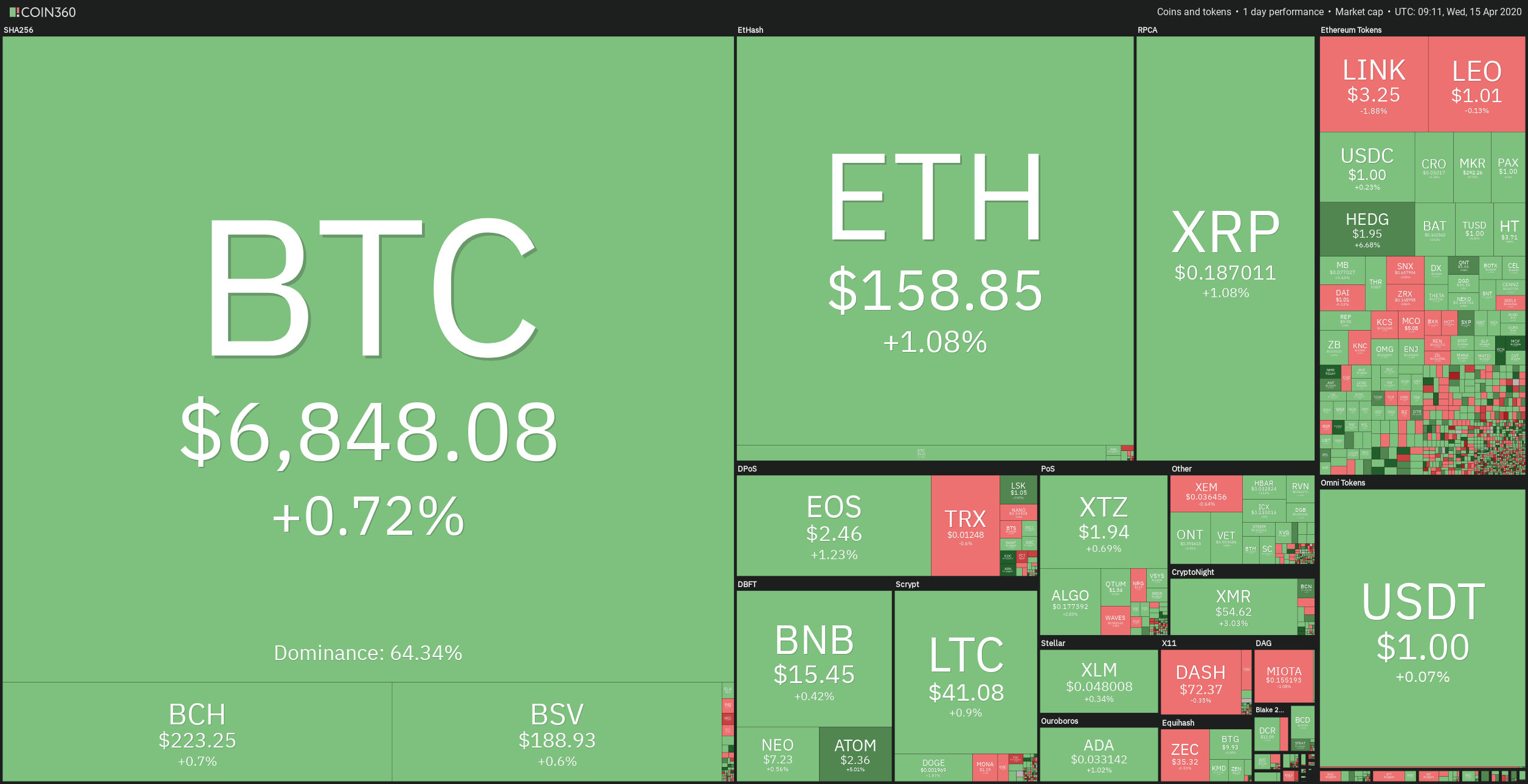

Cryptocurrencies moved slightly up yesterday, although the upward movement range is tightly held by the sellers. Atom (+5%) was the best mover- Meanwhile, the leading cryptos moving up around 1% against their previous 24h level. On the Ethereum-based tokens, the situation is a bit more bullish, with HEDG(+6.85%), QNT(+10%), and MB(+14.8%) and others showing strong behavior.

