Binance's MANTRA DAO listing sparks massive criticism due to fraudulent background

- MANTRA DAO is a DeFi token focused on offering loans and mortgages.

- Binance goes ahead with the listing ignoring the accusations from the Chinese community.

- The founder of MANTRA DAO is a casino owner, while the team members have fraudulent ICO histories.

- OM is up 60% after going live on Binance; it is trading slightly above $0.4.

Binance has come under heavy scrutiny from members of the cryptocurrency community for supporting MANTRA DAO. The token is said to have a fraudulent background stemming from its founders and team. In particular, Chinese leaders frowned at the leading cryptocurrency exchange keeping in mind that its founder had initially opened a casino.

MANTRA DAO starts trading on Binance despite criticism

MANTRA DAO is a decentralized finance (DeFi) project developed to offer loans, mortgages, and cross-chain finance products. The exchange approved its listing on the Binance Innovation, starting March 8. MANTRA DAO runs on Ethereum; however, it has cross-chain functionality made possible by the Binance Smart Chain.

Although the listing is a huge step for the token, Chinese community leaders have questioned its fraudulent background. In addition to the founder opening a casino, most team members are known to be involved in fraudulent initial coin offerings (ICOs).

The community feels like the success being enjoyed by Binance has led to quality being compromised. People believe that agreeing to use the "Binance Smart Chain or Polkadot, Binance will significantly lower the listing standards, and some fraudulent projects will appear."

On the other hand, Binance has maintained that its listing committee, made of five people, is keen on its job. The five are tasked with conducting research on potential projects and approving or disapproving their listing.

MANTRA DAO rallies 60% after listing

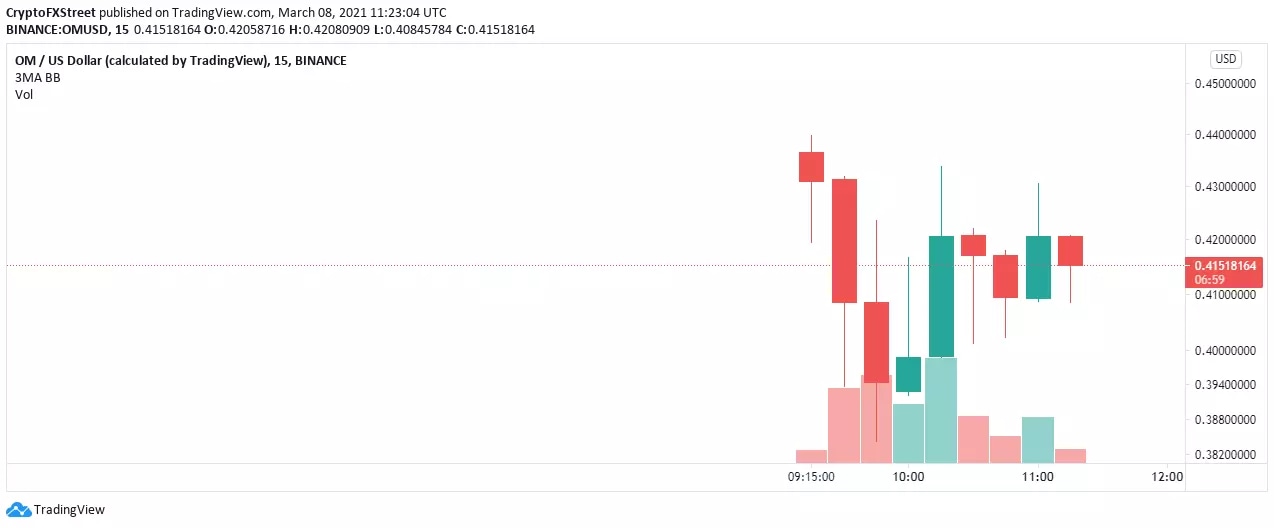

Binance' Innovation Zone' is a unique trading area, allowing users to buy and sell newly listed cryptoassets but at high risk. Following the listing on the exchange, OM is up 60%. The token has attracted a 24-hour trading volume of $74 million and is exchanging hands at $0.41. An intraday low has been traded at $0.38, while OM hit a high of $0.43.

OM/USD 15-minute chart

Despite the accusations, Binance went ahead to launch MANTRA DAO trading. The high trading volume shows that investors are willing to ignore the criticism for high-risk returns. It is still unclear where OM is heading as an asset and pulling its weight as a formidable DeFi project.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren