Bitcoin (BTC $25,859) is about to test hodlers with a “mid cycle lull” before starting a bull run in late 2024, a new BTC price model states.

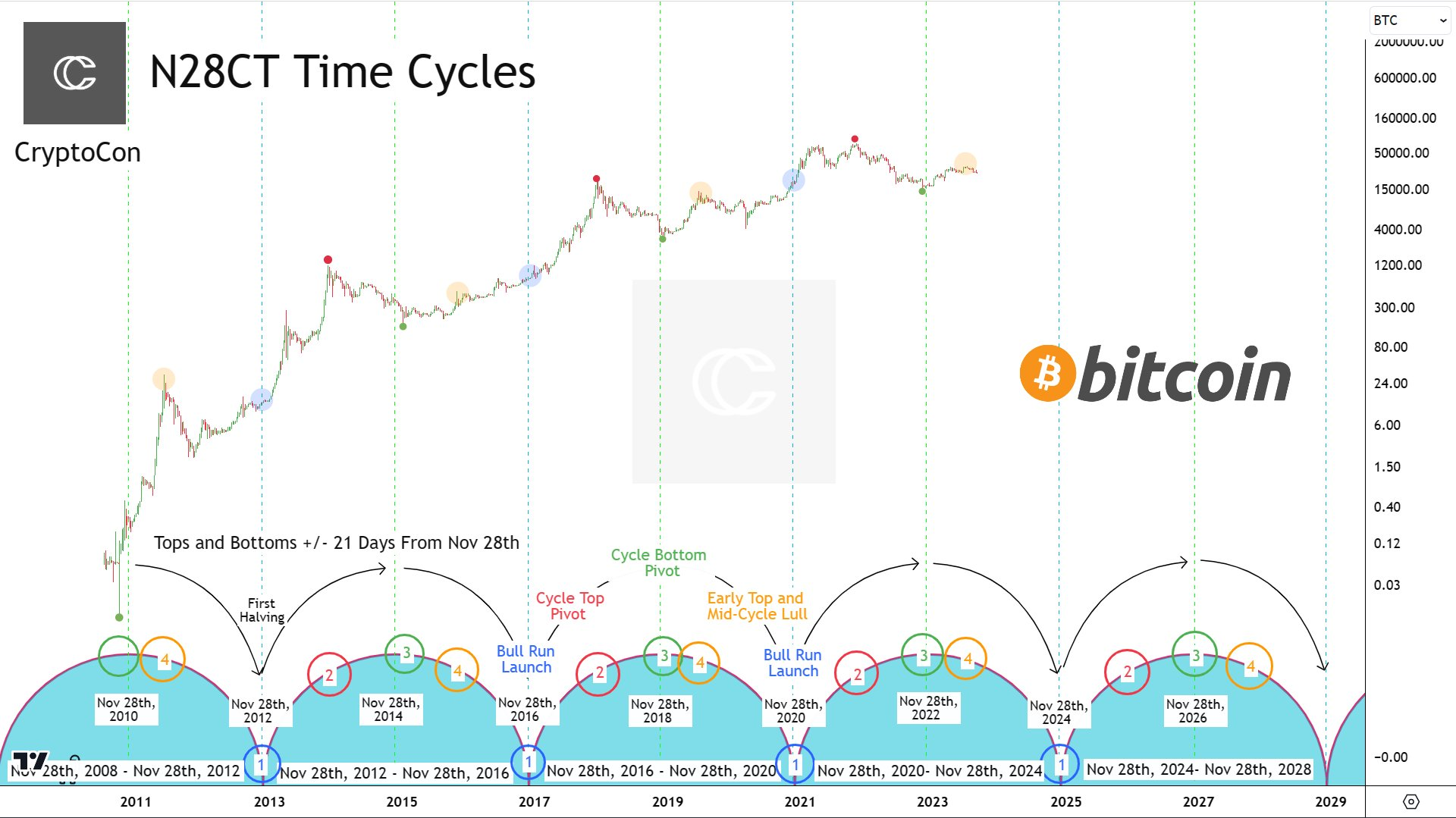

According to its creator, popular analyst CryptoCon, the “November 28th Cycles Theory” demands the BTC price all-time high in 2025.

Countdown to BTC price “bull run launch”

Amid debate over the nature of the current Bitcoin four-year price cycle, CryptoCon believes that all may be simpler than many imagine when it comes to how BTC/USD behaves at a given time.

Unveiling the “November 28th” chart on X (formerly Twitter), he delineated the date as a key pivot point in the year, along with a three-week period on either side.

“Using 4-year time cycles against my Theory, produces Bitcoins exact behavior in time since its inception. Cycles are centered around the date of the first halving Nov 28th,” he explained.

Bitcoin price action began at the first bottom October 8th, 2010. This is where cycle curves peak, every 4 years. Tops and bottoms come +/- 21 days from Nov 28th at their appropriate times on the curve. Tops on the upswing, bottoms on the pinnacle.

The chart describes November 28 as the date Bitcoin sees a “bull run launch” every four years. The last was in 2020 when BTC/USD broke beyond its prior all-time high (ATH) to hit its current $69,000 record a year later.

The next point of interest is thus November 2024. Until then, BTC price action will spend its time in a “mid cycle lull.”

“After Bitcoin bottoms, price makes an early first cycle move (orange) and enters into a mid-cycle lull,” CryptoCon continued.

This is the longest part of the cycle, where Bitcoin spends time around the median price (half of previous ATH), until the curve bottoms.

Bitcoin November 28th theory chart. Source: CryptoCon/X

He added that Bitcoin had “almost certainly” seen its early top, referencing the $31,800 local highs from July.

A Bitcoin “bull market fakeout”

As Cointelegraph reported, opinions on where BTC price action will go into the 2024 block subsidy halving differ.

Related: Bitcoin halving can take BTC price to $148K by July 2025 — Pantera Capital

Some argue that modest gains will be all that hodlers will see before the event, scheduled for April next year.

In an interview with Cointelegraph this week, Filbfilb, co-founder of trading suite DecenTrader, nonetheless delivered a $46,000 target for the halving, with $35,000 slated for year-end.

In his latest newsletter published on Sept. 5, meanwhile, CryptoCon summarized 2023 BTC price behavior as a “bull market fakeout.”

“This makes it appear as if the bull market has begun with the trigger of many signals, but then at some point, price fails to continue,” he wrote.

This is the most convincing example we’ve seen of this yet. Personally, I think there is still some time to go for that and I am patiently awaiting its completion.

BTC/USD 1-day chart. Source: TradingView

BTC/USD traded at $26,200 at the time of writing on Sept. 8, per data from Cointelegraph Markets Pro and TradingView.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.