Binance unintentionally causes Ethereum gas fees to soar 1,900% as hundreds of inactive wallets move ETH

- Binance-connected wallet addresses recorded a spurt of transactions in the early hours of September 21

- Etherscan data shows hundreds of formerly inactive wallets sent ETH to a single wallet tagged as Binance 14.

- Ethereum gas fees skyrocketed from 15 to 300 Gwei as a consequence of the many streams of transactions

- Simple P2P transactions recorded gas fees as high as $10 from the usual rate of around 40 cents.

A Binance-connected wallet, tagged Binance 14, recorded a stream of transactions according to Etherscan data.

Also Read: US Judge denies SEC request to inspect Binance.US

Binance causes Ethereum gas fees to soar

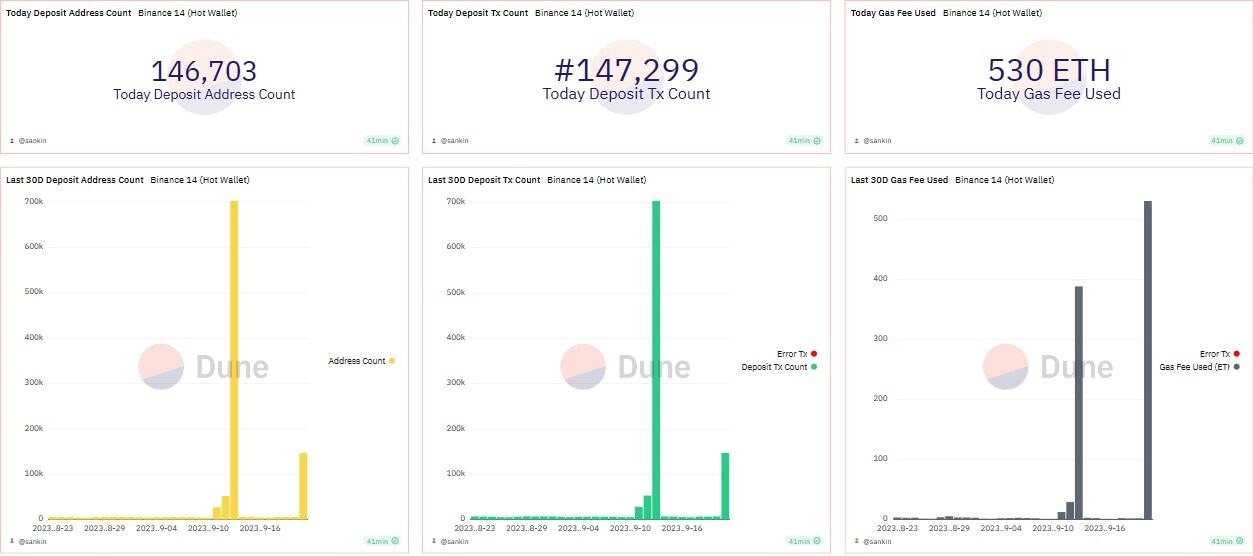

With many transfers happening within a thin timeframe, Ethereum gas fees soared 1,900%, moving from 15 to around 300 Gwei. The same was reflected in simple Peer-to-Peer (P2P) transactions, which soared from the conventional 40 cents to around $10, data from Dune analytics shows.

Binance 14 transactions

Data from Etherscan shows that the recipient wallet, dubbed Binance 14, received the Ether from wallets that were formerly inactive for almost three years. The transfers lasted around 20 minutes, with Ethereum gas fees skyrocketing in the aftermath and P2P transactions bearing the brunt of it. The recipient wallet spent more than $840,000 in Ether gas fees within a 24-hour period.

Gas Fees Alert!

— BuzzBeatHQ (@mely_buzz) September 21, 2023

Binance's crypto wallet, "Binance 14," spent a whopping $843,797 in ETH gas fees within 24 hours!

Community reactions are pouring in, with some questioning Binance's tech capabilities and gas settings.

Binance explained it was aggregating wallets… pic.twitter.com/KNdsoZSZch

Transactions to Binance 14, the list continues

Reportedly, the transfers were part of the Binance ecosystem’s “routine consolidation” of ETH to one of its wallets. According to the largest exchange by trading volume, it normally aggregates wallets during low gas fee times to safeguard user funds. Despite this assertion, Binance said that the heightened gas fees was an “unintentional but quickly resolved” outcome.

Gas fees cause a stir in the crypto world

Nevertheless, traders, who were caught off guard, were not quelled by the explanation. Of concern, is the fact that the network, as knowledgeable as it is, decided to chunk the transactions together and executed in series. The more logical alternative would be to space them out to prevent network congestion and therefore avoid increased fees.

For clarity, Ethereum gas fees are directly proportional to the number of activities on the blockchain at any given time. It is also worth mentioning that the Ethereum network heightens the cost of submitting new transactions automatically when there are alot of transactions awaiting processing. This is a feature designed to protect the network from spam attacks.

Notably, the event positioned Binance 14 in the leading position for top 50 gas guzzlers in today’s list of contracts or accounts that consume a lot of gas.

Top 50 gas guzzlers

One user acknowledged that Binance had overpaid for the transaction.

what makes this slightly fishy is that they are massively overpaying to do this. But large organizations are messy and inefficiencies will always arise so most likely it is just that.

— Martin Köppelmann (@koeppelmann) September 21, 2023

Meanwhile, Binance continues to be a headlining topic in the crypto community, with regulators actively staining the platform on the microscope for different misdeeds, all bordering on fraud or in breach of securities laws.

Today’s news adds to the list of reasons why critics are pointing fingers at Binance, with controversies steadily piling up around the company.

Also Read: Binance staked Ether experiences $573M in inflows this month

Cryptocurrency metrics FAQs

What is circulating supply?

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

What is market capitalization?

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

What is trading volume?

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

What is funding rate?

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.