Binance US gets green light for Voyager Digital acquisition, bulls push BNB price higher

- Binance US receives initial approval from bankruptcy judge to acquire the Voyager Digital lending platform for $20 million.

- Judge Michael E. Wiles needs to accept the bankruptcy liquidation plan to finalize the deal.

- BNB price witnessed a breakout from sideways price action and started an uptrend.

Binance, the world’s largest cryptocurrency exchange platform by trade volume, is on track to acquire bankrupt crypto lender Voyager Digital. After initial hiccups and opposition from the US Securities and Exchange Commission (SEC) a financial regulator, Binance is preparing to complete the acquisition for $20 million. If the deal goes through, former customers of the bankrupt lender stand to get back over half of their lost deposits.

The exchange still needs another round of approvals to complete the deal. News of Binance’s success with the initial approval has fueled a bullish narrative among native token BNB holders and the asset continued its climb in an ascending channel.

Judge gives thumbs up to Binance’s Voyager Digital acquisition

Binance is preparing to acquire shipwrecked crypto lender Voyager Digital. The firm received initial court approval on Tuesday for the sale of $1 billion worth of assets to Binance US. Voyager Digital is in the process of expediting a US national security review of the deal, for the next round of approvals.

Judge Michael Wiles in New York gave the nod to the purchase agreement with Binance US. The deal is in its initial phases and needs to get the go ahead from creditors and a final court hearing before it goes through.

During the holidays, US financial regulators, the US Committee on Foreign Investment in the United States (CFIUS) raised concerns and opposed the deal. In a December 30 court filing, CFIUS said that its review, “could affect the ability of the parties to complete the transactions, the timing of completion, or relevant terms.”

Executives at Voyager Digital have affirmed their intent to address issues raised by the CFIUS. Joshua Sussberg, the bankrupt crypto lender’s attorney said,

We are coordinating with Binance and their attorneys to not only deal with that inquiry, but to voluntarily submit an application to move this process along.

Binance is prepared to close the deal with a $20 million cash payment and an agreement to transfer Voyager’s customers to Binance US’ crypto exchange. Customers will be granted access to withdrawals, and users will recover 51% of the value of their assets lost to Voyager’s bankruptcy filing.

If the deal falls through and fails to get creditor and court approval in the next hearing, the lender will be forced to use assets on hand to repay customers, resulting in a significantly lower payout, according to Attorney Sussberg.

BNB price eyes $292 target in its uptrend

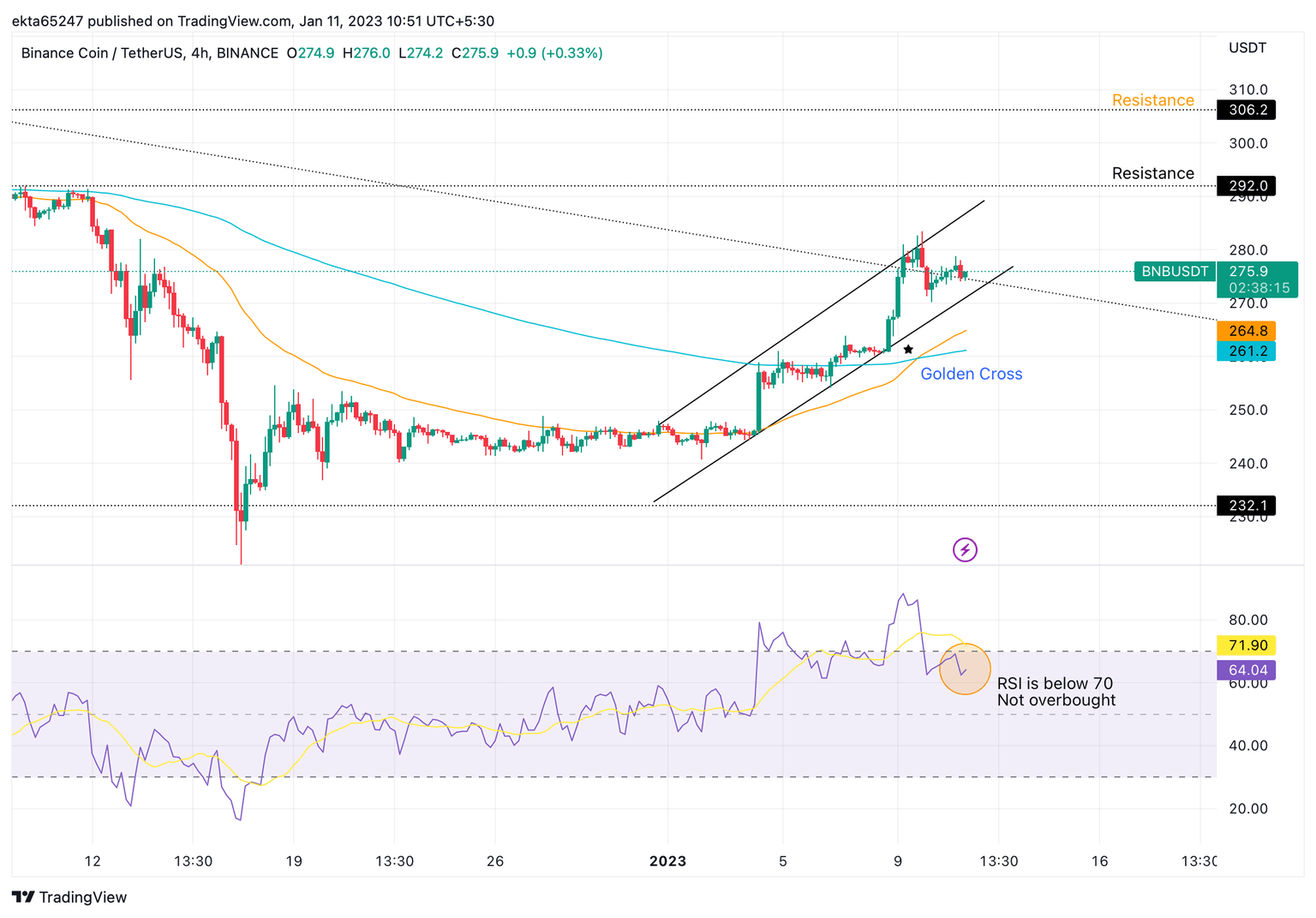

Binance coin (BNB), the native token of crypto exchange platform Binance is on track to breakout of its ascending channel. There are two signs that signal the bullish breakout in Binance’s native token, as seen in the chart below.

The recent crossover of the 50-day Exponential Moving Average (EMA) (in orange) above the 200-day EMA (in blue), referred to as the “Golden Cross” was followed by a candle validating the bullish breakout in BNB. Further, BNB price is climbing higher within an ascending channel since January 4, after sideways price action for the last two weeks of December 2022.

BNB/USDT price chart

The chart above shows that the Relative Strength Index (RSI), a momentum indicator reads 64.04, and has fallen below 70. This suggests that whilst the indicator may have given traders the signal to sell their long positions recently, RSI now has room to continue rising and is not strictly signaling price is ‘overbought’ anymore. Overall there is room for BNB price to climb in the ascending channel again, although initially there is the risk of further downside in the short-term to support at the lower channel line.

The key resistances for BNB price are:

- $292, the level at which 50-day EMA crossed below the 200-day EMA, the “Death Cross” on the weekly chart

- The $306.2 level, that represents the 50-day EMA on the weekly chart

These price levels are areas of interest for bulls pushing the asset’s price higher. A decline below the lower trend line of the ascending channel, accompanied by relatively high trade volume could invalidate the bullish thesis and signal a drop to the long-term EMAs.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.