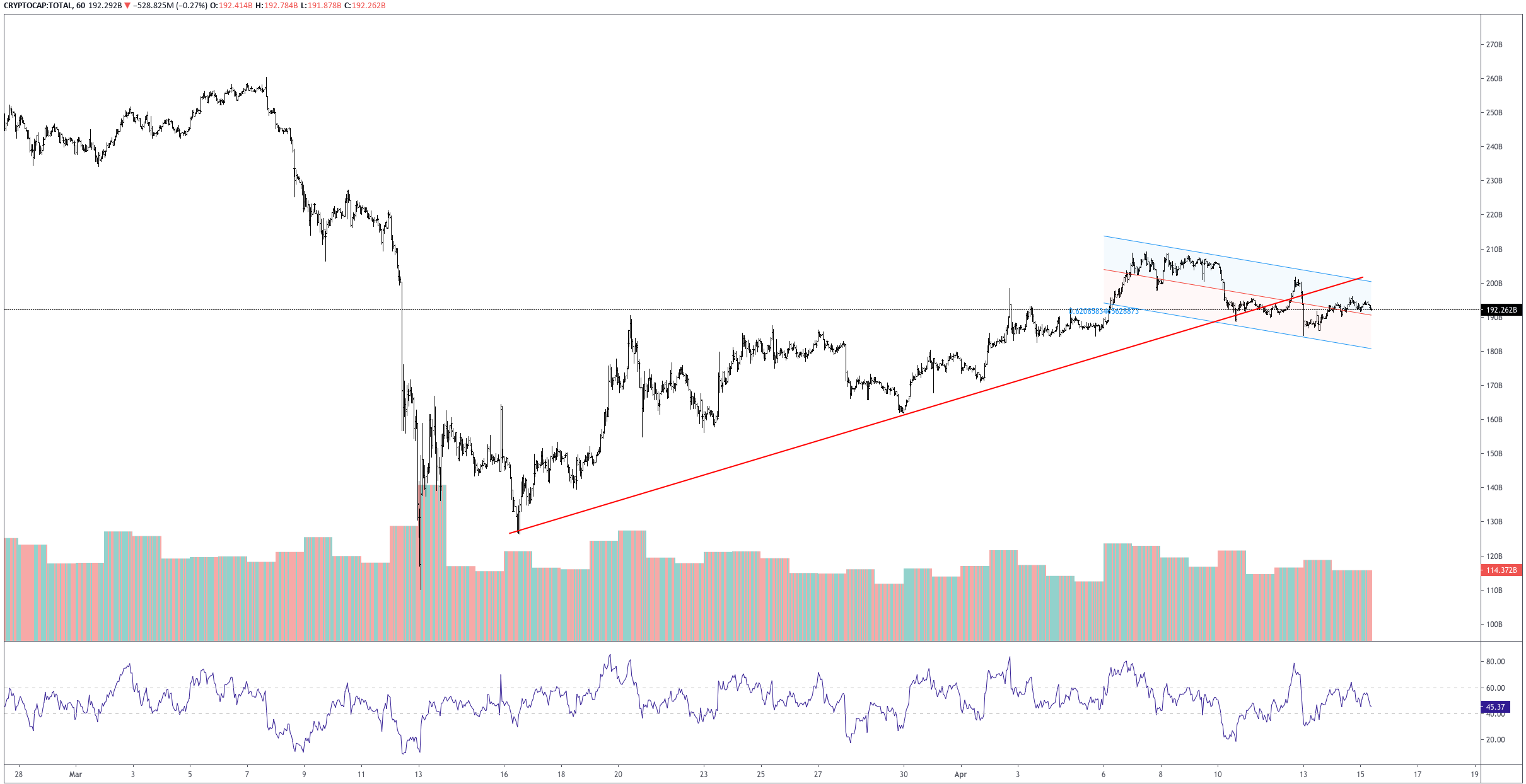

The market capitalization has improved slightly to$192.35 Billion, but we see on the chart that its linear regression channel is pointing to a slightly bearish outlook. The traded volume has decreased to $32.262 billion (-22%), which is common in trading ranges. Bitcoin dominance is stable at 64.26%.

Hot News

CNBC warns in an article that coronavirus job losses could go up to 47 million and raise the unemployment rate to 32 percent as estimated by St Louis Federal Reserve projections. St. Louis Fed President James Bullard says that this effect should be short-lived and that the economy will quickly recover.

China's digital yuan is reported to be tested in four cities. According to this information, the wallet app for the digital yuan is available for download in for cities: Shenzhen, Chengdu, Suzhou, and Xiongan.

Chinese DeFi startup dForce has raised $1.5 million. The action was led by Multicoin Capital, Huobi Capital, and China Merchants Bank International.

Bitcoin hash rate has recovered from the dip after the black Thursday and reaches the level of 122.9 EH/s, attained on March 2. Hash rate refers to the computational power used by miners to create a new block. A high hash rate is good for the network, as it makes it more robust against malicious attacks.

