Binance.US set to make a comeback to Dollar via third-party application MoonPay

- Binance.US has been assessing options to return to its earlier status from the current “crypto-only platform”.

- The partnership with MoonPay would enable users to buy USDT on the application using USD and sell it back for the same, an option that has been unavailable recently.

- Binance Coin seemed to observe no significant impact from the development, declining to a 14-month low as Binance.US stands as a separate entity.

Binance.US, the American arm of the biggest cryptocurrency exchange in the world, recently faced a setback. After being cut off by the banks, the exchange users had to apply creative methods to gain access to USD fiat transfers. However, a new partnership is set to bring these troubles to an end.

Binance.US brings back USD transfers

Binance.US announced to its users first and then to the public its new partnership with crypto service provider MoonPay. The latter is a payment service that allows the purchase of cryptocurrencies using fiat, debit and credit card. By making MoonPay a payment partner, Binance.US will be able to facilitate the use of USD to purchase and trade crypto assets on the exchange.

The cryptocurrency exchange has been attempting to find a solution to this problem for a while now. Attaining the “crypto-only” platform status, Binance.US can only allow the buying and selling of crypto assets using other crypto assets, and as a result, users have to bring their assets over from a cold wallet or other exchanges.

However, with MoonPay, this process will become much simpler. Users will now have to simply purchase USDT using the Dollar to buy and trade crypto assets. In order to withdraw their money, one would have to first sell their cryptocurrencies for USDT and then sell the USDT for USD to withdraw the amount directly to their bank account.

Today, we're excited to introduce a new $USD on-ramp!

— Binance.US (@BinanceUS) August 22, 2023

✔️ Buy $USDT on https://t.co/AZwoBOgsqS through payment partners like @moonpay, which supports debit & credit card, Apple Pay, and Google Pay.

✔️ Sell USDT for USD to withdraw via bank transfer.

Learn more & get started ⤵️

Interestingly, Binance Coin, the native crypto asset of Binance, did not display any sign of bullishness in response to this development. Since Binance.US is a separate entity, it does not hold a direct affiliation with the cryptocurrency, resulting in the lack of movement in BNB at the time of writing.

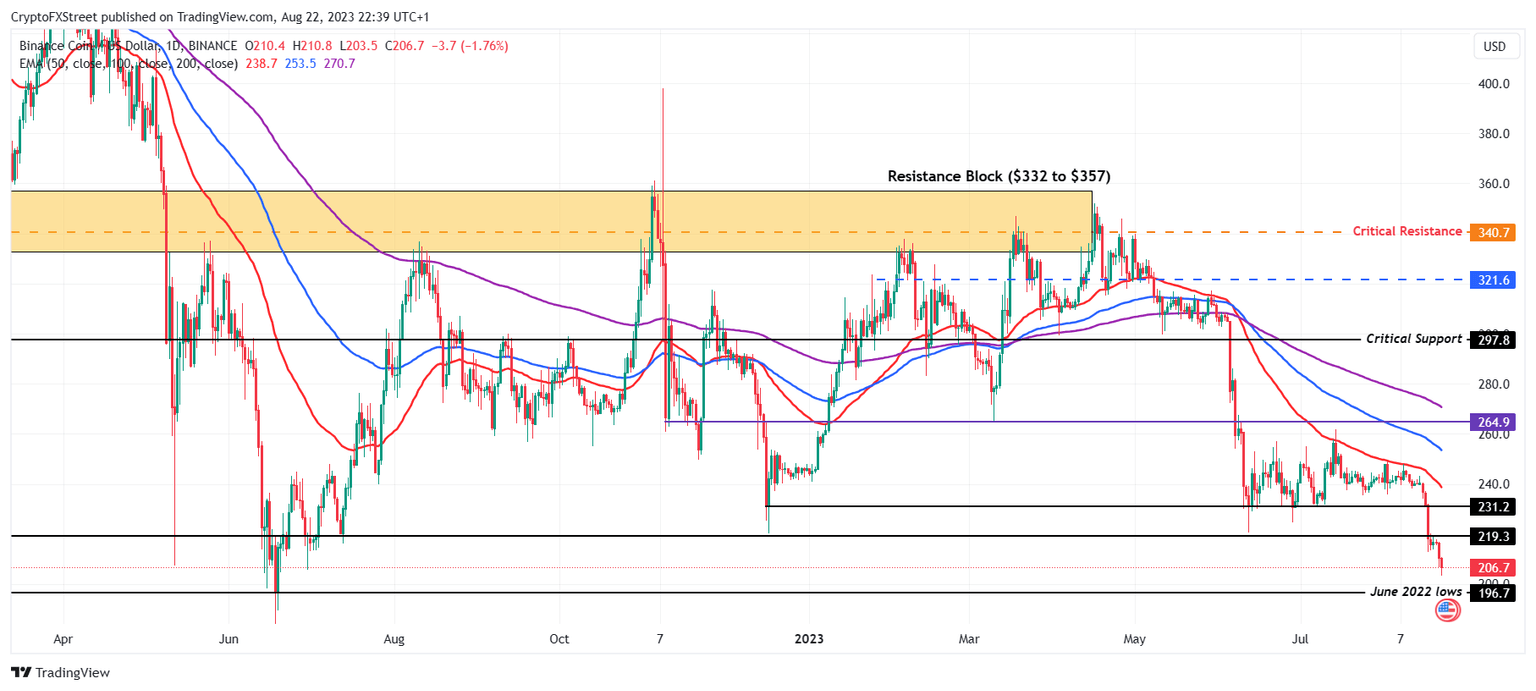

Trading at $206.8, Binance Coin price is in a downtrend falling towards the June 2022 lows of $196. Earlier this month, the altcoin lost the support of $219, and combined with the broader market bearishness, the cryptocurrency seems to be in a freefall.

BNB/USD 1-day chart

If Binance Coin price bounces off the support at $196, it would have a shot at recovery, but for the same, the resistance of $219 must be flipped into a support floor. This would allow BNB to climb back up to $231 and wipe out the losses of August.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.