As a result of various factors external to the BTC operations market, such as wars in Europe, threats of war in Asia and energy crises throughout the world, we find ourselves in a moment of downward trends for traditional and non-traditional economic markets.

One of the main economic consequences is the high levels of inflation existing in the different regions of the world from the USA, India to Asia, among other regions.

Inflation is usually characterized by generating a direct loss of economic capacity in the purchasing power of consumers, by raising the price of goods and services, the income of consumers is directly affected.

The Bitcoin industry has proven to be one of the fastest growing industries from the beginning of the pandemic to the present.

In this sense, more and more people decide to start investing in Bitcoin by opening an account in an exchange or in a virtual wallet.

Bitcoin proposes possible solutions to the high inflationary levels that various economies are currently experiencing.

Currently BTC has a market cap of $380,507,752,015, it is estimated that about 4.2 percent of the population owns Bitcoin, with a number close to 320 million BTC holders worldwide.

Bitcoin vs fiat money

Fiat money tends to depreciate as a result of the monetary issue, in other words, the monetary base increases indefinitely as a result of the issue, higher issue generates higher inflation.

As a consequence of the indefinite increase in the monetary base, the value of the money in circulation is becoming smaller.

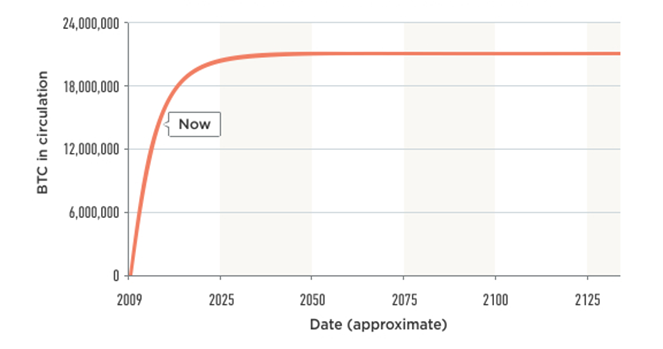

Unlike the monetary emission scenario, BTC has a deflationary emission system, this is because the maximum circulating supply of BTC will reach the number of 21 million.

Source

The monetary base of BTC does not grow indefinitely like money, after the emission reaches that maximum it will stop increasing the monetary base.

What do market experts think?

Jeronimo Ferrer, Business Development at Paxful, says “Bitcoin is changing the reality of people around the world. Thanks to its extraordinary and particular qualities, BTC is a special asset different from the rest of virtual assets, it was the first and without a doubt it will continue to change and challenge traditional real economies for much longer. ”

Marcos Bravo Catalan, Partner Beps Global Consultores, says “ the traditional markets have shown their failures, after different economic crises we can say that our current economic markets are weak, Bitcoin is changing the traditional economic markets, we need to realize that the change is inevitable ”

THE VALUE OF DIGITAL ASSETS CAN GO DOWN AS WELL AS UP AND THERE MAY BE A SUBSTANTIAL RISK THAT YOU COULD LOSE MONEY BUYING, SELLING, HOLDING OR INVESTING IN DIGITAL ASSETS. YOU SHOULD CAREFULLY CONSIDER WHETHER TRADING OR HOLDING DIGITAL ASSETS IS RIGHT FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION.

Recommended Content

Editors’ Picks

Three Arrows Capital demands $1.5B increase in the FTX lawsuit

Liquidators managing Three Arrows Capital's (3AC) bankruptcy have filed a motion to raise their claim against FTX from $120 million to $1.53 billion. Bloomberg reports that FTX allegedly liquidated and seized around $1.33 billion in assets from the hedge fund to settle debts just two weeks before 3AC’s collapse.

Missing crypto influencer Kevin Mirshahi found dead in Montreal Park

Authorities report that the remains of Kevin Mirshahi, a prominent crypto influencer who was abducted in June, have been found in a Montreal park. Local police informed “The Gazette” that a passerby found the grim discovery on October 30 in Île-de-la-Visitation Park.

XRP struggles near $0.7440, could still sustain rally after Robinhood listing

Ripple's XRP open interest has declined by over 10% in the past 24 hours. Robinhood's listing of XRP could serve as a catalyst for renewed demand. XRP continues to struggle near historically strong resistance after sustaining another rejection at $0.7440.

Dogecoin price forecast: Miners offload $240M as DOGE approaches risk zone

After reaching a three-year peak of $0.43 on November 12, Dogecoin price wobbled 13% to find support at the $0.38 level on Wednesday. Miners capitalized on Trump’s recent D.O.G.E confirmation statement to offload 620 million DOGE in the last three days.

Bitcoin: Further upside likely after hitting new all-time high

Bitcoin hit a fresh high of $76,849 on Thursday as crypto-friendly candidate Donald Trump won the US presidential election. Institutional demand returned with the highest single-day inflow on Thursday since the ETFs’ launch in January.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.