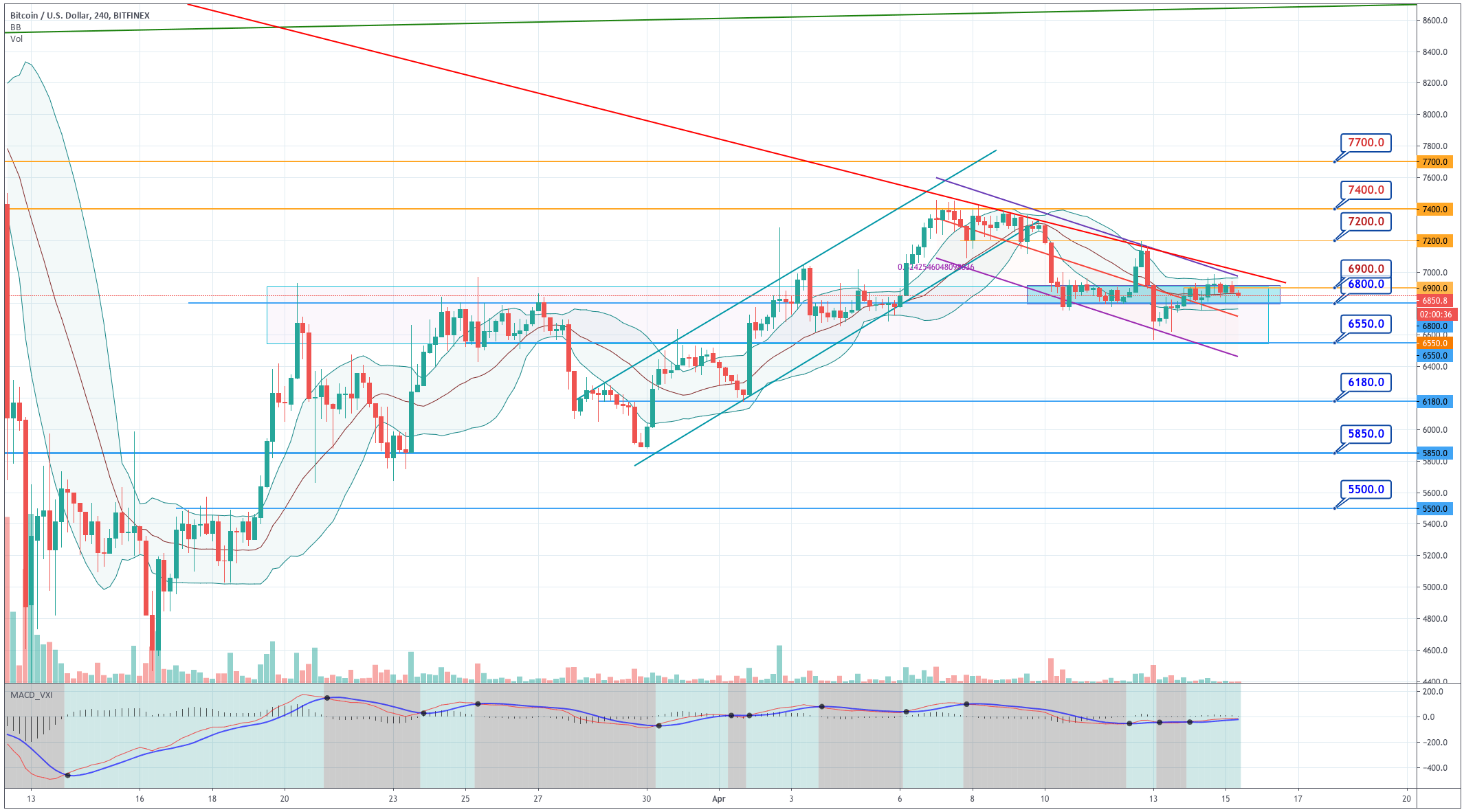

Technical Analysis - Bitcoin

Bitcoin has been retracing the last bearish candle made on Monday's early morning. But the price has been rejected once more at the $7,000 level and is moving in a tight channel. The MACD is almost flat, as is the Bollinger bands. BTC is still following a descending channel, with the current action near the upper limit of the channel. The last candles are showing weakness, although with tiny volume. Thus, we consider that BTC does not show any direction at the moment. Sellers should wait for a breakout below the $6,800 level, whereas buyers should seek a breakout of the $7,000 level.

