Bitcoin adds 265k new users in 24 hours as G20 closes in on crypto regulation standardization

- The world's 20 biggest economies will be advancing on a global crypto regulation framework, impacting two-thirds of the population.

- Following the announcement, the Bitcoin network noted 265k new addresses, the second-highest single-day surge in BTC's history.

- Bitcoin price is vulnerable to crash below $24,500 as a potential death cross looms over the cryptocurrency.

Bitcoin price is facing a challenge as the cryptocurrency is nearing a probable crash at a time when the majority of the world is joining hands in establishing regulation for the crypto market. During the recent G20 summit, the leaders announced the Crypto Asset Reporting Framework (CARF) along with other actions.

Crypto regulation finds global stage

Held in India, the G20 summit noted a critical development pertaining to the crypto space. Twenty of the biggest economies in the world, including names like the United States, United Kingdom, India, China and more, joined hands in taking this decision. The countries will be moving forward with a framework for digital assets which would be applicable globally.

Among the key decisions was the Crypto Asset Reporting Framework (CARF), which would enable governments to gain access to cryptocurrency transactions and their participants in the country. Additionally, the Common Reporting Standard (CRS) would also be amended to improve and standardize the reporting of taxes on crypto gains.

Set to be effective by 2027, the framework would include the exchange of information regarding data on crypto transactions every year. This will likely focus on covering the transactions taking place on unregulated cryptocurrency exchanges and wallet service providers.

Crypto Asset Reporting Framework

Details, including the beneficiaries' names, digital ledger addresses and the account number, will be accessible to governments. This will ensure increased transparency and regulation as well as easier identification of the participants of a crypto transaction.

This decision had an interesting impact on the biggest cryptocurrency in the world.

Bitcoin price at risk but still draws users to the network

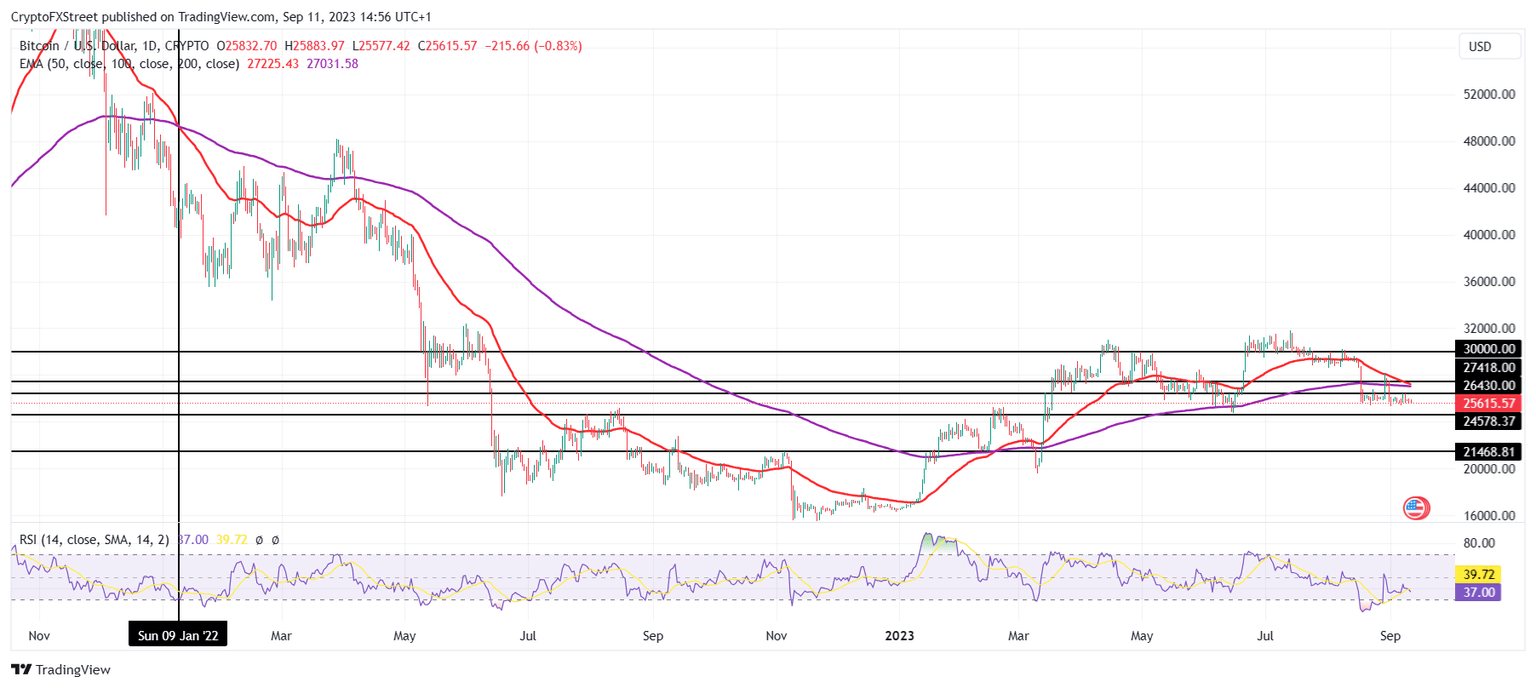

Bitcoin price is currently hovering around $25,600, with the bearishness in the market seemingly getting to the cryptocurrency. The BTC price chart shows a death cross, and its completion could have a devastating effect on the price.

A death cross takes place when the 50-day Exponential Moving average (EMA) line crosses below the 50-day EMA. This pattern reflects weakness in the market and points towards a potential downtrend. This was last witnessed by BTC back in January 2022, after which began a series of red candlesticks until the end of the year. That said, the current cross is not as negative as it could be since the 200-day EMA is still rising – in a perfect example, both EMAs would be turning south.

The immediate impact of a death cross could send Bitcoin price down to test the support levels at $24,578 and $21,468. However, a bullish move from investors to accumulate at low prices could also help in a quick recovery above $25,000.

BTC/USD 1-day chart

Positive gains are made more likely considering the global crypto regulation adoption move, which has triggered bullishness among investors. Bitcoin network noted a surge in the new addresses formed in the past 24 hours. Amounting to 265k, this was the second-highest single-day increase in addresses in Bitcoin's history and the largest in five years.

Looking at the weekly average, the increase led to a 30% rise, which is a positive sign for Bitcoin.

Bitcoin new addresses

Thus, while the cryptocurrency might be looking at a decline, the sentiment of the investors points towards an uptrend.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.