Standard Pivots

|

Support |

Pivot Point |

Resistance |

|

6,634 |

7,042

|

7,333 |

|

6,350 |

7,740 |

|

|

5,922 |

8,030 |

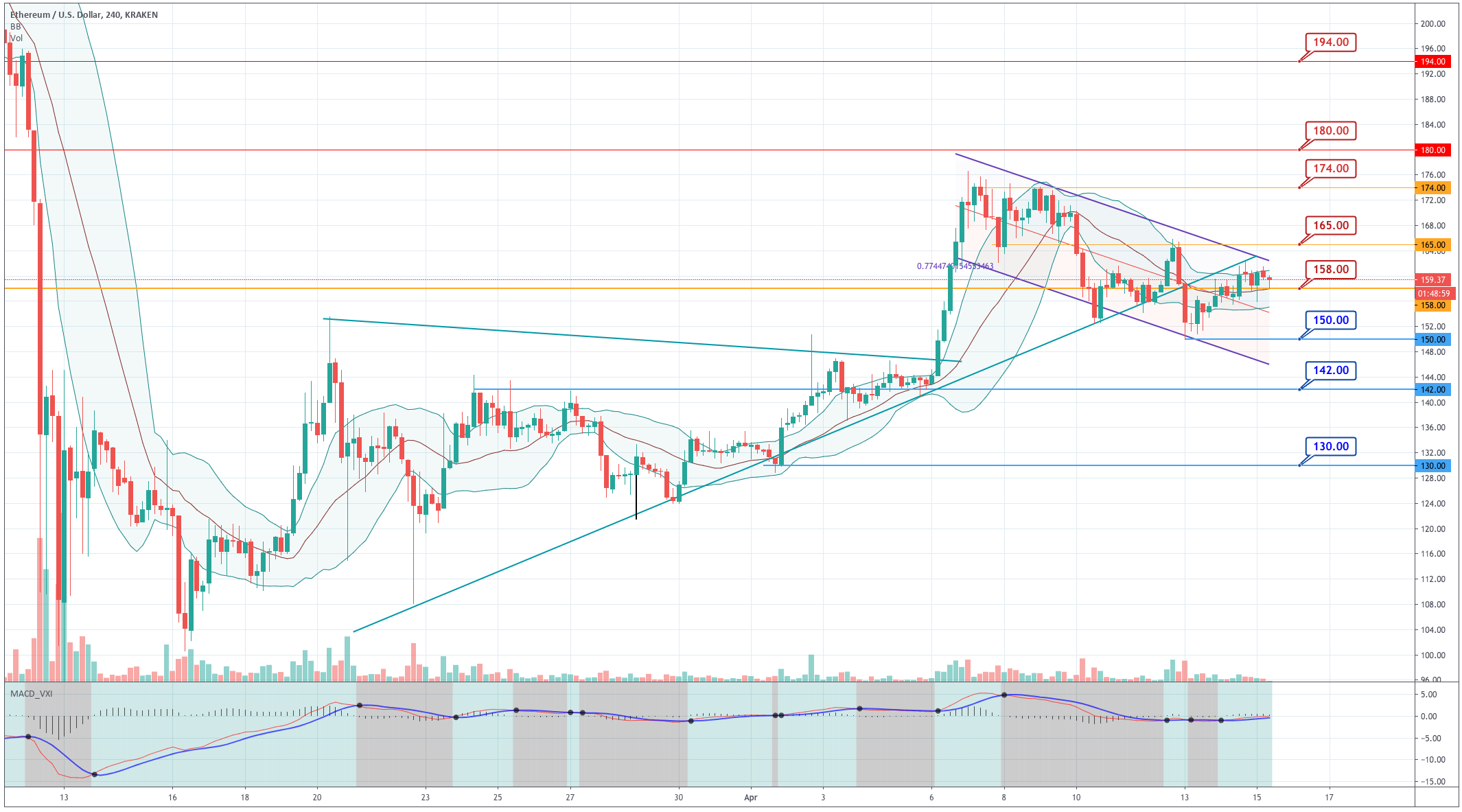

Ethereum

Ethereum moved from the lower to the upper side of the descending channel. The price found new buyers at the level of $160 and has been mildly rejected from there. We see its price moving in the upper side of the Bollinger bands, and the MACD slightly up. We see also that the ascending trendline has acted as a resistance barrier. Thus, although there is some buying power, the current situation limits its upside movement. At the same time, the fact that the price is at the top of a channel makes it likely a move to its bottom. The levels to watch are $165 to the upside and $ 154 to the downside. A strong breakout of one of these levels will show the future direction.

|

Support |

Pivot Point |

Resistance |

|

142 |

159

|

176 |

|

125 |

193 |

|

|

108 |

209 |

Ripple

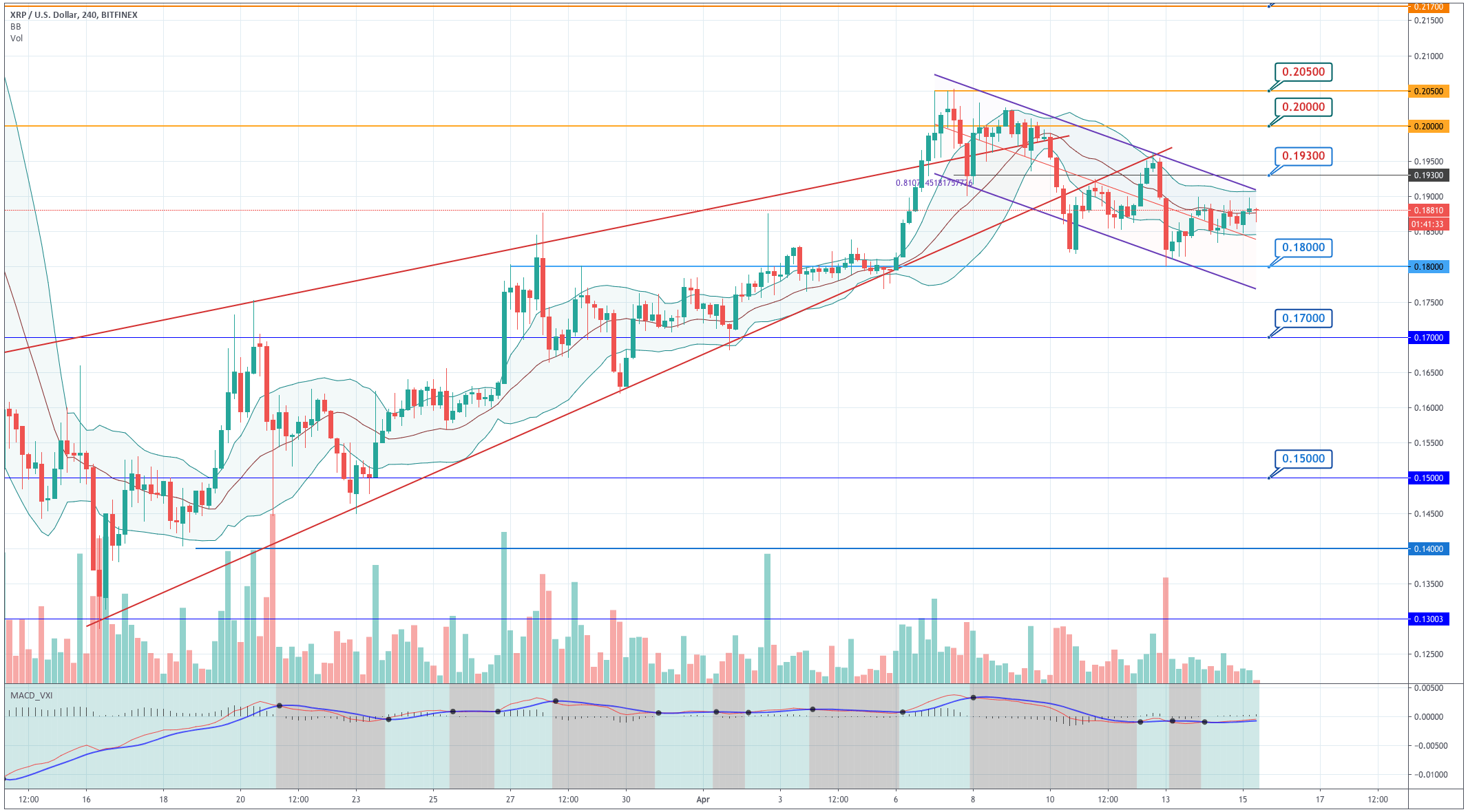

Ripple has moved to the middle of the Bollinger bands, in a retracement that has been stopped by the $0.19 resistance level. The Bollinger bands are moving horizontally as the price approaches the upper side of the descending channel. The recent candles are making a kind of ascending triangle that shows an improvement of the asset, as buyers came in earlier on each candle. That may indicate an increasing buyer power that may send the asset higher.

The buyers should wait for the breakout of the powerful $0.19 resistance. Sellers should come in after the price closes below $0.184.

|

Support |

Pivot Point |

Resistance |

|

0.1770 |

0.1910

|

0.2030 |

|

0.1650 |

0.2170 |

|

|

0.1500 |

0.2300 |

Try Secure Leveraged Trading with EagleFX!

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.